Bear Of The Day: Nike

NIKE, Inc. (NKE - Free Report) is struggling as China faces further COVID restrictions and transit costs rise. This Zacks Rank #5 (Strong Sell) has seen its fiscal 2023 earnings estimates slashed.

NIKE designs, makes and distributes athletic footwear, apparel, equipment, and accessories globally for a wide variety of sports and fitness activities.

It also owns Converse, which designs, markets, and distributes athletic lifestyle footwear, apparel and accessories.

Another Beat in the Fourth Quarter of Fiscal 2022

On June 27, 2022, NIKE reported its fiscal fourth-quarter 2022 results and beat the Zacks Consensus Estimate by $0.09. It reported $0.90 versus the Zacks Consensus Estimate of $0.81.

It was the 8th earnings beat in a row. NIKE has only missed on earnings 2 times in the last 5 years. That's impressive given the difficult retail market conditions during the pandemic with the supply chain, transit, logistics, and rising costs.

Revenue fell 1% to $12.2 billion versus the prior year but was up 3% on a currency-neutral basis.

In its largest market of North America, NIKE saw sales fall 5% year-over-year. But the worst market was Greater China, which sank 19% year-over-year as China's COVID restrictions hit sales.

Gross margin fell 80 basis points to 45%, as higher inventory obsolescence reserves in Greater China and elevated freight and logistics costs, which was partially offset by strategic pricing actions, favorable changes in net foreign currency exchange rates, including hedges, and margin expansion in the NIKE Direct business.

Inventories were up 23% to $8.4 billion.

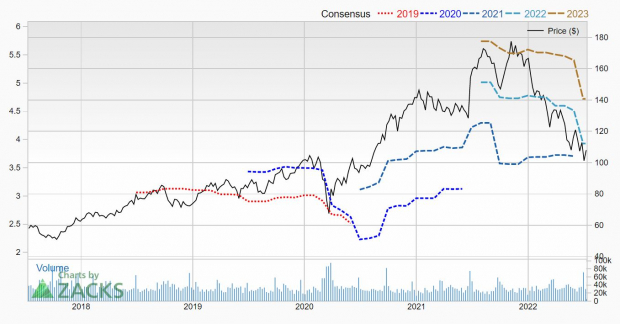

Analysts Slash Fiscal 2023 and 2024 Earnings Estimates

The analysts are bearish on NIKE. 10 estimates have been cut for fiscal 2023 since the fourth-quarter earnings report came out in June.

The Fiscal 2023 Zacks Consensus Estimate has fallen to $3.93 from $4.60 over the last 60 days. That's just a 4.8% rise in earnings as NIKE made $3.75 last year.

However, they are also bearish on fiscal 2024. 6 have been lowered for that year, pushing the Zacks Consensus down to $4.72 from $5.48 in the last 60 days.

Shares Sink in 2022

NIKE shares were initially big winners during the pandemic, but over the last 2 years, they are up just 7.3% compared to a 22.4% gain on the S&P 500.

This year, they have plunged 36.9%.

Image Source: Zacks Investment Research

But with earnings being slashed, are the shares even cheap?

NIKE trades with a forward P/E of 27.5 and a PEG ratio of 2.2. Neither of those metrics falls within the classic value parameters.

NIKE is shareholder-friendly, however, with a dividend currently yielding 1.1%. The board also announced a massive, new, 4-year $18 billion share buyback.

But with uncertainty remaining about China's COVID restrictions to start their fiscal year, and continued rising costs, investors might be wise to wait on the sidelines.

More By This Author:

Meta Platforms Is A Value StockQ2 Earnings: Energy and What Else?

Screening for the Best Growth Stocks in Summer of 2022

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more