Bear Of The Day: AMN Healthcare Services

Labor shortages and staff burnout among nurses are reasons to be wary of AMN Healthcare Services (AMN) stock despite the company’s favorable long-term prospects.

Correlating with this cautious scenario, AMN’s stock currently carries a Zacks Rank #5 (Strong Sell) and lands the Bear of the Day.

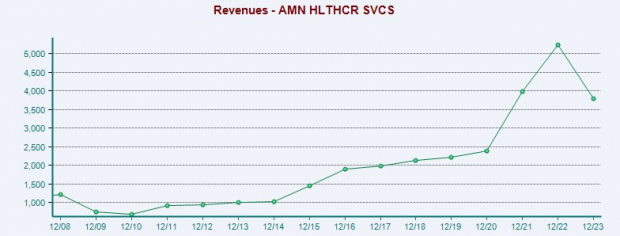

(Click on image to enlarge)

Image Source: Zacks Investment Research

Declining Nurse and Allied Solutions Segment Sales

Providing total talent solutions and staffing networks for healthcare organizations, AMN’s Nurse and Allied Solutions segment revenue fell -38% last quarter to $538 million with the company stating its travel nurse sales fell -40% specifically.

AMN was still able to beat Q4 top and bottom line expectations in February but this is concerning considering the Nurse and Allied Solutions segment makes up more than half of its total revenue.

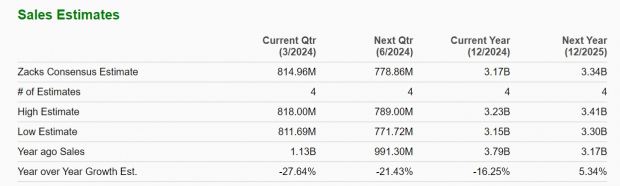

(Click on image to enlarge)

Image Source: Zacks Investment Research

Furthermore, the impact of challenging work conditions and high turnover particularly among "Nurse Leaders" is lingering with AMN forecasting its Nurse and Allied Solutions segment revenue to be down 36-38% for the first quarter. AMN projects its consolidated revenue for Q1 to be 26-28% lower with Zacks estimates of $814.46 million representing a -27% decline.

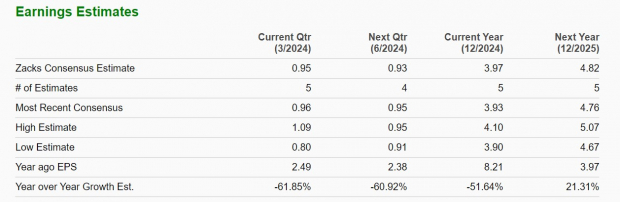

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line Effect

With the proponents of nurse staffing making up such a large chunk of AMN’s core business, the company’s bottom line is expected to be impacted as well. Notably, earnings estimate revisions have declined -20% for fiscal 2024 over the last 30 days from projections of $4.93 per share to $3.97 a share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Plus, FY25 EPS estimates have fallen -14% in the last month which is starting to put a dent in the hopes of a sharp rebound in AMN’s bottom line next year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Takeaway

AMN’s stock is already down -20% year to date and a rebound may not come until its Nurse and Allied Solutions segment sales begin to stabilize. This will need to be monitored by investors going forward and for now, AMN’s stock is one to avoid.

More By This Author:

Tech Sector Resumes Growth ModeMastercard, Nexi To Revolutionize Payment Landscape In Europe

3 Large-Cap Value Mutual Funds To Strengthen Your Portfolio

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more