Bear Of The Day: Teradyne

The Zacks Computer and Technology Sector has struggled mightily year-to-date, decreasing roughly 20% in value and extensively underperforming the S&P 500.

A hawkish Fed, paired with supply chain and geopolitical issues, has created a dark fiscal cloud above companies in the sector.

A company in the sector, Teradyne (TER - Free Report), carries a Zacks Rank #5 (Strong Sell) with an overall VGM Score of an F – never a pairing that you want to see.

Teradyne is a leading provider of automated test equipment, primarily focused on the semiconductor test market, which generates the bulk of its revenues.

Let’s take a closer look at the company and why it’s landed itself into such an unfavorable rank.

Share Performance

Teradyne shares have struggled mightily in 2022, losing more than 40% in value and coming nowhere near the general market’s performance.

Image Source: Zacks Investment Research

Even over the last month, when the market has rallied, TER shares have still lagged, decreasing nearly 5% in value.

The poor share performance indicates that sellers have been in control of shares throughout the whole year.

Growth Estimates

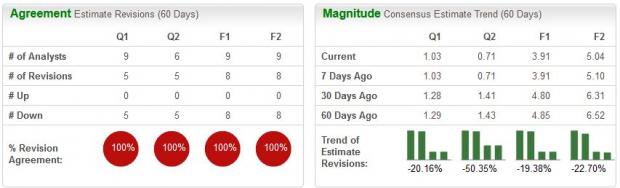

Analysts have been overwhelmingly bearish across all timeframes over the last 60 days with 100% agreement.

Image Source: Zacks Investment Research

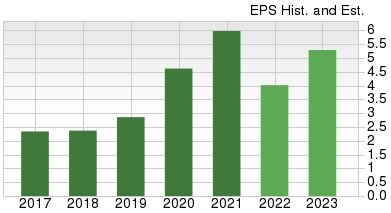

For the company’s current fiscal year (FY22), the Zacks Consensus EPS Estimate of $3.91 reflects a concerning 35% Y/Y drop in earnings.

Image Source: Zacks Investment Research

TER’s top-line projections indicate some softening as well – the company is forecasted to generate $3.1 billion in sales throughout FY22, penciling in a steep 16% drop-off from FY21 annual sales of $3.7 billion.

Image Source: Zacks Investment Research

Valuation

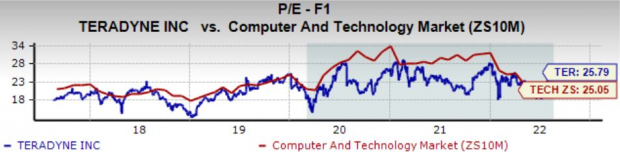

Pivoting to valuation, TER shares could be considered overvalued, further bolstered by its Style Score of an F for Value.

Teradyne’s forward earnings multiple resides at a steep 25.8X, undoubtedly on the higher side. In addition, the value represents a 3% premium relative to its Zack Sector.

Image Source: Zacks Investment Research

Bottom Line

Teradyne shares have been the victim of a deep double-digit valuation slash year-to-date.

This adverse price action, paired with overwhelmingly negative estimate revisions, paints a grim picture for the company in the short term.

The company is a Zacks Rank #5 (Strong Sell) and a stock that investors will be better off staying away from for now.

Instead, investors should pivot to stocks that either carry a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) – the odds of reaping considerable gains are much higher within the companies that carry these ranks.

More By This Author:

Dole Q2 Preview: Can Shares Find New Life?Guide To High Dividend Paying ETFs

Nvidia To Report Q2 Earnings: What's In The Cards?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more