Be Concerned About Tesla's Q3 Earnings Miss?

Image Source: Pexels

Despite missing earnings expectations yesterday evening, Tesla (TSLA - Free Report) stock was resilient in Thursday’s trading session. Falling sharply in early morning trading, TSLA ended the day up +2%, extending YTD gains to a respectable +10% considering the cost challenges the EV leader has faced.

Adding to these headwinds, it was inevitable that Tesla would have to reduce its car prices in China due to an abundance of local competitors. Furthermore, General Motors (GM - Free Report) hasn’t necessarily disrupted Tesla in the domestic market, but has emerged as a serious challenger at the #2 spot.

Keeping this in mind, investors may be wondering if they should be concerned about Tesla’s Q3 earnings miss, with TSLA trading at a lofty price tag of over $440 a share.

Image Source: Zacks Investment Research

Tesla’s Q3 Run Down

Margin pressures that led to an earnings miss came as a somewhat shocking surprise, as Tesla’s Q3 sales spiked nearly 12% year over year to $28.09 billion after delivering a quarterly record 497,099 vehicles. Topping Q3 sales estimates of $26.45 billion, Tesla also achieved record deployment in its energy storage business across residential, industrial, and utility markets.

However, price cuts across its EV models, higher input costs, and lower regulatory tax credit revenue led to a steeper decline in Tesla’s bottom line as Q3 EPS of $0.50 dropped from $0.72 per share a year ago and missed expectations of $0.53.

While Tesla’s growth nuances often give the company the benefit of the doubt, it’s noteworthy that the EV leader has missed earnings expectations in three of its last four quarterly reports with an average EPS surprise of -11.1%.

Image Source: Zacks Investment Research

Monitoring Tesla’s Outlook

Offering cautiously optimistic commentary on its outlook, Tesla didn’t provide specific revenue or delivery targets but emphasized strong demand and operational momentum. Still, management acknowledged that margins may remain under pressure from price cuts and higher input costs.

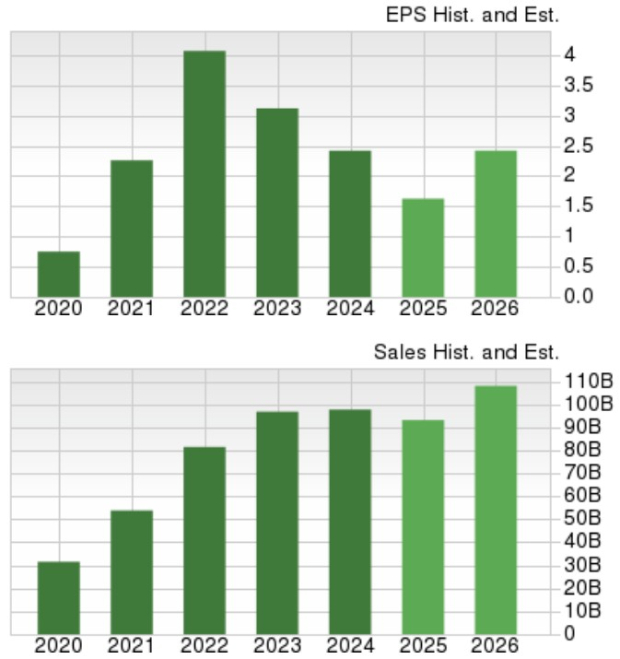

Zacks estimates call for Tesla’s total sales to dip 4% this year, although fiscal 2026 sales are projected to rebound and rise 16% to $108.02 billion. Tesla’s annual earnings are currently slated to drop over 30% to $1.63 a share from EPS of $2.42 in FY24. That said, FY26 EPS is projected to stabilize and bounce back 49% to $2.42.

Image Source: Zacks Investment Research

Tesla’s Stretched Valuation

Of course, what may be concerning investors the most is that Tesla’s stretched P/E valuation draws attention to its "high sentiment" forward earnings multiple of 269X. In comparison, Tesla’s Zacks Automotive-Domestic Industry average is at 13X forward earnings, with GM and Ford (F - Free Report) shares trading under 11X.

In terms of price-to-sales, Tesa’s forward P/S ratio of 15X is also a steep stretch to the industry average of less than 1X, with GM and Ford being on par with these levels.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

For now, Tesla’s sales growth and record deliveries could sustain its stock with TSLA landing a Zacks Rank #3 (Hold). At some point down the line, Tesla’s ability to consistently post a massive profit and at least reach earnings expectations will be necessary if its valuation remains so elevated. Correlating with such, EPS revisions for TSLA may need to trend noticeably higher to receive a buy rating at current levels or avoid a sell rating.

More By This Author:

Intel Tops Q3 Earnings And Revenue Estimates3 Top No-Load Mutual Funds To Buy For Long-Term Gains

Leading Stocks Pullback: Should Investors Buy Now?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more