Bank Of America Profit Tumbles; EPS, Equity Trading Miss, Loss Reserves Jump

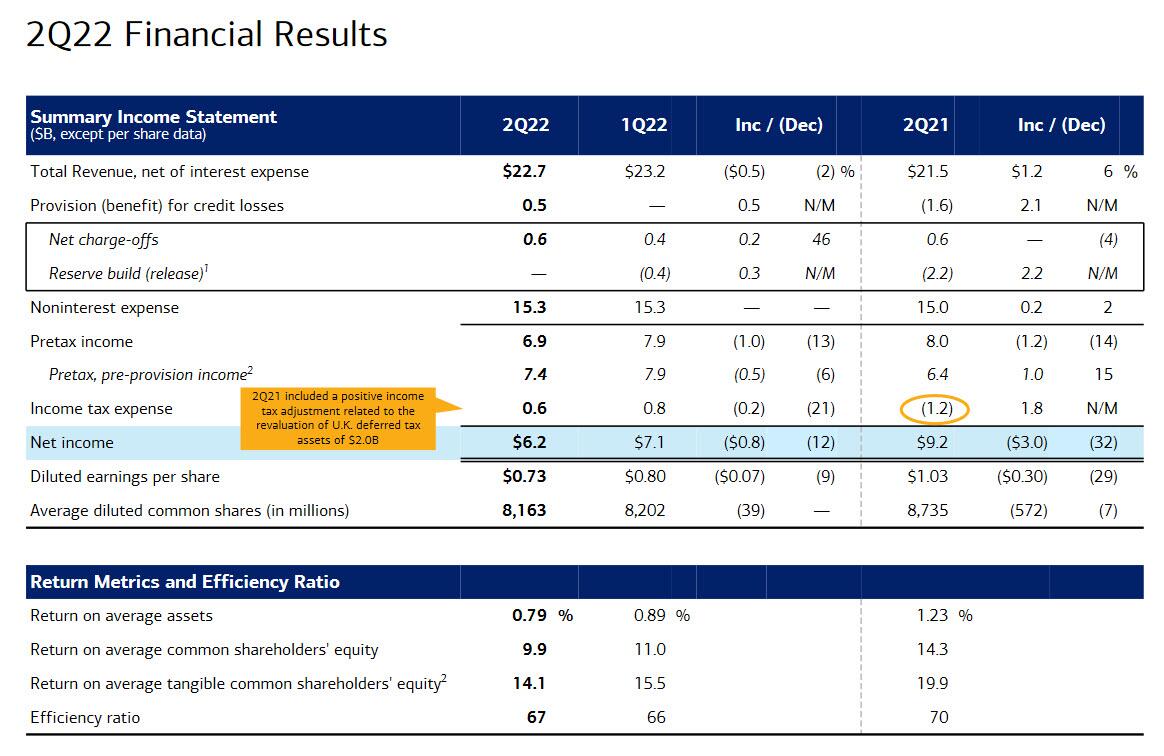

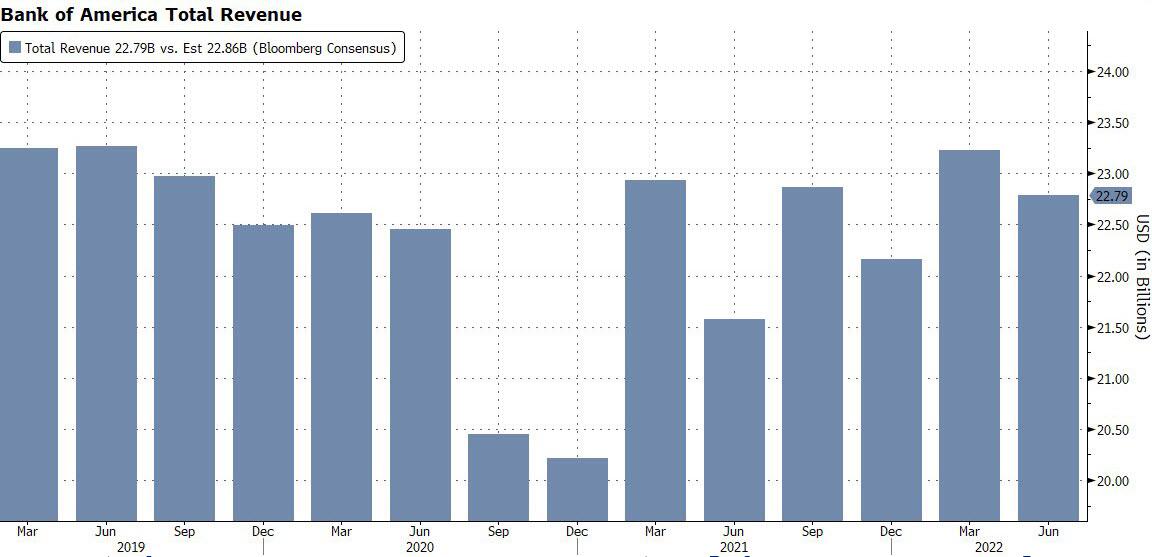

With the final day of bank earnings on deck, the first of two big pre-market reporters, Bank of America, moments ago unveiled Q2 earnings that joined the disappointment parade missing on the top and the bottom line, reporting revenue of $22.7BN, in line with expectations and EPS of $0.73, just below the $0.75 expected, a 9% drop from the EPS reported in Q1 and a 29% plunge from Q2 2021. Net income came in at $6.247 billion, which is down from $7.067 billion last quarter, and a 32%, or $3 billion plunge, compared to $9.224 billion from Q2 2021.

