Bear Of The Day: ASGN

The increased need for online marketing and sales following the pandemic led to higher demand for IT services but the frenzy is beginning to slow and it may be time to sell ASGN’s (ASGN) stock.

As an integrated critical IT solutions provider that offers professional staffing, ASGN’s stock lands a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

Time to take Profits

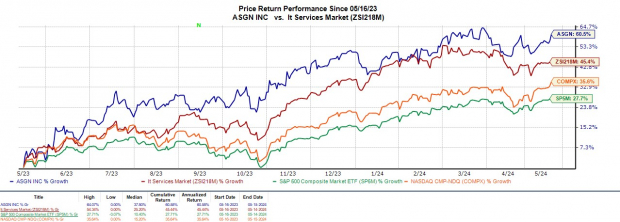

Making it more apparent to sell is that ASGN’s stock has soared +60% over the last year and now may be a good time to take profits as earnings estimate revisions have continued to decline.

(Click on image to enlarge)

Image Source: Zacks Investment Research

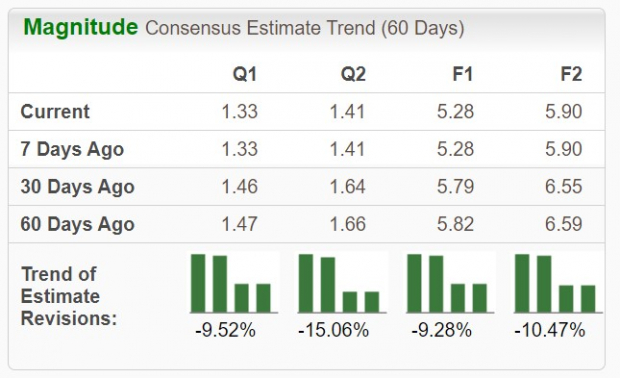

Notably, fiscal 2024 earnings estimates are now down -9% in the last 60 days while FY25 EPS estimates have dropped -10%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Valuation & Growth Risk

Trading at $102, ASGN’s stock still trades at a reasonable 18.9X forward earnings multiple but when considering the company’s long-term growth rate there are some concerns. In this regard, ASGN has a PEG ratio of 7.7 which is uncomfortably above the optimum level of 1 or less and its industry average of 2.7.

To that point, there are a number of faster-growing IT solutions providers in the space that have more diverse business offerings including Dell Technologies (DELL) with a PEG of 1.4 and ServiceNow (NOW) at 2.1.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

The rally in ASGN’s stock is starting to look overdone considering the company’s subpar growth rate and the downward trend in earnings estimate revisions. Investors looking to avoid the risk of stocks that may be due for a correction will want to keep this in mind and those sitting on profits in ASGN may want to take them now.

More By This Author:

2 Intriguing Medical Stocks To Buy For Steady Growth As Earnings Approach3 IT Services Stocks To Buy From A Challenging Industry

4 Paper & Related Products Stocks To Watch In The Promising Industry

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more