Bear Of The Day: CarMax - Thursday, Dec. 29

Image Source: Pixabay

The car market is dying down. The wunderkinds of last year are becoming the face of the bear market now. Earnings are moving in the wrong direction. The Zacks Rank helps point out industries and stocks where earnings estimates are moving south. It helped me uncover today’s Bear of the Day, CarMax (KMX - Free Report).

CarMax is a leading used car retailer in the United States. The company operates a network of over 200 stores across the country and has a strong online presence through its website, CarMax.com. Carmax is known for its wide selection of high-quality used cars, as well as its no-haggle pricing and customer-friendly shopping experience.

In recent years, CarMax has experienced strong growth and financial performance. The company has consistently reported increased revenues and earnings and has a strong balance sheet with low levels of debt.

However, the company is facing some challenges in the near term that could negatively impact its earnings. One of the main factors is the slowdown in the used car market. The demand for used cars has been strong in recent years, but there are signs that this demand may be slowing down. This could lead to lower sales and revenues for CarMax, as well as lower profit margins.

Another factor that could impact CarMax’s earnings is the increasing competition in the used car market. There are a number of new players entering the market, and these companies are offering more competitive pricing and a wider range of services. This could make it more difficult for CarMax to maintain its market share and profitability.

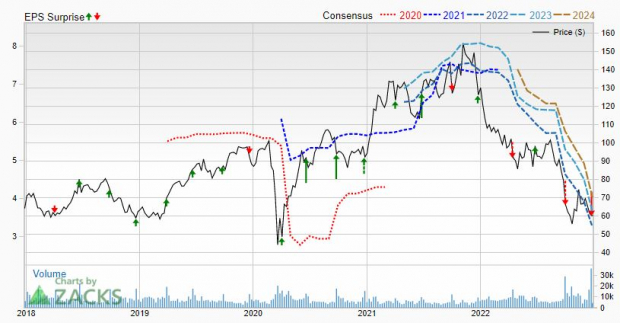

Image Source: Zacks Investment Research

CarMax has dropped to a Zacks Rank #5 (Strong Sell) because four analysts have cut their earnings expectations for the current year and next year. The bearish moves have cut our Zacks Consensus Estimates for the current year from $5.67 to $3.25 while next year’s number is off from $6.21 to $3.65. That represents an earnings contraction of 52% this year.

More By This Author:

3 Balanced Mutual Funds To Buy For Excellent Returns

Bull Of The Day: Caterpillar Inc.

Should SMLF Be On Your Investing Radar?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more