Bear Of The Day - Boeing

Boeing (BA) has been the premier manufacturer of commercial jetliners for decades. The company’s premier jet aircraft, along with varied defense products, positions it as one of the largest defense contractors in the United States.

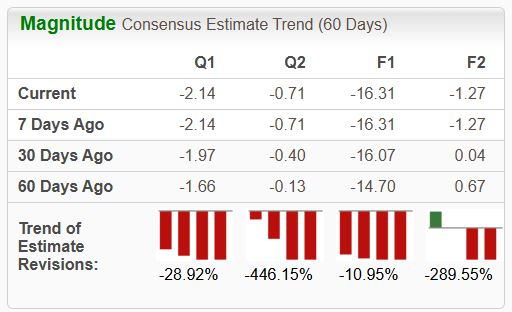

Analysts have taken their earnings expectations lower across the board, landing the stock into a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

The stock also resides in the Zacks Aerospace – Defense industry, which is currently ranked in the bottom 28% of all Zacks industries. Let’s take a closer look at how the company currently stacks up.

Boeing

BA shares have faced turbulence over the last year, losing nearly 30% in value and widely underperforming in an otherwise bullish market. Operational issues shed a negative light on the company, with it regularly seeing itself pop up in news headlines.

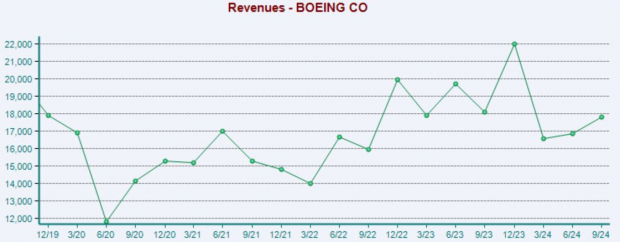

Its latest set of quarterly results was rather disappointing, with sales falling year-over-year alongside a decline in cash-generating abilities. But the company does recognize its struggles, with CEO Kelly Ortberg stating, ‘It will take time to return Boeing to its former legacy, but with the right focus and culture, we can be an iconic company and aerospace leader once again.’

Below is a chart illustrating the company’s sales on a quarterly basis.

(Click on image to enlarge)

Image Source: Zacks Investment Research

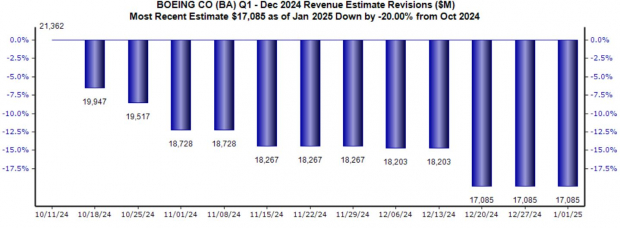

Keep an eye out for Boeing’s next quarterly release expected at the end of January, with current consensus estimates alluding to a -355% pullback in earnings on -22% lower sales. Both items have been revised lower over recent months, with the top line revisions illustrated below.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Analysts' negative earnings estimate revisions, resulting from weak quarterly results, paint a challenging picture for the company’s shares in the near term.

Boeing (BA Quick QuoteBA - Free Report) is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy). These stocks sport a notably stronger earnings outlook and the potential to deliver explosive gains in the near term

More By This Author:

These 2 Mag 7 Members Just Broke All Time Highs

Google Unveils Quantum Chip Willow: A Closer Look

This AI Stock Has Quietly Doubled In Value