Bear Of The Day: CarMax

Photo by Arteum.ro on Unsplash

Today’s Bear of the Day is CarMax (KMX - Free Report). CarMax Inc. is the largest retailer of used vehicles in the U.S. and one of the nation's largest operators of wholesale vehicle auctions.

The company is engaged in providing related services, including financing vehicle purchases and selling extended warranties, accessories, and vehicle repair services.

In addition to being a Zacks Rank #5 (Strong Sell), the company has an overall VGM Score of an F – never a combination that you want to see a stock possess.

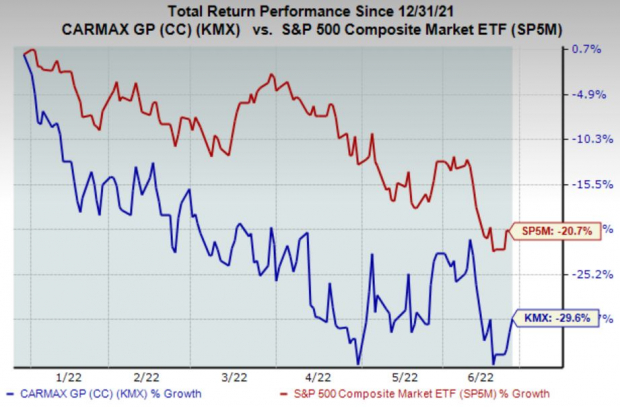

Year-to-date, KMX shares have fallen extensively, losing nearly a third of their value and vastly underperforming the S&P 500.

Image Source: Zacks Investment Research

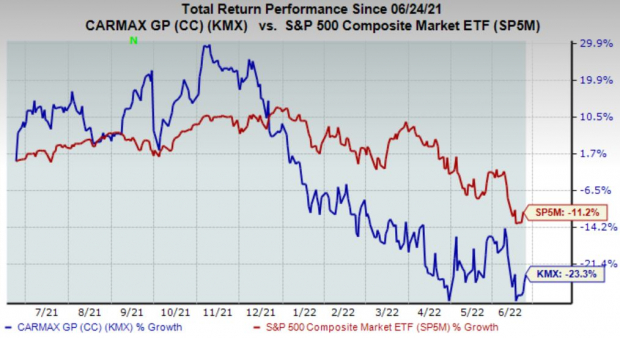

Upon extending the timeframe, the story remains the same – KMX shares have widely underperformed the general market, embarking on a steep downwards trajectory that started in late 2021.

Image Source: Zacks Investment Research

Quarterly Results & Forecasted Growth

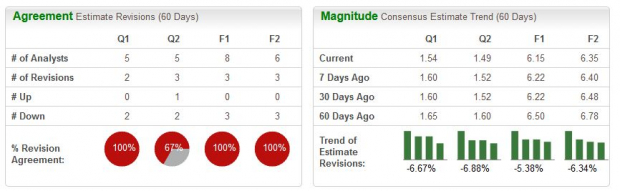

Analysts have been rapidly revising their estimates negatively over the last 60 days with nearly a 100% revision agreement across the board – a big part of why this company currently ranks as a Zacks Rank #5 (Strong Sell).

For the upcoming quarter, the $1.54 EPS estimate displays a nasty 41% decrease in earnings from the year-ago quarter, with the Consensus Estimate Trend retreating nearly 7%.

Image Source: Zacks Investment Research

Additionally, the current fiscal year EPS estimate of $6.15 reflects a concerning 11% decrease in earnings year-over-year.

The company has posted mixed bottom-line results over its last four quarters, exceeding EPS expectations just twice. In its latest quarterly report, the company reported EPS of $0.98, well below the Zacks Consensus Estimate of $1.28, reflecting a 23% negative surprise.

Bottom Line

KMX shares have been the victim of a deep double-digit valuation slash over the last year. This, paired with the earnings picture softening, paints a grim picture for the company within the short term.

The company is a Zacks Rank #5 (Strong Sell) and a stock that investors will be better off staying away from for now. Instead, investors should pivot to stocks that either carry a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) – the odds of reaping considerable gains are much higher within the companies that carry these ranks.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more