Barrick Gold: Amid Recent Mine Moves, Consider Buying In

Image Source: Pixabay

Barrick Gold Corp. (GOLD) recently agreed to sell its 50% stake in the Donlin project in Alaska for $1 billion. On the one hand, the project has not been advancing for years and is only 1% of Barrick’s NAV. However, the project also has big potential, and today’s higher gold price justifies moving it forward, writes Adrian Day, editor of Global Analyst.

Being in the US, it would have offset some of Barrick’s high jurisdictional risk, though there are also environmental and social risks to consider. Selling a high-potential gold mine in a safe jurisdiction perhaps reinforces Barrick’s switch in emphasis towards copper. The price tag, however, was a very good one for Barrick.

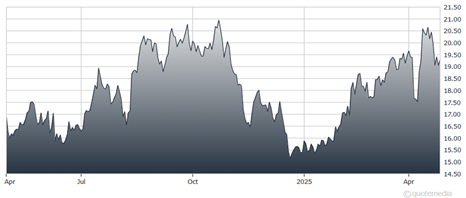

Barrick Gold Corp. (GOLD) Chart

It is also reported that Barrick is looking for buyers for Hemlo, its last gold mine in Canada. Again, for a company that has long stated its desire to build gold operations in Canada, but consistently failed to bid on large development assets that were available, this is a sign that perhaps that goal no longer exists. It is also arguably another step on the road to redomiciling the company to the US.

Barrick is also selling a couple of smaller gold mines in Africa. Increased evidence that there will not be a quick solution to the long dispute with Mali over its shuttered Loulo-Gounkoto mine comes with reports that subcontractors are laying off several hundred employees.

Barrick has stopped paying the subcontractors and is moving thousands of workers to mines in other countries. Though Barrick stock could fall more in the near-term if the gold price consolidates, if you are underweight the seniors, this could be one to buy at this time.

My recommended action would be to consider purchasing shares of Barrick Gold Corp.

About the Author

Adrian Day, a London School of Economics graduate, heads Adrian Day Asset Management, specializing in global diversification and resource equities. Mr. Day is the sub-adviser to the EuroPacific Gold Fund. His latest book is Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.

More By This Author:

SLV: Primed For Take-Off As Precious Metals BoomZweig Signal Triggered - Here's Why You Should Care

GE: Q1 EPS Tops Forecasts, Management Talks Tariff Plans

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more