Bear Of The Day: BioNTech

Overview

Zacks Rank #5 (Strong Sell) stock BioNTech (BNTX) is a German biotech firm that develops and commercializes immunotherapies and innovative cancer treatments based on individualized therapies and precision medicine. The company was founded in 2008 and is based in Mainz, Germany.

BioNTech was relatively obscure until the company partnered with pharmaceutical juggernaut Pfizer (PFE) to develop one of the first mRNA COVID-19 vaccines. The vaccine, called the Pfizer-BioNTech COVID-19 vaccine, has been authorized for emergency use in numerous countries around the world.

Fundamental View

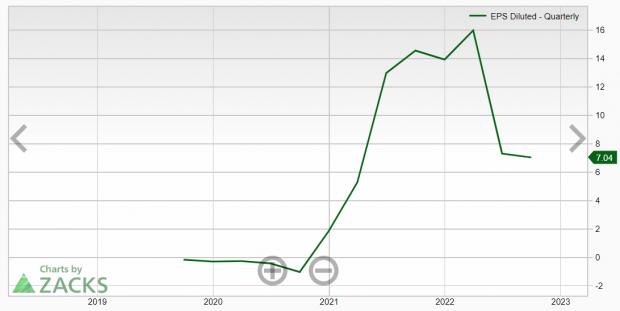

The COVID-19 pandemic was a windfall opportunity for BioNTech and other mRNA vaccine manufacturers. In the heat of the pandemic, BNTX’s EPS grew from zero to nearly $16 per share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

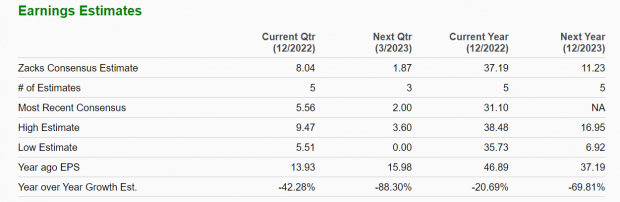

The stock reacted accordingly, rising from $12 to over $400 a share in just months. However, unfortunately for BNTX investors, equities tend to be forward-looking devices rather than backward looking mechanisms. From that perspective, the picture is less rosy. This year, Zacks Consensus Analyst Estimates suggest that BNTX’s earnings will dive 70% year-over-year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

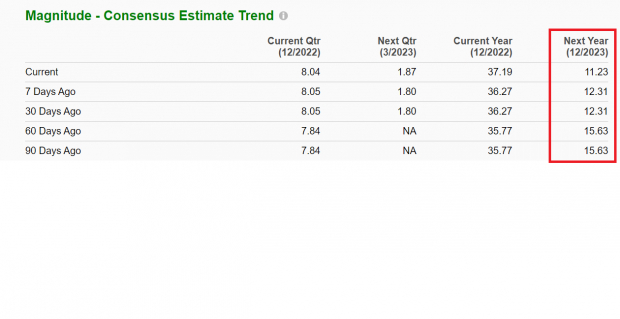

What’s worse is that recent revisions are moving in the wrong direction. Over the past 90 days, Zacks Consensus Analyst Estimates have dropped precipitously.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Technical View

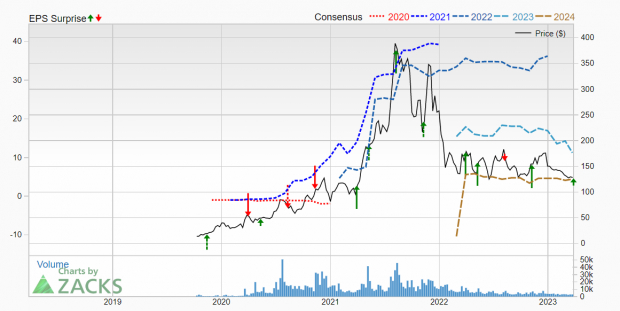

Sometimes, its important to focus on how a stock reacts to earnings, rather than the earnings themselves. Over the past two quarters, BNTX has beat consensus analyst estimates. However, shares are lagging and trading near multi-year lows.

Image Source: Zacks Investment Research

Relatively speaking, BNTX is -25% over the past twelve months while the S&P 500 is only -14%.

Bottom Line

BNTX is ranked a lowly 5 for a reason. Earnings have peaked, COVID hysteria has subsided, and the technical picture is lagging. All else being equal, expect BNTX shares to underperform over the next year.

More By This Author:

Best Buy Rides High on Strategic Efforts: Apt to Hold3 Diversified Bond Mutual Funds To Buy For Steady Gains

Micron To Report Q2 Earnings: What's In The Offing?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more