Bear Of The Day - Cracker Barrel Old Country Store

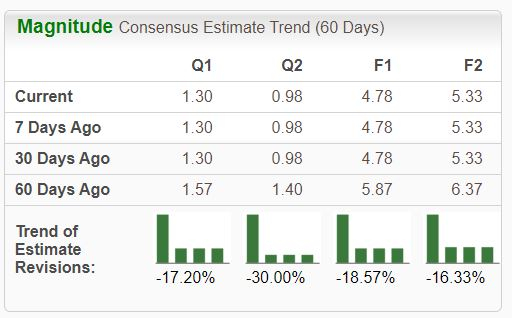

Cracker Barrel Old Country Store (CBRL) owns and operates full-service dining locations with a restaurant and a retail store in the same unit. Analysts have taken a bearish stance on the company’s outlook, pushing it down into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Let’s take a closer look at the company.

Cracker Barrel

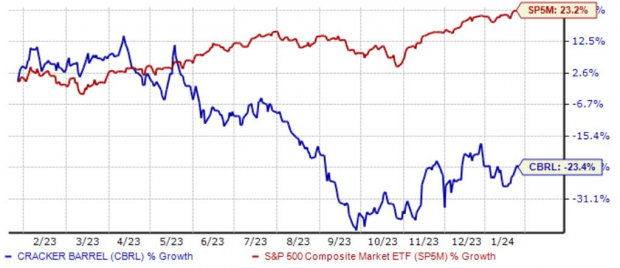

CBRL shares haven’t fared well over the last year, down 23% and widely underperforming relative to the general market. Shares moved lower following several of the quarterly prints in 2023 but have appeared to stabilize following its latest release.

While the recent price action is inspiring, the company’s pressured outlook certainly can’t be ignored.

Image Source: Zacks Investment Research

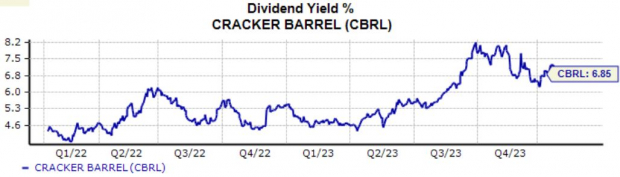

The adverse price action has bumped up CBRL’s annual dividend yield, currently paying a sizable 6.9% annually. Still, the company’s 104% payout ratio remains a concern, reflecting that it’s paying more out to shareholders than earnings generated.

Image Source: Zacks Investment Research

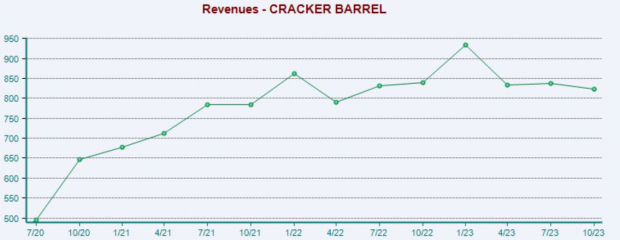

The company has primarily posted mixed earnings results as of late, falling short of the Zacks Consensus EPS Estimate by an average of -7% across its last four releases. Top line results have also been under pressure, with CBRL missing consensus revenue expectations in three consecutive releases.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts and mixed quarterly results paint a challenging picture for the company’s shares in the near term.

Cracker Barrel Old Country Store (CBRL Quick QuoteCBRL - Free Report) is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

2 Financial Stocks To Buy After Massive Earnings Beats3 Stocks To Consider After Beating Earnings Estimates

Starbucks Earnings Expected To Grow: What To Know Ahead Of Next Week's Release