Bear Of The Day: First Solar, Inc. (FSLR)

First Solar (FSLR - Free Report) is a global provider of photovoltaic (PV) solar energy solutions. The company operates in two segments – Modules and Systems. The Modules segment designs and manufactures solar modules that convert sunlight into electricity, driving integrators and operators of PV solar power systems. Its Systems segment offers power plant solutions including project development, engineering, procurement, and maintenance servers geared to utility and industrial companies. First Solar was founded in 1999 and is based out of Tempe, AZ.

The Zacks Rundown

FSLR, a Zacks Rank #5 (Strong Sell), experienced a climax top in late October of last year and has been in a price downtrend for the past several months. The stock is hitting a series of new 52-week lows and represents a compelling short opportunity as the market continues its volatile start to the year.

FSLR is a component of the Zacks Solar industry which ranks in the bottom 13% of all Zacks Ranked Industries. Our proprietary historical research has shown that stocks in the bottom half of industry groups underperform the top half by a factor of more than 2 to 1. As such, we expect this industry group to underperform the market over the next three to six months. Candidates in the worst-performing industries can often represent good shorting opportunities, as their industry association provides a headwind to any rally attempts.

The Past and Present: Earnings History and Forecasts

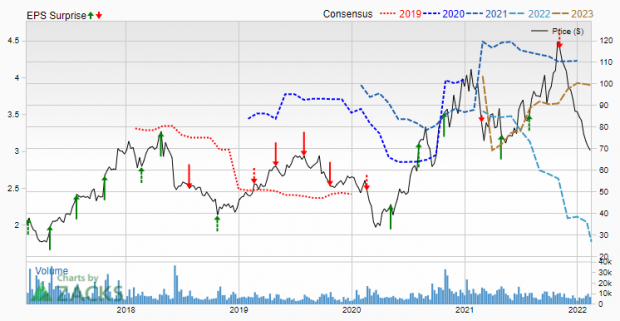

Earnings misses have been a sore spot for First Solar in recent years. The solar provider has fallen short of estimates in seven of the past twelve quarters. FSLR most recently reported Q3 EPS back in November of $0.42, missing the $0.63 consensus estimate by -33.33%.

First Solar is scheduled to report Q4 earnings on March 1st. Analysts are expecting EPS of $1.07, which would translate to negative growth of -0.93% relative to the same quarter in the prior year. The situation looks even direr for the current quarter as analysts have reduced their estimates by -19.05% in the past 60 days. The Q1 Zacks Consensus EPS estimate now sits at $0.34, marking an -82.65% regression versus the first quarter last year. Sales are anticipated to fall -19.61% to $645.79 million.

Looking into 2022, analysts covering FSLR are in agreement and have condensed their full-year EPS estimates by -16.51% during the past two months. The Zacks Consensus Estimate is now $1.77, reflecting a -57.98% reduction in yearly EPS. Sales are seen falling by -6.01% to $2.75 billion.

Consensus earnings estimates have been weakening along with the stock, a good sign for the bears:

Image Source: Zacks Investment Research

Technical Outlook

FSLR stock has been steadily falling since late last year and has now established a well-defined downtrend. Notice how both the 50-day (red line) and 200-day (purple line) moving averages are sloping down. The stock continues to trade below both averages, while the 50-day moving average has acted as steady resistance throughout the down move:

Image Source: TradingView

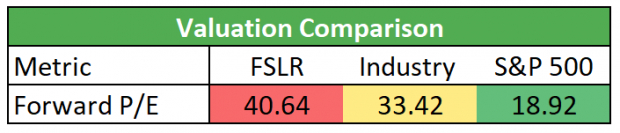

First Solar has continued its descent into the new year, with shares falling nearly 18%. Even with the recent price decline, the stock is still relatively overvalued which could continue to hurt performance in the short term:

Image Source: Zacks Investment Research

Final Thoughts

A variety of headwinds such as pandemic-related delays and shortages as well as unfavorable changes in import tariffs for solar products may continue to hurt the stock. A history of earnings misses and deteriorating sales and earnings estimates are a huge red flag and need to be respected. These will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

FSLR’s characteristics have resulted in a Zacks Momentum Style Score of ‘C’ and an overall ‘D’ VGM score. The company is part of an industry group that ranks in the bottom 13% of all Zacks Ranked Industries. Potential investors will want to steer clear of FSLR until the situation shows drastic signs of improvement, or possibly include it as part of a short or hedge strategy.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more