Bear Of The Day: Herbalife

Company Overview

Zacks Rank #5 (Strong Sell) stock Herbalife (HLF) is a global multi-level marketing (MLM) company that primarily sells nutritional supplements, weight management, sports nutrition, and personal care products. Founded in 1980 by Mark Hughes, Herbalife operates in over 90 countries through a network of independent distributors who sell its products directly to consumers.

The core products of Herbalife include protein shakes, dietary supplements, vitamins, energy drinks, protein bars, and personal care products such as skincare and hair items. These products are often marketed to promote weight loss, improve overall health, and enhance athletic performance.

Pyramid Scheme Accusations Have Weighed on Stock

Billionaire investors Carl Icahn and Bill Ackman famously squared off on live television about their differing HLF positions. Though Icahn ended up winning the dispute by orchestrating a classic short squeeze (netting him billions of dollars), the more time that has passed, the more Ackman’s pyramid scheme short thesis has tarnished HLF shares.

Herbalife’s business model relies heavily on its network of distributors, who purchase products from the company at wholesale prices and then sell them to consumers for a profit. Distributors can also earn commissions by recruiting new distributors and building a downline organization.

Critics of Herbalife’s business model (like Ackman) argue that it resembles a pyramid scheme, emphasizing recruiting new distributors rather than selling products. As a result, Herbalife has faced legal challenges and regulatory scrutiny regarding its business practices. This has included accusations of deceptive marketing, false income claims, and concerns about the sustainability of its MLM structure.

Debt is Mounting While EPS is Slowing

Whether or not HLF meets the criteria for a true pyramid scheme, the legal battles caused by the accusations are costing the company. HLF’s long-term debt has been trending higher for over a decade – the opposite of what investors want to see.

(Click on image to enlarge)

Image Source: Zacks Investment Research

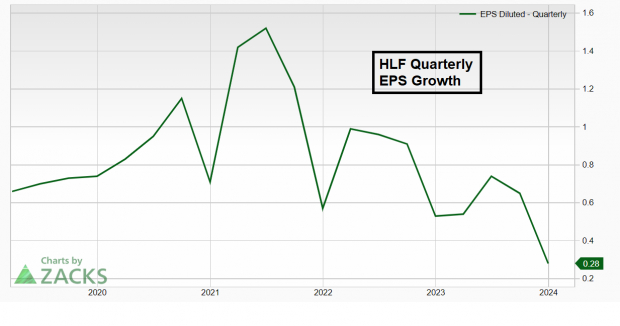

Meanwhile, EPS is moving in the wrong direction also, as HLF is working on its third-straight year of decelerating growth.

(Click on image to enlarge)

Image Source: Zacks Investment Research

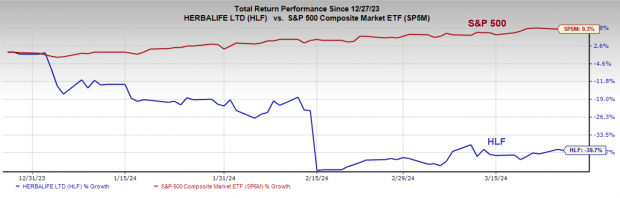

Chart is Deteriorating

Savvy investors understand that weakness tends to beget weakness on Wall Street. HLF is exhibiting worrisome relative weakness. HLF is down a painful 39% over the past three months, underperforming the S&P 500 Index’s 9% gain over the same period.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Finally, HLF shares are carving out a classic bear flag pattern. Notice the long-term downtrend, culminating in a countertrend rally into resistance (the 10-week MA in this case).

(Click on image to enlarge)

Image Source: TradingView

Bottom Line

Herbalife’s struggles with legal battles, mounting debt, and slowing earnings per share casts a shadow over its future prospects. The company’s controversial business model and poor performance suggest ongoing challenges ahead.

More By This Author:

Bull Of The Day: SpotifyDOJ Takes A Bite Out Of Apple As Buffett Sours On The Stock

Bull Of The Day: Li Auto

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more