Bear Of The Day: On Holding

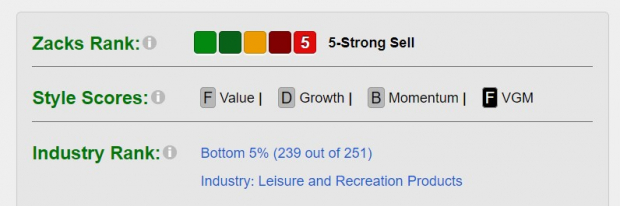

On Holding (ONON) is one stock that investors may want to avoid at the moment landing a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

The concern is industry-based with On Holding’s Zacks Leisure and Recreation Products Industry currently in the bottom 5% of over 250 Zacks industries as there is still a cautionary tale surrounding consumer shopping behavior for many discretionary items.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Time to Cut Losses or Take Profits

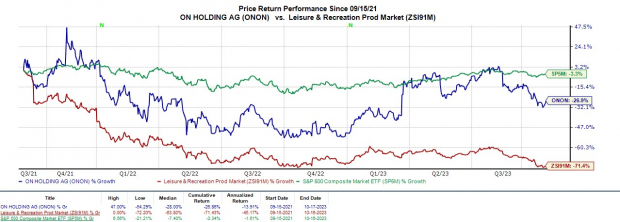

ON Holding went public on U.S. stock exchanges in 2021 and through its subsidiaries, the Switzerland-based company provides footwear and sports apparel products. Although sound growth is anticipated on the company’s top and bottom lines, investors may want to monitor the premium they are paying for ON Holding stock amid a weakening outlook.

To that point, it may be time to cut losses or take profits as ON Holding’s stock has rebounded and soared +50% this year but is still down -27% since its IPO. Notably, ONON shares popped +45% on the first day of trading to $35 a share but currently trade near its IPO price of $24 per share.

Image Source: Zacks Investment Research

Premium Fears Amid a Weakening Outlook

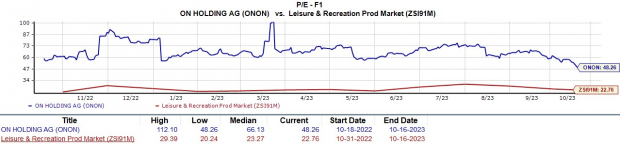

Despite EPS forecasted to climb 79% in fiscal 2023 and soar another 54% in FY24 at $0.80 per share, earnings estimates are slightly down over the last 60 days with ONON shares trading at 48.2X forward earnings.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Any further decline in earnings estimates would be very worrisome as ON Holding's stock trades at a stretched premium to the industry average of 22.7X and well above the S&P 500’s 20.5X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Furthermore, while On Holding’s top-line expansion has been intriguing as well its price-to-sales ratio of 7.8X is uncomfortably above the optimum level of less than 2X and the benchmark’s 3.7X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

This year’s sharp rally in ON Holding’s stock is starting to look overdone, investors who have been intrigued about the possibilities of more upside may want to stay on the sideline as short-term risks start to mount again.

More By This Author:

Bull Of The Day: SkechersNvidia Stock Takes A Hit Amid China Restriction News - Time To Buy The Dip?

Bull Of The Day: Nu Holdings Ltd.

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more