Bear Of The Day: Thermo Fisher Scientific

Thermo Fisher Scientific (TMO) is a scientific instrument maker and a world leader in serving science. The company has three segments: Life Sciences Solutions, Analytical Instruments, and Specialty Diagnostics.

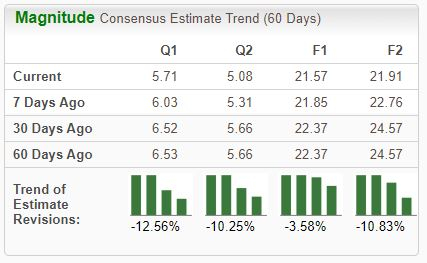

Analysts have slashed their earnings expectations across the board, landing the stock into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Let’s take a closer look at how the company currently stacks up.

Thermo Fisher Scientific

It’s been a bumpy road for TMO shares year-to-date, down nearly 19% and unable to establish consistent strength. As we can see by the arrows circled below, shares have faced adverse recactions post-earnings in several instances throughout 2023.

(Click on image to enlarge)

Image Source: Zacks Investment Research

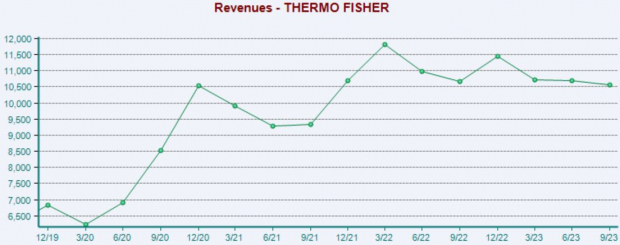

In its latest release, the company beat the Zacks Consensus EPS Estimate by 2% and posted a fractional revenue surprise. Earnings saw growth of 12% year-over-year, whereas revenue declined by roughly 1% from the year-ago period.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition, Thermo Fisher lowered its FY23 guidance following the results, citing a challenging macroeconomic environment. The company now expects FY23 sales to be $42.7 billion and adjusted EPS of $21.50.

It’s worth noting that Thermo Fisher had already lowered FY23 guidance back in July, further reflected by share performance over the last several months.

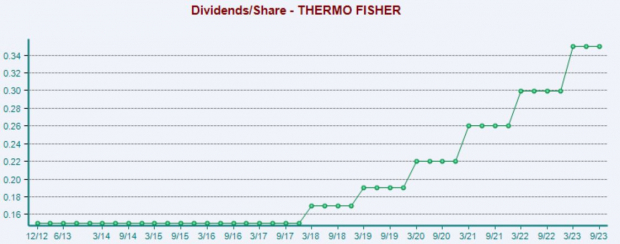

The company has gone a long way in growing its dividend payout, carrying a sizable 16.5% five-year annualized dividend growth rate and reflecting its shareholder-friendly nature. TMO’s payout ratio sits at just 7% of its earnings.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Recent guidance cuts due to a challenging macroeconomic environment paint a challenging picture for the company’s shares in the near term.

Thermo Fisher Scientific is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

Disney Q4 Preview: Can Shares Turnaround?Markets Up Big Again; Apple Beats Modestly

3 Goldman Sachs Mutual Funds For Impressive Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more