Bargain Hunting In “Dollar” Stores

Image Source: Unsplash

Good company, temporary issue—it’s an ongoing theme I keep coming back to in Smart Money Monday.

Why? Because it’s a proven formula for great investment returns.

This week, we’re looking at two companies that dominate the “dollar store” sector of the US economy. And they’ve both been absolutely hammered.

So, what exactly is wrong with Dollar General (DG) and Dollar Tree (DLTR)?

The Dollar Stores

Dollar General and Dollar Tree are huge retailers with a massive presence in the US—particularly in rural areas. Dollar General has nearly 20,000 stores, while Dollar Tree has over 16,000. In the case of Dollar General, 80% of its store fleet is in towns with 20,000 people or fewer.

There’s big money catering to rural America, and both companies have made lots of it. Over the years, they’ve grown revenue, store count, and earnings. The market rewarded DG and DLTR (rightfully so) with a higher stock price.

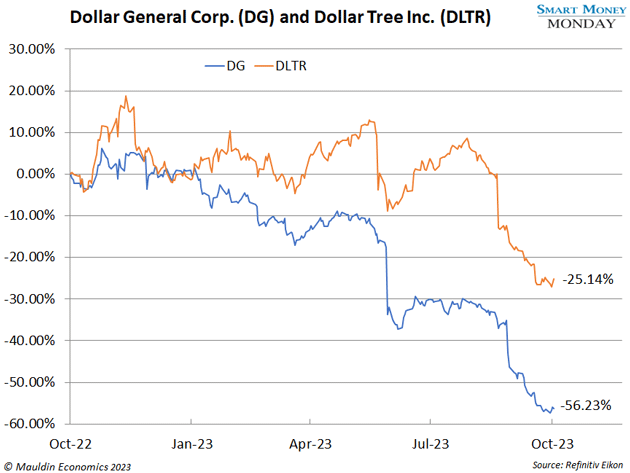

However, in the past 12 months, their stock prices have gone in reverse. Dollar General is down 57% since last October, and Dollar Tree is down 25%. It’s ugly.

Before getting into the issues, let’s segue into the setup and why you should consider passing on one dollar store while targeting the other.

Bad Deals

Dollar Tree has been facing a core issue with its business that really isn’t all that temporary: its arguably failed acquisition of Family Dollar in 2015.

Dollar Tree bought the company for $8.5 billion in a mix of cash and stock. It dramatically increased its store count, which seemed, at the time, to make strategic sense. However, it just hasn’t worked out.

Family Dollar is focused on low-priced goods for low-income consumers. Dollar Tree, on the other hand, caters to both low- and medium-income families. The buying patterns, the merchandising, and the price sensitivity for both consumer groups is quite different.

All this has led to a massive drag on earnings.

That said, Dollar Tree has a catalyst in place that might improve the situation: the appointment of Rick Dreiling as CEO in 2022. Rick came from Dollar General and has a great track record.

I’m watching Dollar Tree here, but the one I’m more interested in is Dollar General (DG). It has higher margins than Dollar Tree, doesn’t have the overhang of a bad acquisition, and is slightly cheaper on a forward-earnings multiple.

Three Issues to Consider with Dollar General

Dollar General trades for around 10X trailing earnings. That’s cheap.

This is heavily COVID-influenced, though. Lots of spending was pulled forward, and consumers flocked to DG at higher-than-normal rates.

DG trades for around 13X the next 12 months’ earnings projection. Looking out a few years, there’s a path for Dollar General to get back to $10 per share in earnings. However, there are a few major things it’ll need to fix…

-

Dollar General, like many retailers, has had a ton of issues with shrinkage.

This is industry jargon for theft. The company will need to address this.

-

The second issue should help with the first, and that’s labor.

Dollar General has had some major issues in this department. This isn’t exactly the case of not paying employees enough. It’s more around supporting them. One issue they’ve called out is stockouts, or inventory not on shelves. The reason is that inventory is in the back of the store. And who puts it there? Store employees.

There are some issues here around processes and systems that the company is actively addressing. For instance, it’s spending $150 million this year on investing in labor. Hopefully, we begin to see this show up in the numbers.

-

The third and final issue is excess inventory.

Like many retailers recovering from the COVID mania period of 2020–2022, Dollar General ended up with excess inventory.

I expect it’ll likely take a write-down on this in the coming quarters.

With the stock down 57% already in the past 12 months, my sense is the market is already anticipating this.

The question isn’t if it will have a write-down but how much of a write-down it will have to take.

DG’s Issues Are Temporary and Fixable

The issues above, from my research, suggest this is fixable. That is, it’s temporary. Sure, it won’t be easy to fix, but the company is actively addressing it. And the stock today is pricing in an assumption that it’ll never fix it.

At its core, Dollar General is a quality business. It serves a market that, historically, hasn’t been served. While I’m not betting on it, the company expects to continue growing its store count.

This year, it’s expected to open 990 stores and remodel 2,000. New and refreshed stores mean higher revenue, higher earnings, and ultimately a higher stock price.

Pretty simple to say but hard to do.

Dollar General at $105 is an interesting bet. It’s got some temporary issues to work through, yes. But this is a high-quality company, and with basic execution, it should be able to fix them.

I own shares of Dollar General (DG), and looking out a few years (or even sooner), I could see the stock back closer to $150 per share.

More By This Author:

Will These Mega Deals Go Through And Create Global Giants?Simplifying The ‘Fed Model’ To Determine Fair Valuation

Is This Dog Of The Dow A Buy?