Bear Of The Day: Ashland Inc.

Image Source: Pexels

Ashland Inc. (ASH - Free Report) is a leading specialty chemicals company serving various consumer and industrial markets, including automotive, construction, architectural coatings, adhesives, energy, food & beverage, and pharmaceutical.

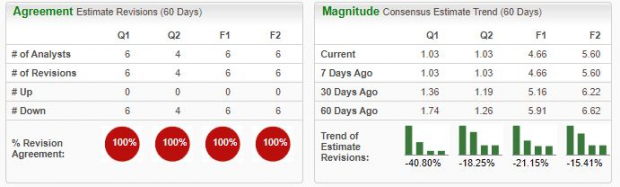

Analysts have taken a bearish stance on the company’s earnings outlook across the board, pushing the stock into an unfavorable Zacks Rank #5 (Strong Sell).

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition, the company resides in the Zacks Chemical – Specialty industry, which is currently ranked in the bottom 22% of all Zacks industries. Let’s take a closer look at how the company currently stacks up.

Current Standing

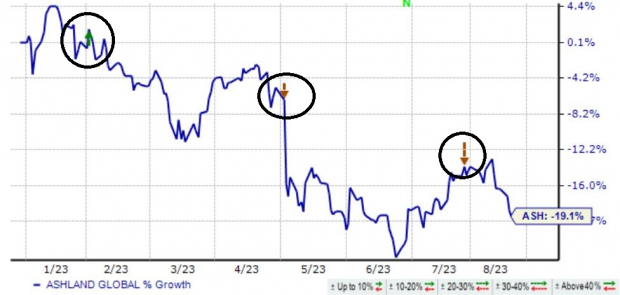

Ashland shares have struggled to find their footing in 2023, down roughly 19% and widely underperforming relative to the general market. As we can see below, recent quarterly results haven’t impressed the market, with ASH shares remaining on a downward trajectory.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Regarding the most recent quarterly release, ASH fell short of the Zacks Consensus EPS Estimate by more than 12% and reported revenue marginally below expectations. It reflected the company’s second consecutive quarter of missing on both the top and bottom lines.

Top-line growth has remained somewhat stagnant over the last several years, as we can see below.

(Click on image to enlarge)

Image Source: Zacks Investment Research

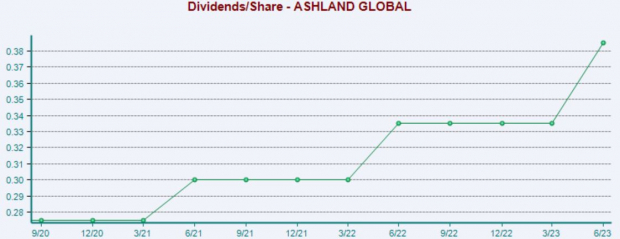

Shares do pay a solid dividend, currently yielding 1.8% annually paired with a payout ratio sitting at 30% of the company’s earnings. Dividend growth is there, too, with the payout growing by an annualized 8% over the last five years.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The company’s growth is slated to taper in its current year, with Zacks Consensus Estimates suggesting an 18% pullback in earnings on 7.5% lower revenues. Still, growth resumes in FY24, with expectations suggesting 20% higher earnings and a 5% revenue bump.

Bottom Line

Negative earnings estimate revisions from analysts and recent negative quarterly results paint a challenging picture for the company’s shares in the near term.

Ashland Inc. (ASH - Free Report) is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

Cisco Systems Beats Q4 Earnings And Revenue Estimates

5 High-Dividend ETFs That Beat S&P 500 Past Month

Bear of the Day: The Scotts Miracle-Gro Co.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more