Bear Of The Day: Labcorp

Labcorp (LH) is a leading healthcare diagnostics company providing comprehensive clinical laboratory services and end-to-end drug development support. The company provides vital information to help doctors, hospitals, pharmaceutical companies, researchers, and patients make clear and confident decisions.

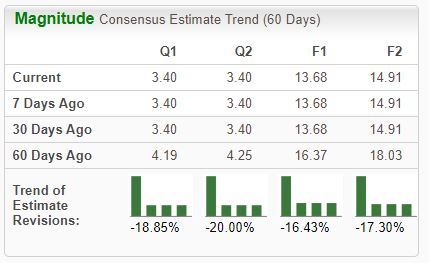

Analysts have slashed their earnings expectations for the company, pushing it down to a Zacks Rank #5 (Strong Sell).

(Click on image to enlarge)

Image Source: Zacks Investment Research

Let’s take a closer look at a few other company characteristics.

Current Standing

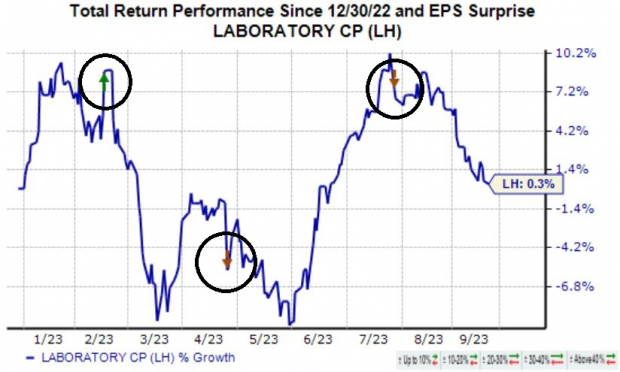

Labcorp shares have seen rollercoaster-type price action in 2023, up a modest 0.3% on a year-to-date basis and widely lagging behind the general market.

As illustrated below, the market hasn’t reacted well to the company’s recent quarterly reports, facing selling pressure regularly.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Regarding the most recent quarterly release, Labcorp fell short of the Zacks Consensus EPS Estimate by 1.5% but exceeded revenue expectations modestly. Earnings declined 31% from the year-ago period, whereas sales contracted 18% year-over-year.

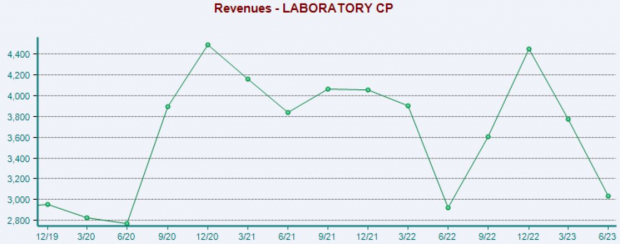

Further, operating income totaled $266 million, down nearly 40% from the comparable period last year due to the notable reduction in COVID-19 testing. Below is a chart illustrating the company’s revenue on a quarterly basis.

(Click on image to enlarge)

Image Source: Zacks Investment Research

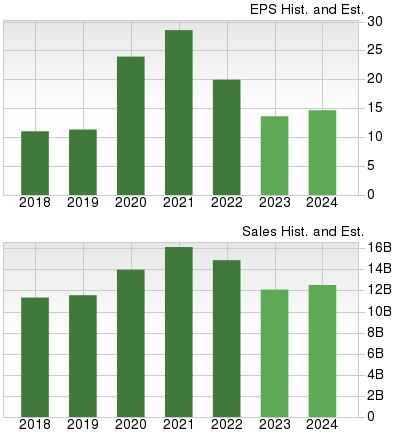

The company is forecasted to witness a growth slowdown in its current year (FY23), likely a reflection of reduced COVID-19 testing. Earnings are forecasted to be down more than 30% on 19% lower revenues in FY23 before returning to growth in FY24.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts and a slowdown in COVID-19 testing paint a challenging picture for the company’s shares in the near term.

Labcorp is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

3 Top Ranked Mutual Funds For Your RetirementIPO Watch: Is It Time To Buy These Intriguing Stocks?

Inside Newly-Launched Nvidia Bull And Bear ETFs

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more