Bear Of The Day: Kohls

Kohl’s (KSS), a specialty department store chain with 1,100 locations across the United States, has struggled significantly in recent years due to deteriorating business fundamentals.

The company's lackluster performance is underscored by a Zacks Rank #5 (Strong Sell) rating, falling sales growth, and a relatively high valuation despite its challenges. Given this setup, investors should approach Kohl's stock with caution and consider avoiding it altogether.

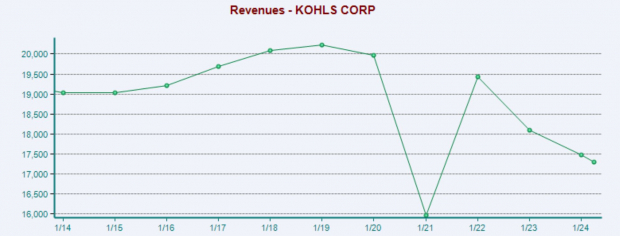

Falling Sales Growth at Kohl’s

One of the most alarming signs for any company is negative sales growth over an extended period. Unfortunately for Kohl’s, the company has experienced a 15% decline in sales over the past five years.

This downward trend is particularly concerning in the retail industry, where sustained growth is crucial for long-term success. As sales continue to fall, it becomes increasingly difficult to justify holding the stock until there is a significant turnaround.

(Click on image to enlarge)

Image Source: Zacks Investment Research

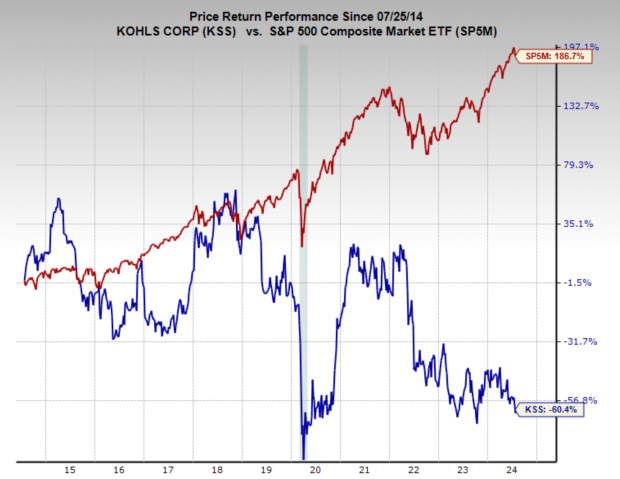

Deep Underperformance for Kohl’s Stock

Kohl’s stock has been a severe underperformer over the past decade, significantly lagging behind the broader market.

This underperformance is not just a relic of the past; recent performance has been equally dismal. Year-to-date, Kohl’s stock is down 29% and is currently trading near its recent lows. This consistent downward trend highlights the ongoing challenges the company faces in a highly competitive retail environment.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Kohl’s Valuation Remains Elevated

Despite its weakening business fundamentals, Kohl’s stock continues to trade at a relatively premium valuation. The stock's one-year forward earnings multiple is 14.4x, which is above its 10-year median of 11.1x and significantly higher than the industry average of 9x.

This elevated valuation is hard to justify given the company’s declining sales and overall poor performance. Investors typically seek bargains in struggling companies, but Kohl’s current valuation suggests it is far from being a bargain.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

While Kohl’s boasts a strong brand developed over many years, the retail and department store industry continues to face intense competition. The rise of e-commerce and changing consumer behaviors have put significant pressure on traditional brick-and-mortar stores like Kohl’s.

Until Kohl’s can address its growth issues in a material and sustainable way, the stock remains an unattractive option for investors. The combination of declining sales, poor stock performance, and an unjustifiably high valuation suggests that investors should steer clear of Kohl’s for the foreseeable future.

More By This Author:

Bull Of The Day: Amplify EnergyTime To Buy Chipotle's Stock As Much Anticipated Q2 Earnings Approach?

Tesla Lags Q2 Earnings Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more