Bear Of The Day: JOANN

Image: Bigstock

JOANN Inc. (JOAN Quick Quote JOAN - Free Report) was a pandemic winner but sales have slowed on the reopen. This Zacks Rank #5 (Strong Sell) is expected to see sales decline 12% this year.

JOANN is the leader in sewing and fabrics, and also is a fast-growing player in arts and crafts. It operates 855 stores across 49 states and e-commerce business.

A Miss in the Second Quarter

On Sep 2, JOANN reported its fiscal second-quarter 2022 results and missed on the Zacks Consensus Estimate by 7 cents.

Earnings were a loss of $0.20 compared to the Zacks Consensus of a loss of $0.13.

Net sales fell by 29.8% to $496.9 million year-over-year as last year the company saw a surge of sales with people staying home during the pandemic.

Comparable sales also fell 29.9% but on a 2-year stack, total comparable sales rose 8.1%.

It's omnichannel net sales were up 115% to $53.5 million, on a two-year basis and now represent about 11% of total second-quarter sales versus about 5% pre-pandemic.

Analysts Cut Estimates

Like every retailer, JOANN is experiencing supply chain challenges as it heads into its two busiest seasons, fall and the winter holidays.

The analysts have gotten more cautious in the last month.

4 estimates have been cut for Fiscal 2022 and Fiscal 2023 in the last 30 days.

The Zacks Consensus Estimate for Fiscal 2022 has fallen to $2.09 from $2.84 in the last month.

Fiscal 2023 has also fallen to $2.16 from $3.03 during that time. That is just earnings growth of 3.5%.

Shareholder Friendly

On Sep 13, JOANN announced its board had authorized a share repurchase up to an aggregate of $20 million through Mar 9, 2022.

The company also pays a dividend, currently yielding 3.6%.

Shares are Dirt Cheap

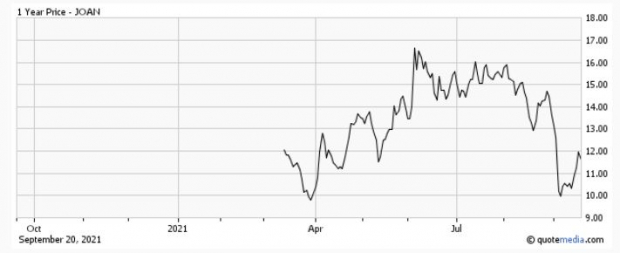

JOANN only went public in March. The second quarter was its full quarter as a public company.

Shares have taken a tumble in the last month, falling 11%.

Image Source: Zacks Investment Research

They are dirt cheap on a P/E basis, with a forward P/E of 5.7.

However, with the uncertainty around the earnings going forward, it might be best for investors to wait on the sidelines.

Disclaimer: Tracey Ryniec is the Value Stock Strategist for Zacks.com. She is also the Editor of the more

Yeah it’s so bearish that even he bought..🤡🤡🤡