Bear Of The Day: Boeing

Boeing (BA) has been the premier manufacturer of commercial jetliners for decades. The company’s premier jet aircraft, along with varied defense products, positions it as one of the largest defense contractors in the United States.

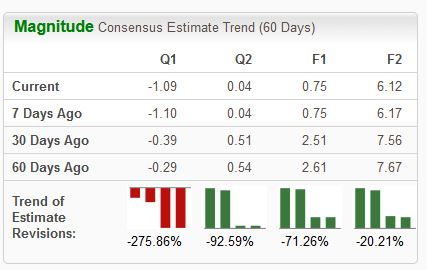

Analysts have taken their earnings expectations lower across the board, landing the stock into a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Let’s take a closer look at how the company currently stacks up.

Boeing

Shares have faced turbulence year-to-date, down 33% and representing one of the worst-performing S&P 500 stocks in 2024. Operational issues have become a significant thorn in the company's side, souring investors’ opinions overall.

Image Source: Zacks Investment Research

Analysts have fully noted the issues, reflected in their negative revisions. The safety issues are undoubtedly expected to impact the company significantly, and the FAA has stated it won’t allow Boeing to ramp up production for any of its Max family of aircraft.

Mike Whitaker, FAA Administrator, said, “This won’t be back to business as usual for Boeing. We will not agree to any request from Boeing for an expansion in production or approve additional production lines for the 737 MAX until we are satisfied that the quality control issues uncovered during this process are resolved.”

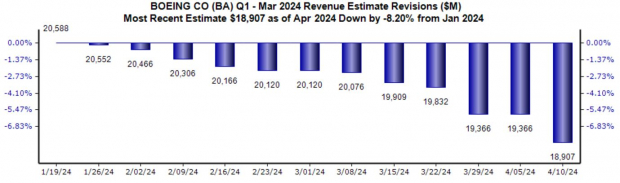

We’ll undoubtedly hear more about the situation during the company’s next quarterly release, expected on April 24th. Revenue revisions for the quarter-to-be-reported have similarly been slashed, with the $18.9 billion Zacks Consensus Sales estimate down 8.2% since mid-January.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Analysts' negative earnings estimate revisions, resulting from operational issues, paint a challenging picture for the company’s shares in the near term.

Boeing is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy). These stocks sport a notably stronger earnings outlook and the potential to deliver explosive gains in the near term.

More By This Author:

3 Tech Stocks To Buy For Passive IncomeAre These Recent IPOs Worth Investors' Attention?

3 Stocks To Buy For Decreased Volatility