Bear Of The Day: Delek Logistics Partners

Photo by Zbynek Burival on Unsplash

Delek Logistics Partners, LP (DKL) owns and operates logistics and marketing assets for crude oil and refined products in the United States. DKL operates crude oil transportation pipelines and associated crude oil storage tanks.

The energy company’s facilities provide crude oil and natural gas gathering and processing, water disposal and recycling, and transportation services. Its terminals and pipelines operate in Texas, Tennessee, Arkansas, Oklahoma, New Mexico, as well as the Gulf Coast region.

The Zacks Rundown

Delek Logistics Partners, a Zacks Rank #5 (Strong Sell), is a component of the Zacks Oil and Gas – Production Pipeline – MLB industry group, which ranks in the bottom 31% out of more than 250 Zacks Ranked Industries. As such, we expect this industry group as a whole to underperform the market over the next 3 to 6 months.

Candidates in the bottom tiers of industries can often be solid potential short candidates. While individual stocks have the ability to outperform even when included in a poorly-performing industry group, the inclusion in a weaker group serves as a headwind for any potential rallies and the journey forward is that much more difficult.

Despite a rebound in energy stocks over the past two months, DKL shares have not been gushing lately. The stock has experienced considerable volatility over the past year. Shares recently hit a 52-week low following a disappointing earnings report and represent a compelling short or hedge opportunity.

Recent Earnings Misses and Deteriorating Outlook

DKL has fallen short of earnings estimates in three of the last four quarters. The energy company most recently reported second-quarter earnings earlier this month of $0.73/share, missing the $0.81/share consensus EPS estimate by 9.88%. Earnings declined slightly from the same quarter in the prior year.

Delek Logistics Partners has delivered a trailing four-quarter average earnings miss of -7.35%. Consistently falling short of earnings estimates is a recipe for underperformance, and DKL is no exception.

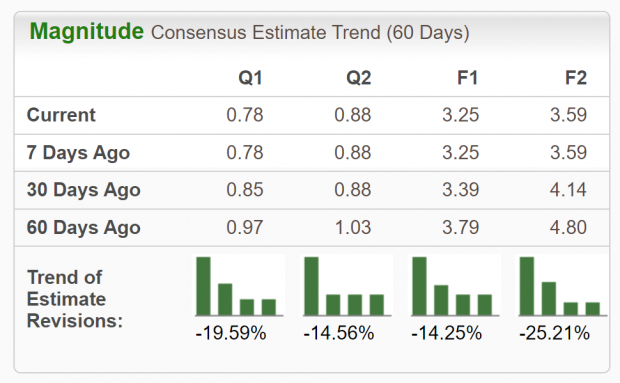

The company has been on the receiving end of negative earnings estimate revisions as of late. For the current quarter, analysts have decreased estimates by 19.59% in the past 60 days. The third-quarter Zacks Consensus EPS Estimate is now $0.78/share, reflecting negative growth of -24.27% relative to the same quarter last year. Revenues are expected to drop -10.94% during Q3.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Falling earnings estimates are a huge red flag and need to be respected. Negative growth year-over-year is the type of trend that bears like to see.

Technical Outlook

As illustrated below, DKL stock is in a sustained downtrend. Notice how shares have plunged below both the 50-day and 200-day moving averages signaled by the blue and red lines, respectively. The stock is making a series of lower lows, with no respite from the selling in sight. Also note how both moving averages have rolled over and are sloping down – another good sign for the bears.

(Click on image to enlarge)

Image Source: StockCharts

While not the most accurate indicator, DKL stock has also experienced what is known as a ‘death cross’, wherein the stock’s 50-day moving average crosses below its 200-day moving average. Delek Logistics Partners would have to make a serious move to the upside and show increasing earnings estimate revisions to warrant taking any long positions in the stock. The stock has fallen more than 20% in the past 2 months alone.

Final Thoughts

A deteriorating fundamental and technical backdrop show that this stock is not set to gush to new highs anytime soon. The fact that DKL stock is included in one of the worst-performing industry groups provides yet another headwind to a long list of concerns. A history of earnings misses and falling future earnings estimates will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.

A potential false breakout in crude oil may temper down the recent move in energy stocks. Potential investors may want to consider including this stock as part of a short or hedge strategy. Bulls will want to steer clear of DKL shares until the situation shows major signs of improvement.

More By This Author:

Bull of the Day: Fomento Economico MexicanoHewlett Packard Enterprise Tops Q3 Earnings And Revenue Estimates

Bull Of The Day: Rover Group

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more