Bear Of The Day: Malibu Boats Inc.

Image Source: Pexels

Experiencing the broader macro pressures on consumer discretionary spending, it may be best to avoid Malibu Boats (MBUU - Free Report) stock at the moment, which lands a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

Despite a strong balance sheet and leadership in boating tech, continued retail headwinds and margin volatility have led to cautious sentiment for Malibu's stock, with MBUU falling more than 10% year to date and now down a grizzly 35% in the last five years.

Image Source: Zacks Investment Research

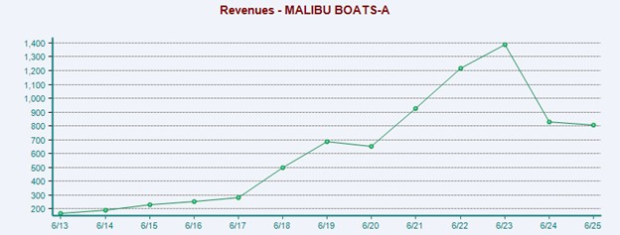

Implied Production Cuts & Soft Guidance

Recently reporting results for its fiscal fourth quarter in late August, Malibu announced a cautious outlook for its current fiscal year 2026. This included lower revenue guidance and implied production cuts due to persistent softness in saltwater markets and a muted rebound in demand during the early-season boat shows.

Notably, Malibu expects net sales to be flat to down mid-single digits in FY26 after seeing its top line decrease 2% in FY25 to $807.56 million. Free-falling from peaks of more than $1.3 billion in FY23, the ongoing sales weakness has led to more pessimism about Malibu’s ability to maintain its operational strength. To that point, Malibu’s net income surged 127% in FY25 to $15.2 million, but the company saw a 9% decline in adjusted EBITDA ($74.8 million) and unit volumes (4,898).

Image Source: Zacks Investment Research

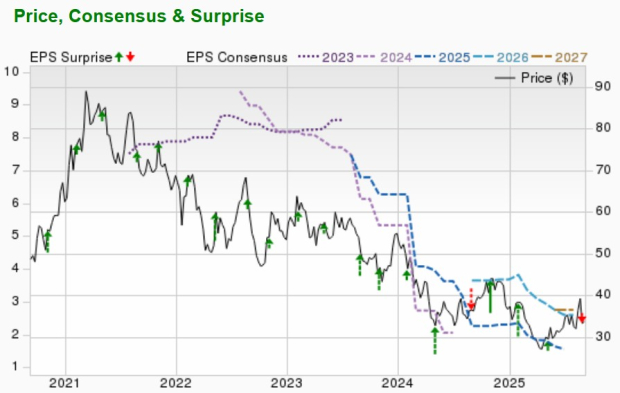

Declining EPS Revisions

Amid the acknowledgement of retail headwinds, earnings estimate revisions for Malibu have fallen mightily in the last 30 days.

Suggesting more short-term weakness in MBUU shares, FY26 EPS estimates have dropped 39% in the last month from $2.59 to $1.58. Starting to drain hopes of a sharp rebound in Malibu stock and taking away from its growth narrative is that FY27 EPS estimates have fallen 20% from $2.75 to $2.14.

Image Source: Zacks Investment Research

Bottom Line

Although Malibu is a leading manufacturer of sports boats, the company is starting to be more susceptible to a weaker operating environment, with its Zacks Leisure and Recreation Products Industry currently in the bottom 29% of over 240 Zacks industries.

More By This Author:

Buy The Dip In These Top Financial Management Stocks: AAMI, ABIs Turning To Growth ETFs A Smart Move Now?

3 Oil Pipeline Stocks With Strong Potential From A Thriving Industry

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more