Bear Of The Day: Brownforman

Nowadays it seems like every ultra-famous celebrity has their own whisky line, leading to increased competition for Brown-Forman (BF-B) and its iconic Jack Daniel’s brand.

While Brown-Forman is one of the largest producers in the spirits and wine business, the company has grappled with supply chain disruptions along with the impact of higher inflation and interest rates.

Landing a Zacks Rank #5 (Strong Sell) and the Bear of the Day, it may be best to avoid Brown-Forman’s stock at the moment.

Poor Price Performance

Attributed to the growing alternatives regarding whiskey brands and its choppy operating environment, Brown-Forman’s stock has fallen -23% year to date and plummeted -37% over the last year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Subpar Outlook

Although Brown-Forman believes its turnaround is ahead, the company still expects a volatile operating environment due to global macroeconomic and geopolitical uncertainties.

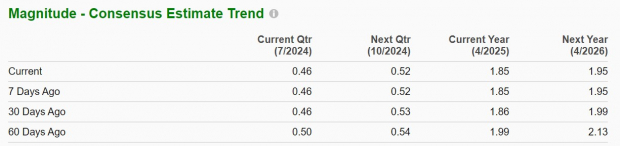

To that point, earnings for Brown-Forman’s current fiscal 2025 are expected to decline -13% to $1.85 versus $2.14 per share in FY24. Brown-Forman’s bottom line is expected to rebound and rise 5% in FY26 but it’s noteworthy that earnings estimate revisions are noticeably lower over the last 60 days.

Image Source: Zacks Investment Research

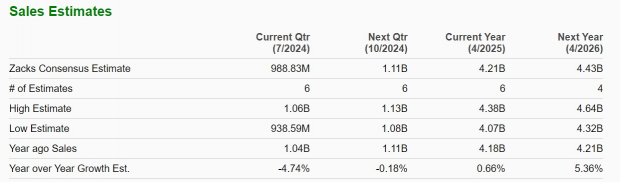

Furthermore, Brown-Forman’s sales growth doesn’t necessarily sway investors to think its future earnings potential will be lucrative once its higher operating costs and expenses normalize.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Valuation Concerns

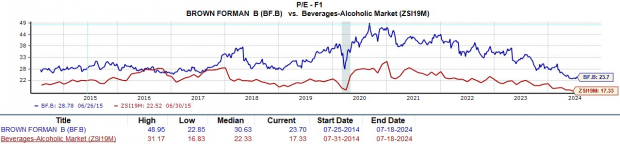

Considering its mediocre top line expansion, Brown-Forman’s stock trades at a high price-to-sales valuation of 4.9X compared to the Zacks Beverages-Alcohol Industry average of 1.6X which is closer to the optimum level of less than 1X.

More concerning is that amid its lowered profitability (and poor stock performance), BF. B still trades at a 23.7X forward earnings multiple which doesn’t offer a discount to the S&P 500’s 23.2X. Plus, this is a premium to the industry average of 17.3X forward earnings.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Brown-Forman’s stock has been on a slippery downward slope and a rebound doesn’t look likely at this point, especially as there are competition issues to address on top of broader economic factors.

More By This Author:

3 Restaurant Stocks Poised To Deliver Q2 Earnings Beat5 Non-Tech Nasdaq Stocks To Buy Amid Index's Recent Bloodbath

3 Software Stocks To Keep An Eye On In A Troubled Industry

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more