Bear Of The Day: Malibu Boats

Malibu Boats, Inc. (MBUU) is navigating choppy waters as consumer demand for boats remains soft. This Zacks Rank #5 (Strong Sell) is riding out the slowdown while preparing for normalization.

Malibu Boats is a designer and manufacturer of recreational powerboats, including performance sport, sterndrive, and outboard boats.

It’s brands include Malibu and Axis in sport boats, Cobalt in sterndrive boats, Pursuit and Cobia in saltwater fishing boat market and the Pathfinder, Maverick and Hewes flats and bay boat brands.

A Rare Earnings Miss in the Fiscal Fourth Quarter

On Aug 29, 2024, Malibu Boats reported its fiscal fourth quarter 2024 results. It reported a loss of $0.39 versus the Zacks Consensus of a loss of $0.31.

It was, however, the first earnings miss by Malibu Boats in the last 5 years. That was an incredible earnings surprise track record given everything that had happened during the pandemic and after.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Sales were down 57.4% to $158.7 million from $213.6 million in the same quarter last year due to lower wholesale shipments driven by lower retail activity during the period. In other words, consumers were buying fewer boats.

Sales were down in all segments and promotional costs were higher.

Unit volume for the quarter fell 59% to 1,405 units from 2,550 units a year ago as retail sales slowed and channel inventory remained elevated.

For the full year, it was much the same. Sales were down 40.3% from fiscal 2023 to $829 million.

Unit volume for fiscal 2024 fell 45.4% to 5,385 units.

“Despite a softened retail demand environment, we are pleased with our execution as we closed out the fiscal fourth quarter,” said Bruce Beckman, Chief Financial Officer.

“We generated positive cash flow, paid down our remaining debt and returned cash to shareholders. We also made significant progress returning inventory to more normalized levels while upgrading our dealer network,” he added.

Analysts Bearish on Fiscal 2025

Despite some of the positives as Malibu Boats closed out fiscal 2024, the industry is simply waiting for normalization of the market.

Malibu Boats gave sales guidance in the low single digits for fiscal 2025. The Zacks Consensus has sales up just 1.8% to $843.7 million from $829 million in fiscal 2024.

The analysts are bearish on earnings. 3 estimates have been cut in the last 30 days for fiscal 2025 which has pushed the Zacks Consensus down to $2.26 from $3.17.

However, that’s still earnings growth of 17.7% compared to fiscal 2024’s earnings of $1.92.

Here’s what it looks like on the price and consensus chart.

(Click on image to enlarge)

Image Source: Zacks Investment Research

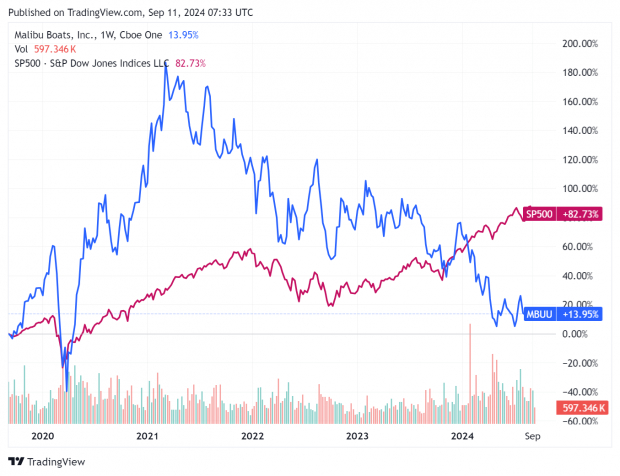

Malibu Boats Shares Struggle as Boat Sales Remain Depressed

Boat sales soared during the pandemic as everyone took to the outdoors. Shares of Malibu Boats soared as well.

But over the last 5-years, it is now under performing the S&P 500 and is at multi-year lows.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Malibu Boats trades with a forward P/E of 15.8. While that’s considered cheap, with the earnings estimates being cut, it could be a value trap.

Investors might want to wait on the sidelines until earnings, and sales, finally start to turn around.

More By This Author:

Nvidia Earnings Preview: Will It Beat Again?5 Best Of The Best Stock Picks

Bull Of The Day: Twilio

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more