Bear Of The Day: DocuSign, Inc.

DocuSign, Inc. (DOCU) sells software offerings highlighted by e-signature, document generation, contract lifecycle management, and more.

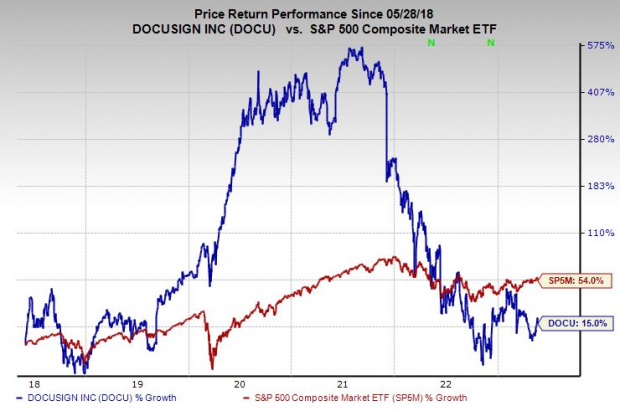

DocuSign stock got overheated alongside many other pandemic high-flyers, and it currently trades around 80% below its peaks as Wall Street remains concerned about slowing growth and increased competition from Adobe and others. And some of DocuSign’s earnings revisions are trending in the wrong direction.

Slowing Down

DocuSign offers various platforms for e-signature, document generation, contract lifecycle management, and beyond. DocuSign sells industry and department-specific solutions, and it has pre-built integrations within other big names in business software.

DocuSign’s revenue boomed as more of the economy moves to the digital world. Mortgage documents, tons of legal agreements, and much more now often live in electronic format. DOCU’s revenue soared following its 2018 IPO, including four-straight years of between roughly 35% to 45% growth. However, the company reported its full-year fiscal 2023 results in early March that showed revenue only climbed 19%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Zacks estimates call for DocuSign’s revenue to climb 7.3% this year and 8% next year. The slowing revenue growth comes as DOCU faces a difficult-to-compete-against stretch, a slowing economy, and growing competition from the likes of Adobe (ADBE) and other large, more diversified tech companies.

DocuSign’s earnings outlook has recently dipped slightly for next year. On top of that, the most accurate (most recent) EPS estimate for next year comes in 7% below the current Zacks consensus to help it land a Zacks Rank #5 (Strong Sell) at the moment.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

DocuSign still operates a solid business, and Zacks estimates call for it to post 15% adjusted earnings growth this year and 10% higher EPS next year. And DOCU is attempting to cut costs to improve its bottom line and help make up for slowing revenue expansion.

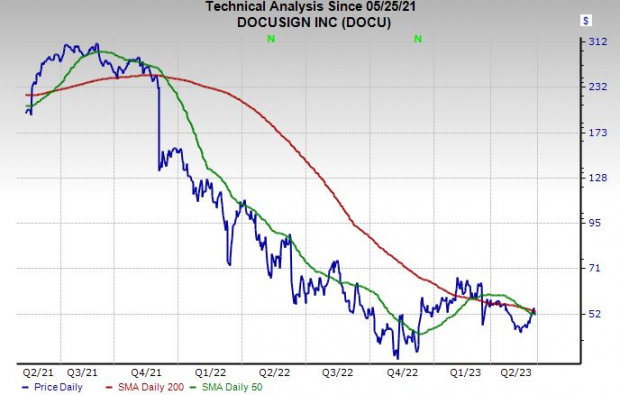

But Wall Street and the price movement are telling investors to stay away from DocuSign right now. DOCU is still down 34% in the last year and it has slipped around 4% YTD. DOCU’s technical chart appears a little worrisome as well. Plus, DocuSign is sitting slightly above neutral RSI levels, which means it would take even more selling to get it near oversold territory.

Until there is a material change in its guidance or buyers finally start to show up in waves to buy the beaten-down DocuSign, investors might want to look at other tech stocks that have boosted their earnings guidance and participated more heavily in the 2023 comeback.

DocuSign will have a chance to start changing the hearts and minds of Wall Street when it reports its first quarter fiscal 2024 results on Thursday, June 8.

More By This Author:

Highly-Ranked Growth Tech Stocks To Buy And Hold As The Bulls Fight Back2 Beaten-Down Stocks To Buy And Hold For Years

Bear Of The Day: Foot Locker, Inc.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more