Bear Of The Day: Sun Country Airlines

With very expansive top and bottom line growth expected over the next few years, investors may be wondering why Sun Country Airlines (SNCY) stock is down -5% year to date.

The answer to this question lies in the trend of earnings estimate revisions which have largely declined landing Sun Country’s stock a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

Brief Overview

Founded in 1982, Minnesota-based Sun Country is an air carrier company that provides scheduled passenger, air cargo, and charter air transportation services primarily in the U.S. and Latin America among other international destinations.

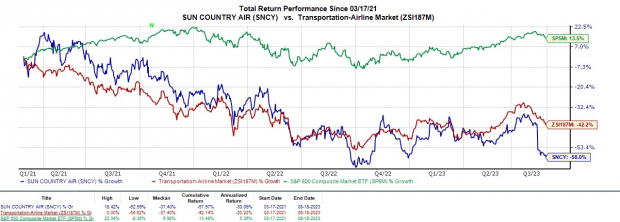

Sun Country’s stock went public in March of 2021 and despite what appears to be very promising growth prospects has now plummeted -58% since its IPO.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Value Trap Concerns

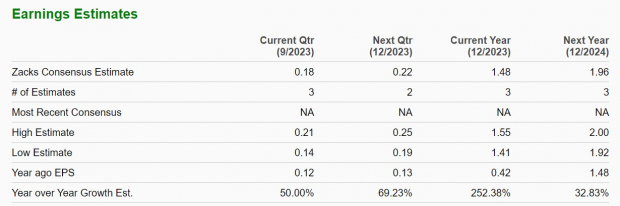

Early investors may undoubtedly have the feeling that Sun Country’s stock is a value trap at the moment. This is because shares of SNCY trade very reasonably at 10X forward earnings with EPS forecasted to skyrocket 252% this year at $1.48 per share compared to $0.42 a share in 2022. Plus, fiscal 2024 earnings are projected to climb another 33% to $1.96 per share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

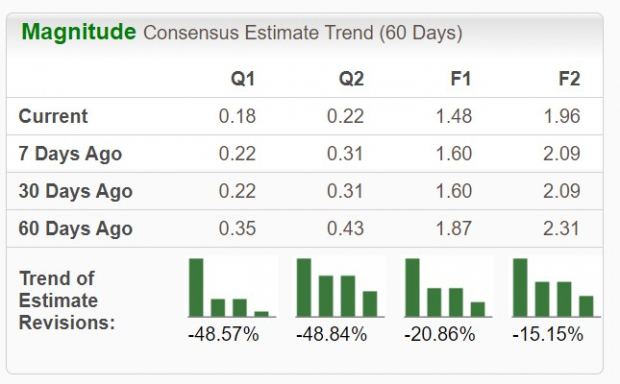

However, fiscal 2023 earnings estimates are actually down -20% over the last 60 days with FY24 EPS estimates falling -15%. Unfortunately, this alludes to more short-term weakness ahead and reconfirms why value trap concerns may be valid.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

On the surface, Sun County Airlines stock may look cheap but judging from its performance since going public and the steep decline in earnings estimate revisions it may be wise to be cautious at the moment despite the company’s attractive outlook.

More By This Author:

Bull of the Day: National Fuel Gas Company3 Low-Beta Stocks To Buy For Technology Exposure

Paypal Suffers A Larger Drop Than The General Market: Key Insights

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more