Bear Of The Day: Albemarle

Albemarle Corp. (ALB) is growing its sales but lithium prices have depressed earnings. This Zacks Rank #5 (Strong Sell) is expected to see a double digit decline in earnings in 2024.

Albemarle is a global lithium and bromine producer. Headquartered in Charlotte, NC, it serves customers in 100 countries.

A Big Miss in the Third Quarter

On Nov 1, 2023, Albemarle reported its third quarter results and missed on the Zacks Consensus by $0.96. Earnings were $2.74 versus the consensus of $3.70.

Lithium prices have fallen throughout the year.

Sales rose 10% to $2.3 billion due to higher volumes in the Energy Storage business.

Albemarle also signed agreements with Caterpillar to collaborate on solutions to support the full circular battery value chain and sustainable mining operations.

It also received a $90 million critical materials award from the US Department of Defense to restart the Kings Mountain, NC mine.

Albemarle also completed the previously disclosed transaction to amend and simplify the MARBL joint venture with Mineral Resources Ltd.

For the full year, the company said net sales were expected to increase 30% to 35% over the prior year, primarily driven by new mining and conversion capacity delivering 30% to 35% volumetric growth in Energy Storage.

2024 Estimates Cut

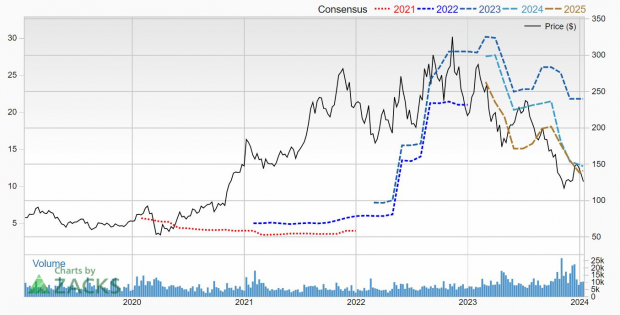

The analysts are not bullish on Albemarle for 2024. 5 earnings estimates have been cut in the last 60 days with one being cut in even the last week. The 2024 Zacks Consensus Estimate has fallen to $12.70 from $15.10 over the last 2 months.

That's an earnings decline of 42% compared to 2023 when Albemarle is expected to make $21.82.

(Click on image to enlarge)

Image Source: Zacks Investment Research

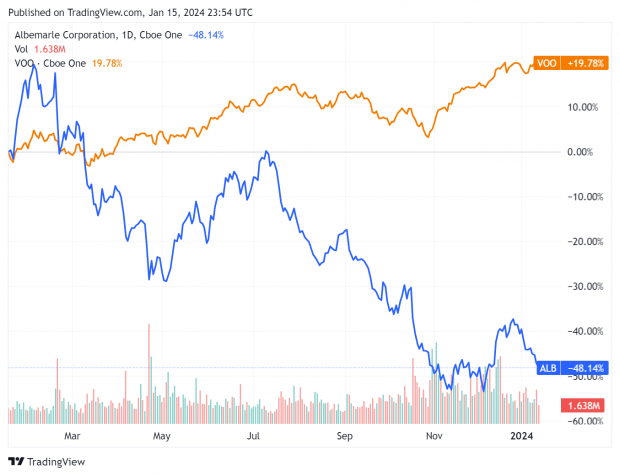

Shares Plunge in the Last Year

When lithium prices were rising, so were Albemarle shares. When they fall, so does Albemarle. The shares are down 48.1% in the last year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

They're cheap, with a forward P/E of just 9.9. Albemarle also has a PEG ratio of just 0.9. A PEG ratio under 1.0 means a company has both value and growth. That's a rare combination.

But investors might want to wait for Albemarle's earnings to turn around. That's likely to mean that lithium prices have to reverse course and move higher.

More By This Author:

How To Be A Better Stock Investor In 20245 Stocks For Your 2024 Investing Game Plan

Bull Of The Day: Abercrombie & Fitch

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more