Bear Of The Day: Kforce

Investors may want to start monitoring the premium they are paying for Kforce (KFRC) stock as earnings estimate revisions have remained lower over the last two 60 days.

The professional staffing services company is coming off of a weaker-than-expected second quarter and there could be more downside risk ahead.

Subpar Q2 Results

It has been over a month since Kforce reported underwhelming Q2 results in late July but the trend in earnings estimates remains bleak.

Kforce stated its second quarter reflected the continuation of an uncertain economic environment with the company needing to adjust its structural costs to align with lower levels of revenue. Notably, Q2 sales of $389.19 million missed estimates by roughly -2% and dropped -11% from the prior-year quarter.

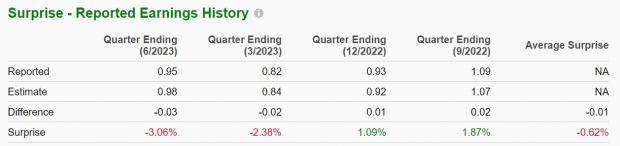

More concerning, Q2 earnings of $0.95 per share came up -3% short of expectations and dropped -27% from a year ago. This also marked the second straight quarter of missing top and bottom line expectations.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Following Kforce's Q2 report, annual earnings estimates have remained -8% lower for fiscal 2023 and -11% lower for FY24. Although Kforce's stock is still up a modest +12% YTD, shares of KFRC are down -6% since the company's Q2 report and lower EPS estimates are a sign the decline could continue.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Less Attractive Valuation

Declining earnings estimates have made Kforce’s P/E valuation less attractive relative to its peers. Trading at $61 a share and 19.3X forward earnings, Kforce stock trades slightly beneath the S&P 500’s 21.1X but 22% above the Zacks Staffing Firms Industry average of 15.7X.

This industry includes companies like GEE Group (JOB) and Heidrick & Struggles International (HSII) which have seen their annual earnings estimates go up despite a challenging operating environment and may be better options at the moment.

Furthermore, GEE Group and Heidrick & Struggles stock both trade under 10X forward earnings which is a more specific example of why investors might want to monitor the premium they are paying for Kforce stock.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Kforce should still have the potential to be a meaningful investment as it relates to the business services sector but now doesn’t look like a good time to buy.

Right now It may be best to stay on the sidelines in regard to Kforce's stock as there are better options in the Zacks Staffing Firms Industry with GEE Group’s stock currently boasting a Zacks Rank #1 (Strong Buy) and Heidrick & Struggles stock sporting a Zacks Rank #2 (Buy).

More By This Author:

Bull of the Day: Uber TechnologiesBear Of The Day: Paramount Global

Beyond The Hype: Are Market Participants Underestimating The Role Of AI?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more