Bear Of The Day: Hershey

Reporting lackluster third quarter results on Thursday, there could be more downside risk ahead for Hershey’s (HSY) stock.

To that point, the iconic chocolate manufacturer had already seen a decline in its earnings estimate revisions with HSY landing a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

Hershey’s Dismal Q3 Results

Attributed to what it called a challenging consumer environment, Hershey’s Q3 sales of $2.98 billion dipped 1% from the comparative period and missed estimates of $3.07 billion by 3%.

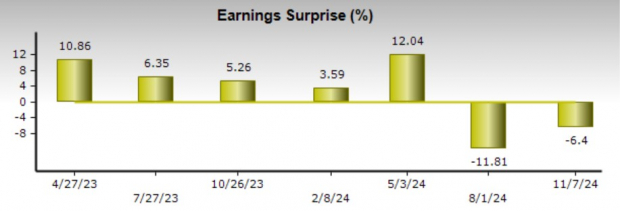

Lower sales volumes curtailed Hershey’s profit with Q3 EPS of $2.34 dipping 10% from a year ago and missing expectations of $2.50 per share by 6%.

Furthermore, Hershey previously missed Q2 earnings and sales estimates in August with surprises of -12% and -10% respectively.

Image Source: Zacks Investment Research

High Cocoa Prices

Causing more concern was Hershey’s acknowledgment that historically high cocoa prices are weighing on its operating efficiency as well. As the prime ingredient in producing chocolate, cocoa prices are still toward the high end of its 50-year range at over $7,000 per ton.

Image Source: Trading Economics

Declining EPS Estimates

Leading to the strong sell rating for Hershey’s stock, EPS estimates for fiscal 2024 and FY25 have continued to decline over the last 90 days. Unfortunately, the trend of declining earnings estimate revisions will likely continue as Hershey’s full-year FY24 EPS guidance of $9.00-$9.10 came in below the current Zacks Consensus of $9.39 per share.

Image Source: Zacks Investment Research

Bottom Line

For now, it could be best to avoid Hershey’s stock as weaker snacking demand and high cocoa prices are starting to weigh on North America’s largest chocolate producer.

Hershey’s stock is now down -7% year to date and has dropped -25% in the last three years. Correlating with such, it’s noteworthy that Hershey’s Zacks Food-Confectionary Industry is currently in the bottom 5% of over 250 Zacks industries.

More By This Author:

Bull Of The Day: TargetBlock Q3 Earnings Meet Estimates

Qualcomm Q4 Earnings And Revenues Surpass Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more