Bear Of The Day: The Estee Lauder Companies Inc.

Company Overview

New York-based Zacks Rank #5 (Strong Sell) stock The Estee Lauder Companies Inc. (EL) is one of the world’s leading manufacturers and marketers of skincare, makeup, fragrance, and hair care products. The company’s products are sold through department stores, mass retailers, company-owned retail stores, hair salons, and travel-related establishments. Though the company is headquartered in the US, its manufacturing and research facilities are spread across Canada, Belgium, Switzerland, Japan, South Africa, and the UK.

Inflation and Currency Headwinds

Because of Estee Lauder’s wide-ranging international presence, the company is exposed to unfavorable currency fluctuations. A strong US dollar will lead the company to increase prices or suffer from contracting profit margins. For now, the dollar is up roughly 4% over the past three weeks (a strong move for the dollar) and is on the brink of breaking out.

(Click on image to enlarge)

Image Source: TradingView

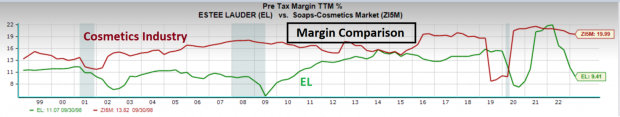

Regardless of the fluctuations in the dollar, Estee Lauder has a much lower profit margin (9.41) versus the cosmetics industry (19.99).

(Click on image to enlarge)

Image Source: Zacks Investment Research

The Death of the Department Store

One headwind that Estee Lauder has little control over is the death of the department store. The COVID-19 pandemic drove consumers away from department stores and to e-commerce platforms such as Amazon (AMZN) (a trend already in motion). Consumer preferences are also changing. Consumers are more drawn to specialty stores, boutiques, and direct-to-consumer brands than ever before.

Increased Competition

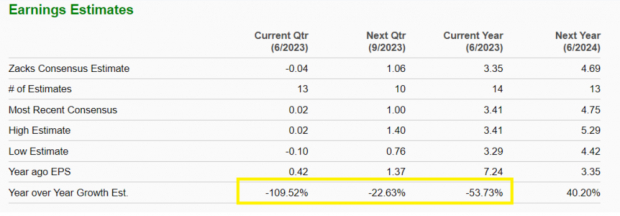

“Fast-fashion” retailers have gained popularity for their ability to quickly respond to changing fashion trends. While EL earnings dropped 75% last quarter while competitor e.l.f. Beauty (ELF) saw EPS launch by 182%, year-over-year. Consumers are clearly searching for inexpensive, high-quality cosmetics brands like ELF versus legacy, more expensive brands like EL. The trend is showing up in EL’s estimates moving forward.

(Click on image to enlarge)

Image Source: Zacks Investment Research

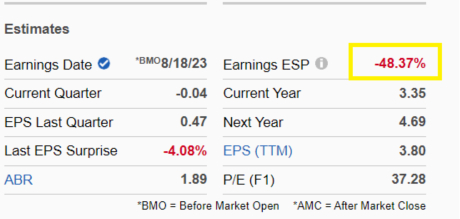

Negative Earnings ESP Score

EL is expected to report earnings on August 18th. Last quarter, EL missed earnings expectations by 4.08%. Investors should expect earnings to miss this quarter again because of its negative Earnings ESP Score. A negative Zacks Earnings ESP (Expected Surprise Prediction) combined with a poor rank of strong sell suggests that the company will likely miss earnings expectations.

(Click on image to enlarge)

Image Source: Zacks Investment Research

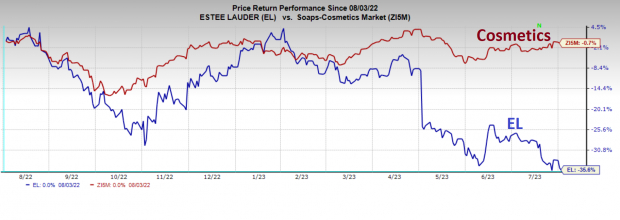

Price is the Ultimate Arbiter

Beyond the faltering fundamentals and business headwinds, EL shares exhibit relative weakness versus the general market and its industry group. Over the past year, EL shares are down 35%, while the Soap-Cosmetic Industry is flat.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Takeaway

Currency headwinds, growing competition, and slowing growth point to a bleak outlook for Estee Lauder.

More By This Author:

Bull of the Day: HubbellBear of the Day: Advance Auto Parts

3 Lord Abbett Mutual Funds For Solid Returns

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more