Bear Of The Day - Dollar General

Zacks Rank #5 (Strong Sell) stock Dollar General Corporation (DG) is one of the largest discount retailers in the United States. Dollar General specializes in merchandise that typically sells for below $10 and includes consumable items, seasonal items, home products, and apparel. The company sells a mix of products, including merchandise created in-house, as well as inventory from leading national brands. Dollar General operates nearly 20,000 locations across the United States and Mexico.

Rising Expenses Due to Theft

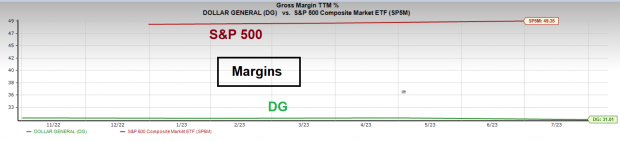

Shoplifting is on the rise across major cities in the United States. For example, popular drug store Walgreens (WBA) recently revealed that shrink was up by more than 50% due to a spike in organized retail crime! Meanwhile, other retailers such as Target (TGT) have been forced to close dozens of stores in these crime “hot spots.” Though Dollar General is less impacted due to its low-cost items, rising SG&A expenses are straining its margins. Dollar General’s gross margins of 31% are well below the S&P 500’s margins of 49.35.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Softness in Discretionary Space Means Slowing Growth

While Dollar General’s margins are shrinking, growth is slowing – a dangerous combination. As stimulus-driven spending gradually wanes, the consumer products discretionary industry finds itself in a vulnerable position. Last quarter, sales declined by nearly 30%, while EPS grew at a feebly 4% year-over-year.

To make matters worse, Zacks Consensus Estimates paint an ominous picture. Next quarter, Wall Street expects EPS growth to drop 42%. Full-year 2024 EPS is expected to come in at -26.5%. In 2025, analysts expect mediocre growth of 7.35%.

Defensive Name not Acting Defensive

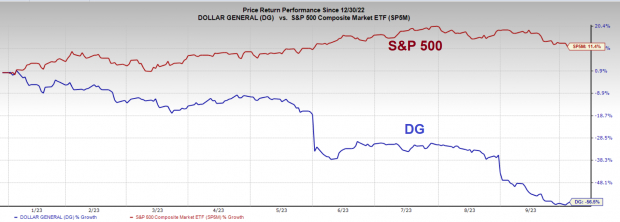

Discount retailers like Dollar General are considered defensive because their rock-bottom prices mean more resistance to economic downturns. However, DG’s growth is slowing even in the tough consumer economy. Furthermore, DG underperformed alongside high-tech, risk-on type stocks through the September stock market correction. In other words, if DG provides little safe-haven protection and is likely to underperform risk-on assets if the market bottoms, what’s the point of holding shares? The chart below illustrates how relatively weak the stock has performed.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Conclusion

Dollar General is not living up to its defensive, safe-haven reputation. Despite its low-cost offerings, margins are shrinking while growth is slowing – a poor combination.

More By This Author:

5 Balanced Mutual Funds To Buy Amid Market MeltdownBull Of The Day - Super Micro Computer

What's Going On With Tesla Shares?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more