Bear Of The Day: Best Buy Co., Inc.

Best Buy Co., Inc. (BBY - Free Report) faces a quickly changing consumer spending environment and rising inflation. The broad-based economic tailwinds that helped Best Buy post back-to-back big years of impressive growth are coming to an end, as the housing market cools and people start spending less on big-ticket items.

Pandemic-Style Shopping Slows

Best Buy sells smartphones, TVs, connected appliances, and nearly every other consumer electronics device under the sun. Best Buy has grown even though Target (TGT - Free Report), Walmart (WMT - Free Report), and other giants sell similar products. The company, like everyone else, has spent years improving its digital commerce offerings.

Image Source: Zacks Investment Research

Best Buy’s core business and its e-commerce efforts helped it thrive when people began to work from home and spent big on items to fill new homes. Best Buy also benefited from stimulus checks and pandemic rebound shopping sprees. And its long-term outlook remains intact. But consumers are shifting their spending to services and other areas of retail, while also slowing big purchases amid soaring inflation and recession fears.

Best Buy’s sales climbed over 8% during 2020 (its FY21), with FY22 revenue up 9.5%. But the firm’s fourth-quarter sales slipped over 3% and its first-quarter FY23 revenue dipped 9% on the back of changing spending habits and tough-to-compete against periods.

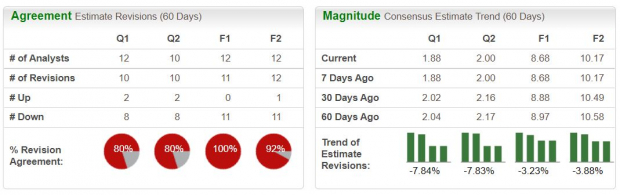

The electronics retailer fell short of Zacks Q1 estimates on May 24. Best Buy's management lowered its guidance, with its FY23 and FY24 consensus EPS estimates down 3.3% and 3.9%, respectively.

Zacks estimates call for BBY’s revenue to slip over 5% this year, with its adjusted earnings projected to fall 13%. “Macro conditions worsened since we provided our guidance in early March… Those trends have continued into Q2 and, as a result, we are revising our sales and profitability expectations for the year,” CEO Corie Barry said in prepared remarks.

Image Source: Zacks Investment Research

Bottom Line

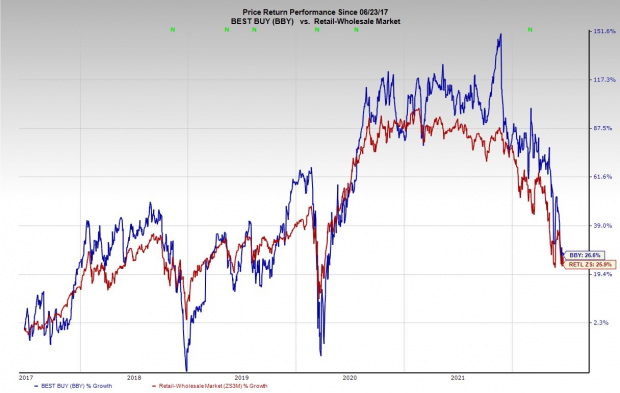

Best Buy’s downward earnings revisions help it land a Zacks Rank #5 (Strong Sell) right now. The company is also part of the Consumer Electronics industry which is in the bottom 3% of over 250 Zacks industries right now. BBY shares have tumbled 31% in 2022 to lag its industry and the broader retail market.

Best Buy stock is still up 26% in the past five years to roughly match the Zacks Retail-Wholesale Market. And the fall has made its dividend yield stronger. Still, it might be best to stay away from Best Buy stock with consumer sentiment at historic lows and shoppers focused on other areas of retail, as well as services.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more