Bear Of The Day: MasterCraft

The boom times are over for MasterCraft Boat Holdings, Inc. (MCFT) . This Zacks Rank #5 (Strong Sell) is expecting to see a dramatic decline in earnings and sales in Fiscal 2024.

MasterCraft designs and manufactures recreational powerboats through three brands: MasterCraft, Crest and Aviara. It has two segments of the powerboat industry, performance sport boats and pontoon boats, while also entering the luxury day boat segment.

Retail Sales Slowed in Fiscal Q4 2023

On Aug 30, 2023, MasterCraft reported its fiscal fourth quarter 2023 and full year 2023 results. The pandemic was a catalyst for the boating industry as consumers bought boats during the lock downs to be outdoors.

Fiscal 2023 was the third consecutive record year for earnings and sales for the company. It was also the most profitable fiscal year in the Company's history as net sales rose to $662 million, up 3.2% over the prior year.

It saw the highest cash flow in the company's history at $134 million. Times were good.

MasterCraft also beat on the fiscal fourth quarter for the 13th time in a row. It reported earnings of $1.37 versus the Zacks Consensus of $1.08.

It has an excellent earnings surprise track record with just one miss in the last 5 years.

(Click on image to enlarge)

Image Source: Zacks Investment Research

But as the fourth quarter progressed, MasterCraft saw retail sales slow significantly. It reduced production plans but dealer inventories at the end of fiscal 2023 were at higher levels than the company would consider optimal.

Fiscal 2024 Guidance Was Below Consensus

“Macroeconomic factors, including elevated interest rates as well as tightening credit standards and availability, are creating significant uncertainty which is limiting our retail demand visibility," said Fred Brightbill, CEO.

"In addition, the general expectation for an economic downturn during fiscal 2024 will likely be a headwind for the industry."

As a result, it guided net sales to be between $390 million and $420 million, well under the $662 million it made in fiscal 2023.

The earnings guidance was in the range of $1.46 to $1.88, well below the consensus of $4.03.

As a result, the analysts have had to slash their earnings and sales estimates. 5 earnings estimates have been cut since the Q4 earnings report which has pushed the Zacks Consensus down to $1.81.

That's at the high end of the company's guidance range, but it is still 66.2% below the record $5.35 the company made last year.

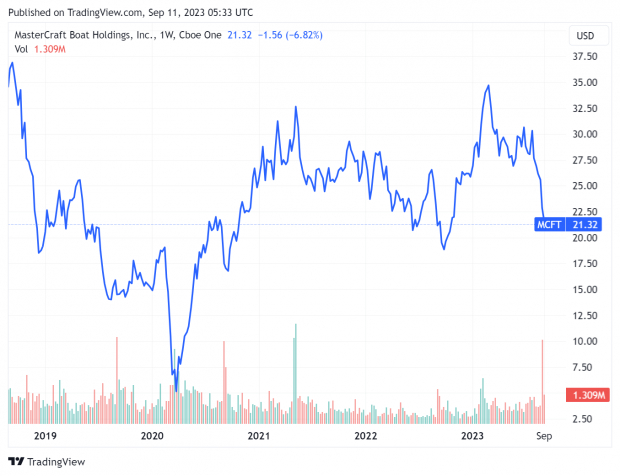

Shares Plunge in the Last Month

With earnings and sales expected to fall sharply in fiscal 2024, it's not surprising that the shares fell on the news. They're down 22.4% in the last month.

Over the last year, they're up, but just 0.7%. Will they re-test the Sep 2022 lows soon?

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shares are cheap, with a forward P/E of 11.8.

With the record free cash flow, the company has been buying back shares. MasterCraft bought back $22.9 million in shares in fiscal 2023.

But with the possibility of a recession looming, investors should probably stay away from this boat manufacturer until there is visibility on the consumer.

More By This Author:

Bull of the Day: TrexHow to Invest In NVIDIA's AI Revolution

Bear of the Day: KeyCorp

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more