Bear Of The Day - Tyson Foods

Company Overview

Zacks Rank #5 (Strong Sell) stock Tyson Foods (TSN) is a multinational food company that operates in the meat and poultry industry. Headquartered in the United States, Tyson Foods is one of the largest producers of chicken, beef, and pork products globally. The company is involved in various aspects of the food supply chain, including the processing, production, and marketing of a wide range of protein-based products. Tyson Foods serves retail and food service customers, providing a diverse portfolio of brands and products.

Margin Pressures

In April, I wrote a “Bear of the Day” article on Tyson Foods discussing its margin pressures. Since then, little has changed. Tyson has been facing weak margins for quite some time due to increased cattle costs, unfavorable derivative impacts, and higher labor costs.

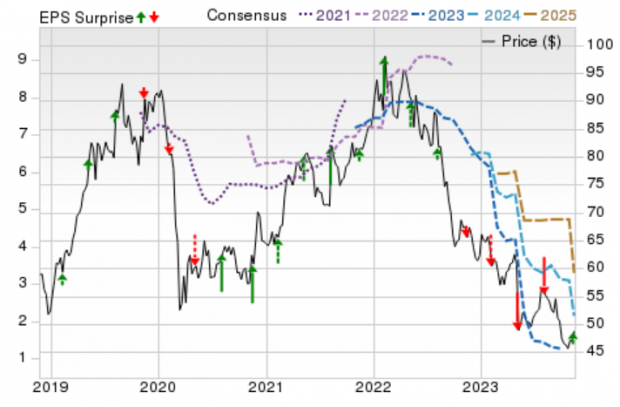

Spotty Earnings Surprise History

Earnings surprises account for one of the main driving forces behind a stock’s move. That’s bad news for Tyson. The company has missed earnings in four of the past five quarters.

(Click on image to enlarge)

Image Source: Zacks Investment Research

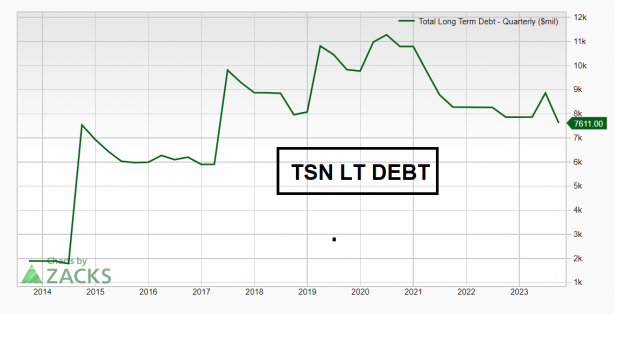

Debt Concerns

Tyson Food’s long-term debt of $8,863 million at the end of the third quarter of fiscal 2023 increased from $7,862 million in the second quarter. Margin pressure coupled with debt concerns is a fundamental recipe for disaster.

(Click on image to enlarge)

Image Source: Zacks Investment Research

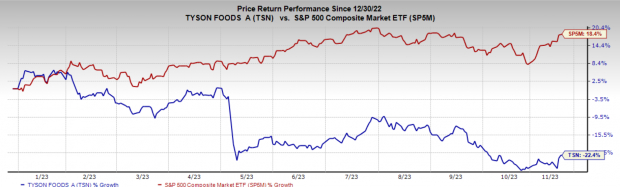

Opportunity Cost

Because each investor has finite resources, a big part of being a winning investor is gravitating to what’s working and avoiding what’s not. For months, TSN has exhibited relative weakness. Relative weakness in the stock market refers to the underperformance of a particular stock versus the general market. When an asset displays relative weakness, its price tends to decline at a faster rate or rise more slowly than the overall market or its peers. Investors often analyze relative strength and weakness to make informed decisions about their portfolio allocation, identifying opportunities to capitalize on stronger-performing assets or to manage risk by avoiding or reducing exposure to weaker ones. Year-to-date TSN is down 22.4%, while the S&P 500 Index is up 18.4%. In other words, there are better places to allocate your money. Don’t fight the trend.

(Click on image to enlarge)

Image Source: Zacks Investment Research

More By This Author:

Bull of the Day: CoinbaseAI Events Dictate Monday's Bull Market; Zoom Beats

Bear Of The Day: Dollar General (DG)

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more