Bear Of The Day: KeyCorp

KeyCorp (KEY) earnings are expected to slide in 2023 as the regional banks struggle while the Fed hikes. The analysts have recently cut full year earnings estimates again on this Zacks Rank #5 (Strong Sell).

KeyCorp is one of the largest bank-based financial services companies in the United States. It is headquartered in Cleveland, Ohio, and has assets of about $198 billion as of Mar 31, 2023. It provides deposit, lending, cash management and investment services to individuals and businesses in 15 states. KeyCorp operates, under the name KeyBank, about 1,000 branches and 1,300 ATMS.

It also operates KeyBanc Capital Markets and offers M&A advice, public and private debt and equity, syndications and derivatives to middle market companies in select industries.

The Analysts Are Cutting Again

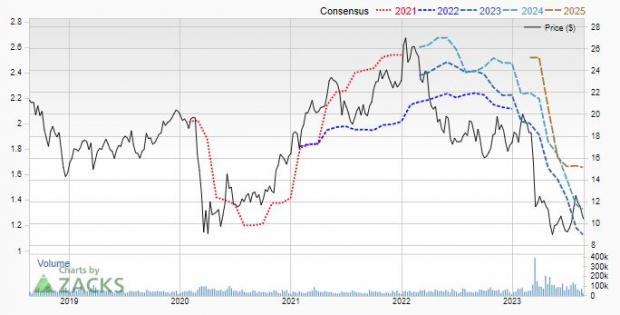

In late July 2023 and early Aug 2023, 4 analysts cut full year earnings estimates on KeyCorp for both 2023 and 2024.

4 estimates have been cut for 2023 in the last 30 days. That has pushed the Zacks Consensus down to $1.13 from $1.22 during that time. That's an earnings decline of 41.2% as KeyCorp made $1.92 last year.

4 estimates have also been cut for next year as well. That has pushed the Zacks Consensus down to $1.33 from $1.41, but that is earnings growth of 17.7%.

It's been a rough year for the regional banks in terms of beating the earnings estimates. KeyCorp has missed on the Zacks Consensus 3 out of the last 4 quarters.

Do the analysts have it right this time? Will 2023 turn out to be the earnings bottom?

Here's what the Zacks Price and Consensus chart looks like. This is why KeyCorp is a Rank #5 (Strong Sell). The analysts have been aggressively cutting earnings estimates for this year and next.

(Click on image to enlarge)

Image Source: Zacks Investment Research

What About that Dividend?

Shares of KeyCorp have fallen 38.3% year-to-date as fears about the banks have taken their toll. Over the last month, some of the weakness in the shares has returned. KeyCorp is down 5.9% over the last 30 days.

It's cheap, however, with a forward P/E of 9.2.

KeyCorp is also paying a massive dividend, currently yielding 7.9%. But I know what you're thinking: is that dividend for real?

KeyCorp declared the dividend on July 11, 2023. It is payable on Sep 15, 2023 to shareholders as of the close of business on Aug 29, 2023. But remember, your trade must clear by that date for you to qualify for the dividend. Be sure to check with your broker on clearing times.

Earnings are telling the story, for now, on some of the regional banks. The Zacks Rank is a short-term recommendation of 1 to 3 months. Investors interested in the banks, should be sure to check in on the earnings picture later on this year.

More By This Author:

Bull of the Day: The AndersonsInvesting Lessons From Rich Retirees

Gold, Copper, Energy And Cocoa: Hot Or Not?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more