Bear Of The Day: Albemarle

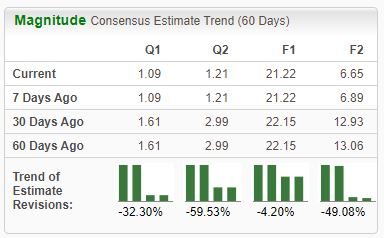

Albemarle Corp. (ALB) is a global leader in providing essential elements for mobility, energy, connectivity, and health. Analysts have taken their earnings expectations lower over the last several months, pushing the stock into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

In addition, the company currently resides in the Zacks Chemical – Diversified industry, which is currently ranked in the bottom 10% of all Zacks industries. Let’s take a closer look at a few other aspects of the company.

Albemarle

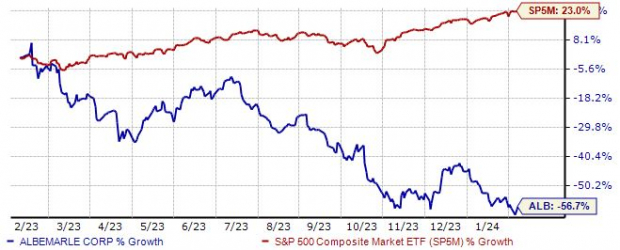

Shares have had a rough showing over the past year, down more than 50% and widely underperforming relative to the S&P 500. Recent quarterly prints haven’t supported shares much, moving lower post-earnings in back-to-back releases.

(Click on image to enlarge)

Image Source: Zacks Investment Research

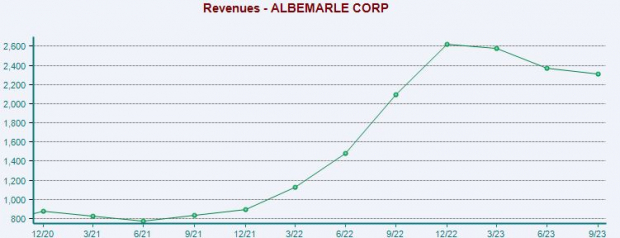

Concerning its latest quarterly release, the company fell short of the Zacks Consensus EPS estimate by nearly 26% and posted sales 3.4% below expectations. Falling lithium prices have stunted ALB’s growth, as we can see illustrated below.

(Click on image to enlarge)

Image Source: Zacks Investment Research

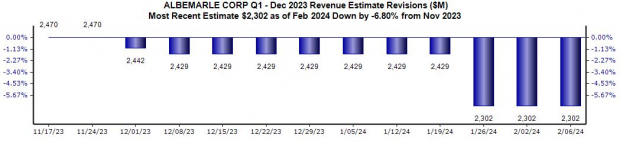

It’s worth noting that the company is scheduled to reveal its next set of results on February 14th after the market’s close. Analysts have taken revenue expectations lower along with earnings expectations, with the $2.3 billion expected down nearly 7% since last November.

(Click on image to enlarge)

Image Source: Zacks Investment Research

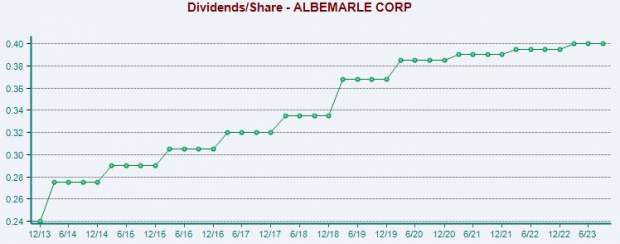

The unfavorable price action has boosted ALB’s yield, with shares now paying out 1.4% annually paired with a sustainable 8% payout ratio. Albemarle has also shown a nice commitment to increasingly rewarding shareholders, currently carrying a 2% five-year annualized dividend growth rate.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts stemming from falling lithium prices paint a challenging picture for the company’s shares in the near term.

Albemarle is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

More By This Author:

Bull Of The Day: Meta Platforms3 Sector ETFs & Stocks To Bet On Superb January Jobs Data

3 Companies Enjoying Meaningful Margin Expansion