Bear Of The Day: Pool Corp.

POOLCORP (POOL) is seeing a slowdown in pool demand this summer. This Zacks Rank #5 (Strong Sell) recently lowered full year guidance.

POOLCORP is the world's largest wholesale distributor of swimming pool and related outdoor living products. It operates about 440 sales centers in North America, Europe and Australia from where it distributes more than 200,000 products to 125,000 wholesale customers.

POOLCORP Warns on the Full Year

On June 24, 2024, POOLCORP warned on the full year as discretionary pool spending has slowed. The company believed that new construction pool activity could be down 15% to 20% for the year with remodel activity down as much as 15%.

For the year-to-date period, POOLCORP's sales were trending down approximately 6.5% from the same period in 2023. While swimming pools and outdoor living projects are expected to decline, it was encouraged as maintenance-related product sales remained stable.

There's been volume growth in chemicals, and equipment sales, excluding cleaners, were down only 2% for the year. That was an improvement from the 3% decline in the first quarter of the year.

Full Year Guidance Slashed

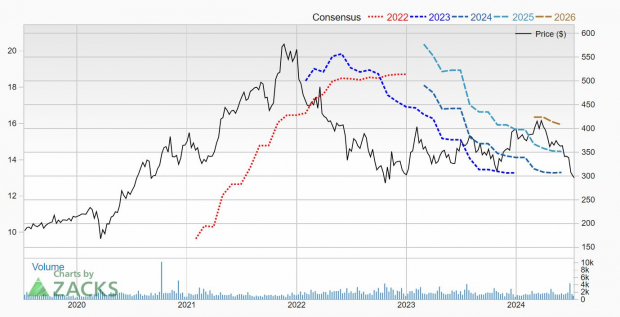

Given the pool slowdown, it's not a surprise that POOLCORP cut its full year guidance. It lowered the range to $11.04 to $11.44 from $13.19 to $14.19.

The analysts followed by cutting their earnings estimates. 5 estimates were cut after the company warned.

It has pushed the Zacks Consensus Estimate down to $11.10 from $13.21. That's at the low end of the company's guidance range.

This is an earnings decline of 16.9% from 2023 as the company made $13.35 last year.

Here's what it looks like on the price and consensus chart.

Image Source: Zacks Investment Research

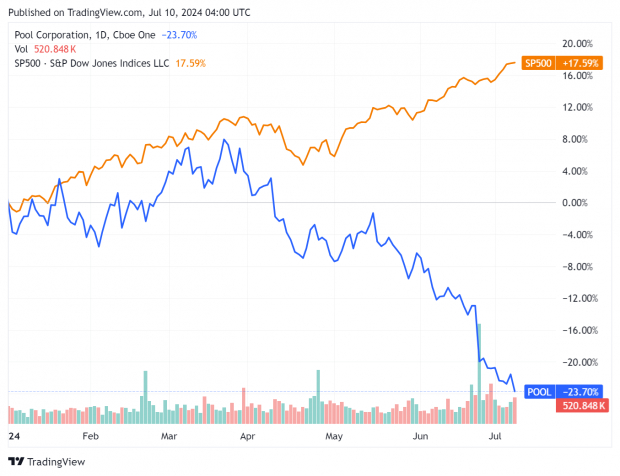

Shares Fall to New 52-Week Lows

Not surprising, the shares fell on the guidance warning and are now down 23.7% year-to-date.

Image Source: Zacks Investment Research

But with the earnings being cut, the shares aren't that cheap. It's trading at 27x forward earnings.

POOLCORP also pays a dividend, currently yielding 1.6%.

POOLCORP will be reporting second quarter results on July 25, 2024 so the company will give more color then.

But until the pool slowdown hits a bottom, investors might want to stay on the sidelines. Watch the earnings estimates for signs of a turnaround.

More By This Author:

Bull Of The Day: Paycom SoftwareQ2 Earnings Season Kicks Off With These 5 Key Charts

Bull Of The Day: J. Jill

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more