Bear Of The Day: Gildan Activewear Inc.

Image Source: Pexels

Gildan Activewear Inc. (GIL - Free Report) is an apparel firm focused on the basics and operating behind the scenes through wholesalers and beyond. Gildan is facing a difficult to compete against a stretch of growth and a challenging macro backdrop that’s seen its earnings outlook fade.

Proud to Be Basic

Gildan is an apparel giant that some might not even know they own. Gildan’s tagline is that it is a leading manufacturer of “everyday basic apparel.”

The company is essentially a wholesaler of everyday basic apparel that is most often branded by some other entity. If one were to look in their closet at any vacation destination T-shirt, school sweatshirt, or company polo, there is a good chance at least one of them was made by Gildan.

Gildan operates a diverse portfolio of company-owned brands, including its namesake, American Apparel, Comfort Colors, GoldToe, and others. Its products include sweatshirts/fleece, T-shirts & tanks, socks, activewear, underwear, and most other basic wardrobe staples.

Gildan’s customers include screen printers or embellishers, wholesale distributors, traditional and e-commerce retailers, and “global lifestyle brand companies.”

Image Source: Zacks Investment Research

Outlook and EPS Revisions

Gildan posted nearly 50% sales growth in 2021 and another 11% revenue expansion in 2022 after it bounced back from a big Covid-19 downturn. GIL’s revenue is projected to slip about 1% in 2023 and then pop 3.4% next year, based on Zacks estimates.

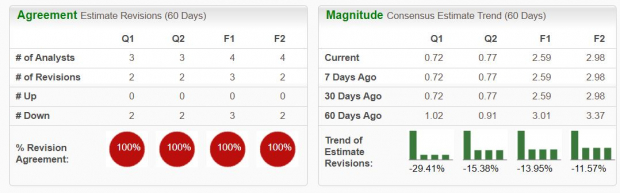

The company’s bottom line appears to be coming under a bit more pressure. GIL’s consensus earnings estimate has trended lower since its Q2 release, with its FY23 EPS estimate down 14% and its FY24 figure 12% lower. Gildan’s adjusted FY23 earnings are projected to slip by 17% YoY to $2.59 a share vs. $3.11 per share in the prior-year quarter.

Image Source: Zacks Investment Research

Bottom Line

Gildan’s bottom-line revisions help the stock land a Zacks Rank #5 (Strong Sell) at the moment. The company’s Textile – Apparel industry also ranks in the bottom 22% of over 250 Zacks industries right now.

GIL shares have slipped by 18% over the last six months and 15% in the past three months. Gildan stock has hugely underperformed the S&P 500 over the past 10 years, up 19% vs. 163% for the benchmark. GIL is also currently trading below its 50-day and 200-day moving averages.

Gildan is projected to return to earnings growth in 2024. But it might be best to stay away from the stock, at least for now.

More By This Author:

Buy this Tech Stock on the Dip in October for 50% Upside?3 Top Stocks to Buy in October Despite Market Fears

3 Top-Ranked Tech Stocks Crushing The Market To Buy In Q4

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more