Bear Of The Day: Delta Air Lines

Delta Airlines Company Overview

Zacks Rank #5 (Strong Sell) stock Delta Air Lines (DAL) is known for its travel services for both passengers and cargo. Delta, the second-largest U.S. airline, links customers to locations in the United States and worldwide. The company follows a “hub and spoke system” with hubs located in cities such as Atalanta and New York. Delta offers a range of seating options and amenities through its “SkyTeam” alliance partnerships. The airline is also renowned for its customer rewards program, SkyMiles Delta.

The Inherent Unpredictability of Airline Stocks

Warren Buffett, the most successful value investor of all-time, once quipped, “The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money.”

As the COVID-19 pandemic reared its ugly head in 2020, Buffett was forced to panic sell $10 billion worth of Delta, American Airlines (AAL) United Airlines (UAL), and Southwest Airlines (LUV) stock. Though Buffett made the mistake of buying airlines in 2016, like every great investor, he learned from his mistake, cut his losses, licked his wounds, and moved on.

Below are five reasons the airline industry is as unpredictable as ever.

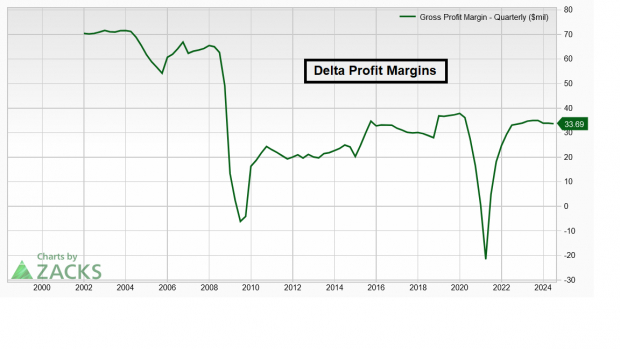

High Fuel Costs are Bearish for Delta

OPEC’s ongoing production cuts have caused high fuel costs. Because fuel costs are a major input for Delta, the company has suffered lower margins as energy prices have increased.

Image Source: Zacks Investment Research

Geopolitical Tensions Hurt Airline Industry

Rising geopolitical tensions in Europe and the Middle East present a major “Black Swan” threat to the travel industry should global war escalate further.

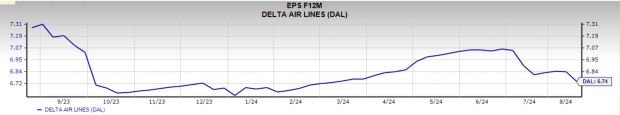

Delta Suffers From Price Wars with Low-Cost Carriers

Weak pricing power is hurting Delta’s EPS. Discount carriers like Spirit Airlines (SAVE) currently have excess seats available, causing them to lower fares and steal business from larger airlines like Delta.

Image Source: Zacks Investment Research

Rising Costs Ex Energy

In addition to rising fuel expenses, DAL is also burdened with rising non-energy costs. For instance, salaries and related costs jumped 12%. Though rising salaries are not bearish by themselves, I see them as a negative when the stock is performing the way that it has.

Unknowns: IT Outage, Boeing Issues

The global IT outage blamed on CrowdStrike (CRWD) impacted Delta dramatically, causing the cancellation of thousands of flights. Meanwhile, another unforeseen issue is that Delta has several Boeing (BA) airplanes in its fleet. Boeing planes have seen a plethora of mechanical and safety issues over the past few years.

Delta Bear Thesis Continued:

Weak Technical Picture

Delta is exhibiting troubling relative weakness. The stock is flat for the year, while the S&P 500 is up nearly 18%. Worse, DAL’s chart shows a bear flag pattern emerging on the daily chart.

Image Source: TradingView

Negative ESP Score

Zacks in-house studies prove that when a stock has a negative Earnings Surprise Prediction (ESP) score combined with a Zacks Rank #3 or worse, like Delta does, the stock tends to underperform over the next year.

Weak Consumer

Strength in lending stocks like UpStart (UPST) shows that the average U.S. consumer is weak.

Bottom Line

The airline industry is notoriously unpredictable. Rising fuel costs and cutthroat competition make Delta stock and avoid.

More By This Author:

Bear Of The Day: American AirlinesBull Of The Day: Inuitive Surgical

Bear Of The Day: Airbus Group

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more