Bear Of The Day: Ally Financial

Image Source: Pexels

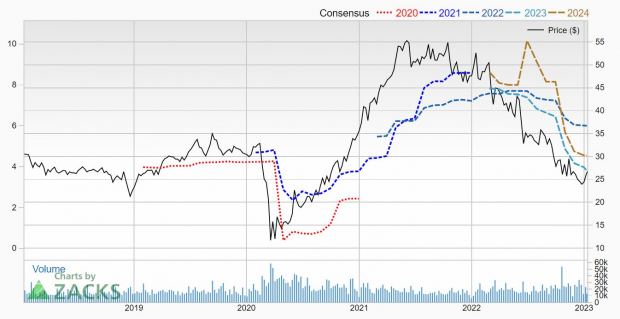

Analysts remain bearish on Ally Financial Inc. (ALLY - Free Report), as they continue to cut earnings estimates ahead of fourth-quarter earnings. This Zacks Rank #5 (Strong Sell) is expected to see earnings plunge 37% this year.

Ally Financial is a digital financial services company with commercial and corporate customers. It operates a digital bank, Ally Bank, which offers mortgage lending, personal lending, deposits, and other banking products, as well as auto finance and insurance operations.

Ally also operates a consumer credit card business, a securities brokerage and investment advisory service, and a corporate finance business for equity sponsors and middle-market companies.

A Big Miss in the Third Quarter

On Oct 19, 2022, Ally Financial reported its third quarter results and missed big on the Zacks Consensus Estimate. It missed by $0.61, with earnings at $1.12 versus the consensus of $1.73. It was the second earnings miss in a row.

Net income was $272 million compared to $683 million a year ago as higher net financing revenue was offset by higher provision for credit losses, higher noninterest expenses, and lower other revenue.

The company's mortgage business was hit by rising mortgage rates which cooled the housing market.

"Financial results were partially depressed this quarter as a result of an impairment on a nonmarketable equity investment related to our mortgage business, impacting $0.33 of EPS, and higher provisions as a result of loan growth in auto finance and a larger coverage build to ensure the company remains protected as recessionary conditions feel more likely to occur in the coming months," said Jeffrey J. Brown, CEO.

Ally's provision for credit losses increased $362 million year-over-year to $438 million, due to credit losses which are normalizing in line with expectations and CECL reserve build attributable to robust retail auto origination volume.

Most of the build came in autos where the provision for credit losses jumped $275 million year-over-year to $328 million. The retail auto net charge-off rate was 1.05%, up 78 basis points year-over-year.

Analysts Get Even More Bearish

In the three months since the third quarter report, the analysts have only gotten even more bearish. Ally is set to report fourth-quarter earnings on Jan 20, 2023, and the analysts are already lowering estimates in that report.

One estimate has been lowered for both 2022 and 2023 in the last 7 days. The 2022 Zacks Consensus Estimate has fallen to $6.00 from $7.20 three months ago. That's an earnings decline of 30.3% as Ally made $8.61 last year.

The cuts have been even more dramatic for 2023. The 2023 Zacks Consensus Estimate has fallen to $3.80 from $4.17 in the last 2 months. That's another 36.7% decline.

Shares Remain Cheap

Shares of Ally Financial have plunged over the last year. They're down 46.8% in that time, but have recently staged a mini-rally and have gained 8.9% over the last month.

Image Source: Zacks Investment Research

Even with earnings being slashed, the forward P/E is still cheap at 7x. But investors need to ask themselves, will the earnings be cut further after fourth-quarter earnings next week?

Ally is also shareholder friendly. In the third-quarter, it had $415 million in share repurchases. It also pays a dividend, currently yielding a juicy 4.9%.

But there's a lot of uncertainty surrounding the economic environment as the Federal Reserve continues to raise interest rates. Investors might want to wait on the sidelines to see what develops with earnings estimates before diving in.

More By This Author:

The Stocks Behind 2022's Popular ETFsThe Best Investing Advice For 2023

Bull Of The Day: CNH Industrial

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more