Bear Of The Day: Pfizer Inc.

The Zacks Medical sector has struggled in 2023, down roughly 5% YTD and underperforming relative to the S&P 500.

One stock residing in the realm, Pfizer (PFE) , has seen its near-term outlook shift negative over the last several months, pushing the stock down into a Zacks Rank #5 (Strong Sell).

(Click on image to enlarge)

Image Source: Zacks Investment Research

Pfizer is a multinational pharmaceutical and biotechnology corporation headquartered in New York City, well-known for its COVID-19 vaccine. How does the company currently stack up? Let’s take a closer look.

Share Performance

PFE shares have been in a downward trend throughout 2023, losing more than 20% in value and widely underperforming relative to the S&P 500.

(Click on image to enlarge)

Image Source: Zacks Investment Research

And over the last six months, PFE shares have again lagged behind the general market, losing 6% in value compared to the S&P 500’s 9% gain. The adverse price action indicates that sellers have been in control with no meaningful buying yet to step up.

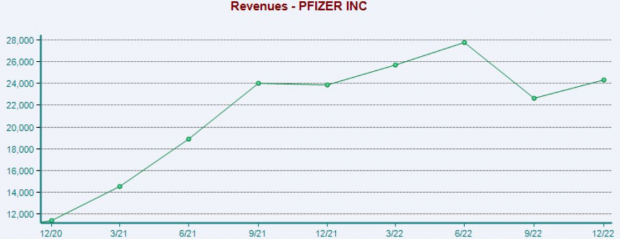

Quarterly Performance

Pfizer has consistently posted better-than-expected results recently, exceeding earnings and revenue estimates in three consecutive quarters. Just in its latest release, the pharmaceutical titan penciled in a 10% bottom line beat and reported sales marginally above expectations.

(Click on image to enlarge)

Image Source: Zacks Investment Research

However, the market wasn’t impressed with the recent double-beat, sending shares downward post-earnings. This is illustrated by the green arrow circled in the chart below.

(Click on image to enlarge)

Image Source: Zacks Investment Research

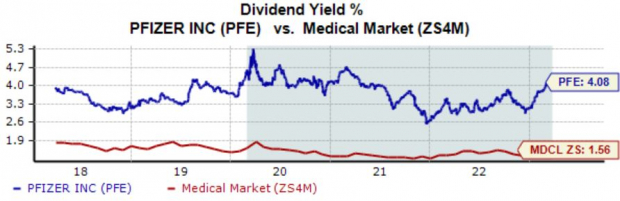

Dividends

Pfizer shares do pay a solid dividend, currently yielding 4.1% annually. As we can see, the current yield is more than double the average of the Zacks Medical sector.

Over the last five years, PFE’s payout has grown by roughly 4%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Weak share performance and negative earnings estimate revisions from analysts paint a challenging picture for the company’s shares in the near term.

Pfizer is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook over the last several months.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

4 Inflation-Proof Sector ETFs To PlayBuy These 3 Top Ranked Stocks To Survive The Banking Crisis

3 Affordable & Diverse Top-Rated REITs To Buy Now

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more