Barrick Gold: Quality And Value

Image Source: Pixabay

I’m going to take a deep dive review of Barrick Gold (GOLD), which is the world’s second largest gold producer in the world. It’s been in our model portfolio since June 2020.

We certainly seem to be entering a new rally phase for gold, and by all accounts it looks like the best, biggest gold producers should perform well. After Newmont (NEM), Barrick is the world’s second largest gold miner by production, with 4.4Moz. of output in 2021.

Barrick boasts one of the largest portfolios of Tier One gold assets and copper mines. A Tier One gold asset is a mine with a mine life longer than 10 years, producing at least 500 thousand gold ounces, and total cash cost per ounce in the bottom half for the industry.

Barrick has mines and/or has land positions in some of the world’s best gold districts:

Nevada Gold Mines is a joint venture between Barrick (61.5%) and Newmont (38.5%) that combined their significant assets across Nevada in 2019 to create the single largest gold-producing complex in the world, and is operated by Barrick. Nevada Gold Mines produced superb results last year.

In Latin America, Barrick has the Veladero mine in Argentina, and the Pueblo Viejo mine in the Dominican Republic. And then there is Africa and the Middle East. Its three largest mines in this area are Loulo-Gounkoto in Mali, Kibali in the Democratic Republic of Congo, and the North Mara/Bulyanhulu in Tanzania.

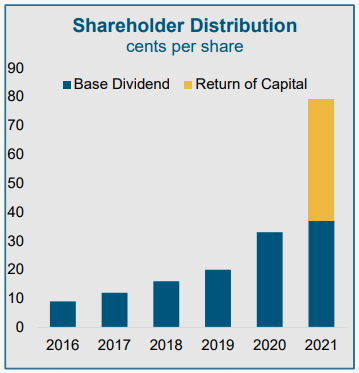

Importantly, Barrick is not only very profitable with $1.9 billion in free cash flow last year, but it has steadily grown its return over the past five years. Shareholders got a record $1.4 billion in cash, including a $750 million return of capital.

Overall, Barrick is doing most things right. It has some of the best mines in the business, many being Tier One, with several more being advanced. All the company’s mines have 10-year business plans, with some being extended to 15-20 years.

Overall they’ve been replacing their mined reserves with similar quality ores. They continue to advance through exploration to add new projects and support future growth. A lack of debt and strong free cash flow allow Barrick to fund growth while rewarding shareholders with solid dividends.

This is one of the major gold miners that’s sure to attract a lot more investor money as the market begins to realize the quality of its assets, the value it offers, the attractiveness of its dividend, and its big upside as a profitable gold miner.