Bear Of The Day: Churchill Downs

Image Source: Unsplash

Following lackluster Q2 results in late July, earnings estimate revisions are still noticeably lower for Churchill Downs' (CHDN - Free Report) stock landing it a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

Churchill Downs is the world’s most legendary horse track but there have been short-term concerns after the company had to suspend operations at the historic venue following the deaths of 12 horses in May alone.

The horses were euthanized after suffering serious injuries on the racetrack which has created unwanted headlines over the last few months.

Declining Earnings Estimates

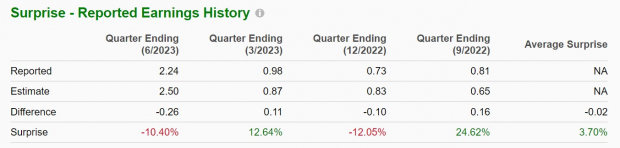

It’s notable that Churchill missed Q2 top and bottom line expectations. Earnings missed estimates by -10% with Q2 EPS at $2.24 per share compared to estimates of $2.50 a share. On the top line, sales of $768.50 million came up -3% short of estimates.

(Click on image to enlarge)

Image Source: Zacks Investment Research

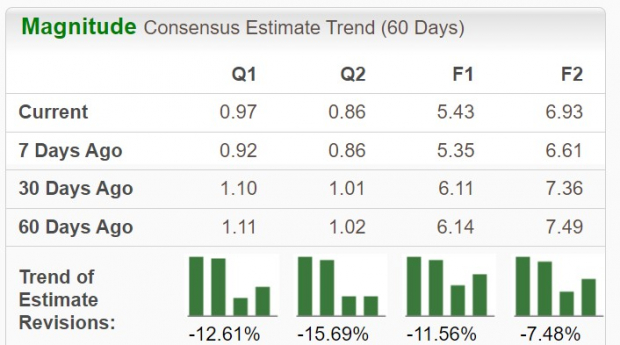

The lackluster results may not seem too alarming but amid the mounting safety and health concerns, earnings estimates are largely down over the last two months despite ticking up in the last week.

Analysts are expecting Churchill to have expansive bottom-line growth over the next few years but fiscal 2023 earnings estimates are down -11% over the last 60 days with FY24 EPS estimates down -7%. This has correlated with Churchill's stock falling -16% over the last three months despite shares of CHDN still up +15% for the year.

Image Source: Zacks Investment Research

Valuation Concerns

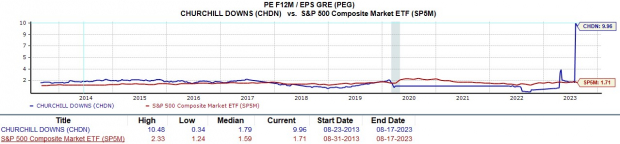

Taking a closer look at Churchill’s valuation we can see some cracks as well. Looking at Churchill’s PEG ratio may be beneficial right now due to the hiccups from halting horseraces.

With the PEG ratio, analysts can compare a company’s valuation with different growth rates. Taking the price-to-earnings ratio and dividing it by the long-term growth rate consensus, the optimum PEG is less than 1.

Unfortunately, Churchill’s PEG is currently at 9.9 and well above this level along with its industry average of 4.6, and the S&P 500’s 1.71.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

While Churchill Downs is expected to resume live racing at its namesake Kentucky Derby track in September, investors may want to be cautious of its stock until the smoke clears surrounding health and safety concerns for horses at its venue.

More By This Author:

2 Foreign Auto Stocks To Tap Into The Industry's Continued Positivity

5 Insurance Brokerage Stocks To Benefit From Higher Demand

How Is Lowe's Poised Ahead Of Q2 Earnings Release?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more