Bear Of The Day: Adient

Before investors get too excited about what appears to be a cheap P/E valuation for Adient's (ADNT) stock, they may want to pay attention to the trend of declining earnings estimate revisions.

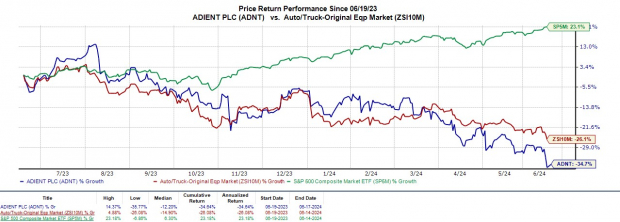

Adient’s stock has the remnants of a value trap as ADNT has fallen -29% YTD and although the Dublin Ireland-based company is one of the world’s largest automotive seating suppliers there are more attractive original equipment manufacturers (OEMs) to choose from in the auto sector. Considering such, Adient lands a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

Image Source: Zacks Investment Research

Industry Challenges

Notably, the Zacks Automotive-Original Equipment Industry is currently in the bottom 33% of approximately 250 Zacks industries. Supply chain issues and softer demand for EV production have started to perplex the industry’s growth with Adient already dealing with challenges related to adverse customer mix and the slower-than-expected ramp-up of programs aimed at boosting its operational performance.

Declining Earnings Estimates

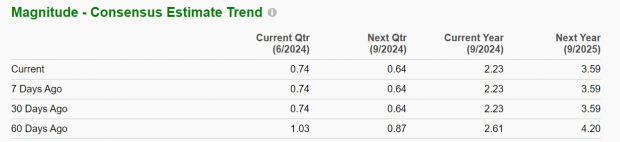

For investors not following the trend of earnings estimate revisions the projected bottom-line expansion of Adient may be persuasive as EPS is expected to increase 3% in fiscal 2024 and is forecasted to expand another 60% in FY25 to $3.59 per share.

Plus, Adient’s stock trades at 11.2X forward earnings but the risk of ADNT being a value trap has been on the horizon with FY24 and FY25 EPS estimates falling -14% over the last 60 days respectively.

Image Source: Zacks Investment Research

Market Value Analysis

With there being an abundance of OEMs to choose from in the auto sector, broader competitors are seemingly taking market share from Adient. This is illustrated by the slope beneath the red trendline as shown below in regards to Adient’s $2.2 billion market cap compared to the industry average of $5.35 billion which also shows most of its peers have moved above the trendline.

For instance, some of the OEMs that appear to be taking market share and experiencing more consistent demand for their auto part offerings are Allison Transmission Holdings (ALSN) with a market cap of $6.34 billion, and Gentex (GNTX) at $7.86 billion.

Image Source: Zacks Investment Research

Bottom Line

For now, it's best to stay clear of Adient’s stock as investors hoping for a rebound in ADNT may be disappointed given the downward trend of earnings estimate revisions which still suggests more short-term weakness ahead.

More By This Author:

Bull Of The Day: SunocoClean Energy ETFs Soar On Global Investment Surge

3 Energy Stocks To Gain From Seismic Imaging Technologies

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more