Bear Of The Day: Thor Industries

THOR Industries, Inc. (THO) is facing industry headwinds as higher interest rates hit the demand for RVs. This Zacks Rank #5 (Strong Sell) recently cut its fiscal 2024 earnings guidance.

THOR is the world's largest manufacturer of recreational vehicles, otherwise known as "RVs." It was founded on Aug 29, 1980 when it acquired the iconic brand of Airstream.

Big Miss on Fiscal Q2 Earnings

On Mar 6, 2024, THOR reported its fiscal second quarter 2024 earnings and missed big on the Zacks Consensus. Earnings were $0.40 versus the Zacks Consensus which was looking for $0.69. That's a miss of $0.29, or 42%.

It was the company's first miss in 4 quarters.

THOR saw seasonally lower retail demand and cautious dealer sentiment. Macro conditions continued to pressure the top-line.

THOR worked with independent dealer partners to match wholesale production with the pace of retail sales. It also enacted promotional programs to assist in moving prior-model-year units and stimulate retail demand.

But dealers are facing elevated floor plan financing costs that have put substantial pressure on their operations. As a result, THOR believes dealers will limit inventory levels.

Consumer interest in the RV lifestyle remains high as does attendance at RV shows.

THOR Cuts Full Year Earnings Guidance

THOR remains cautious heading into the prime retail selling season. Higher interest rates are pressuring both the independent dealers as well as consumers' ability to make large discretionary purchases.

As a result, THOR lowered its full year earnings guidance to a range of $5.00 to $5.50 from $6.25 to $7.25.

The analysts lowered too. 4 estimates have been cut for fiscal 2024 in the last month, pushing the Zacks Consensus down to $5.19 from $6.62. That's in the range the company gave.

That's also an earnings decline of 25.3% from fiscal 2023, when THOR made $6.95.

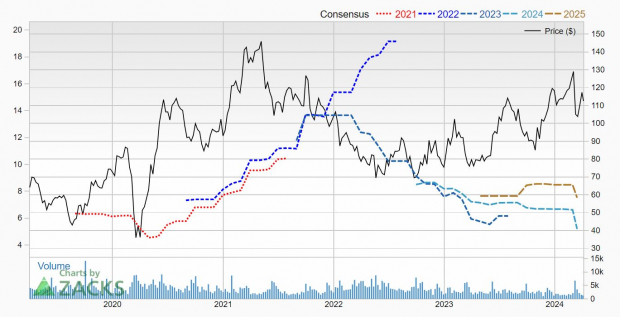

Here's what the earnings outlook looks like on the price and consensus chart.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shares Aren't Cheap

Despite the cutting of guidance, shares of THOR haven't gotten hit. Over the last month, shares are down just 12.8%. They are nowhere near 52-week lows.

(Click on image to enlarge)

Image Source: Zacks Investment Research

They also aren't cheap on a P/E basis. THOR trades with a forward P/E of 21.7.

It continues to reward shareholders, however, with a dividend, currently yielding 1.7%.

The RV industry is still facing numerous headwinds. Investors interested in THOR, and the RV industry, might want to wait on the sidelines until the consensus earnings are on the move higher, instead of lower.

More By This Author:

5 Top Small Cap Stocks With Growth And Value5 Strong Buy Stocks Hitting 52-Week Highs

Alphabet Is On Sale: Will Buffett Buy Shares?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more