Here are some more top-line results details: revenue, net of interest expense, rose $1.2BN or 6% Y/Y to $22.69B; it dropped 2% or $0.5BN from Q1 2022 however.

A breakdown of revenues shows the following:

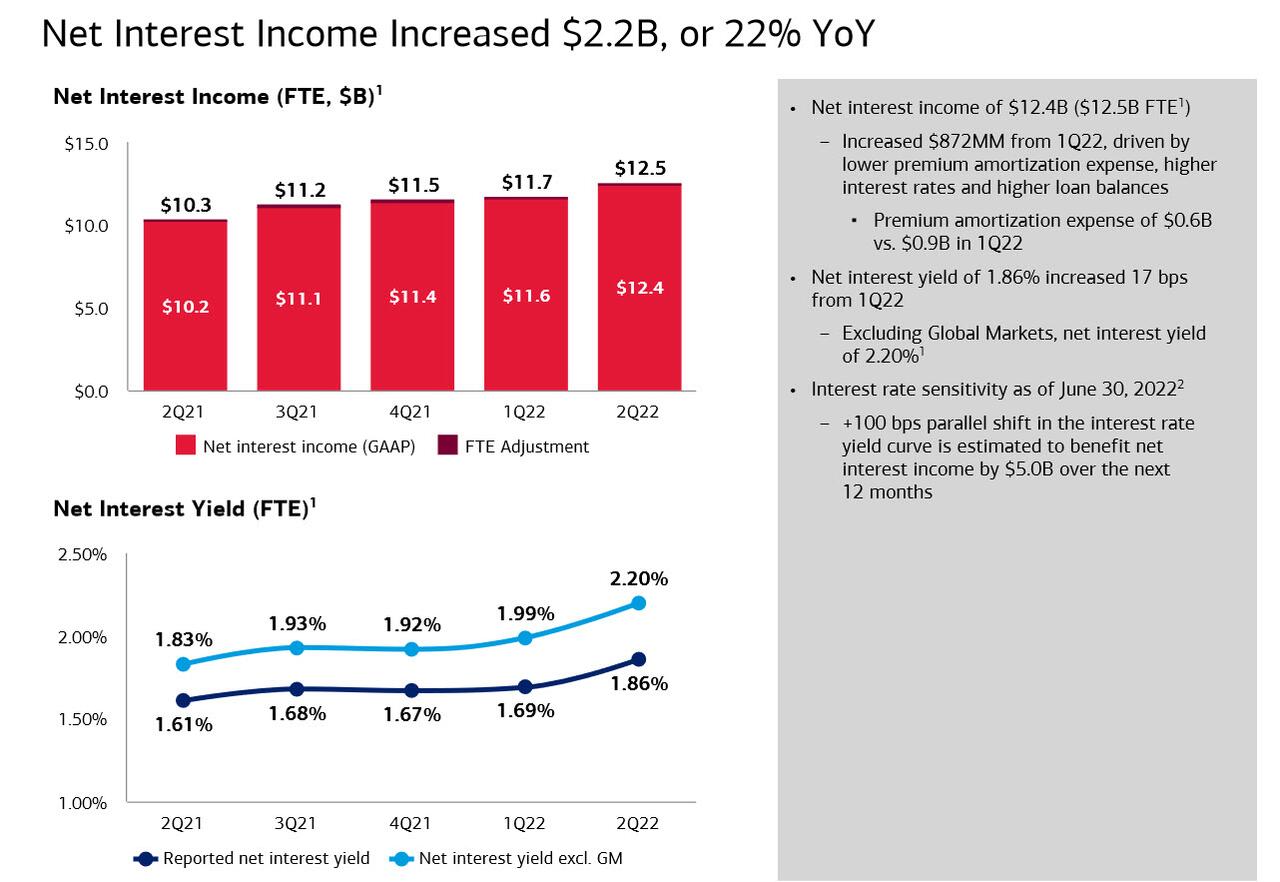

- Net interest income (NII) of $12.4B ($12.5B FTE) increased $2.2B, or 22%, smashing expectations of a $12.3BN print, and driven by higher interest rates, lower premium amortization, and strong loan growth. The net interest yield of 1.86% was well above the 1.77% estimate.

- However, while NII jumped, Noninterest income of $10.2B disappointed as it decreased $1.0B, or 9%, "driven by lower investment banking fees, mark-to-market losses related to leveraged finance positions and lower service charges due to non-sufficient funds and overdraft policy changes," partially offset by higher sales and trading revenues

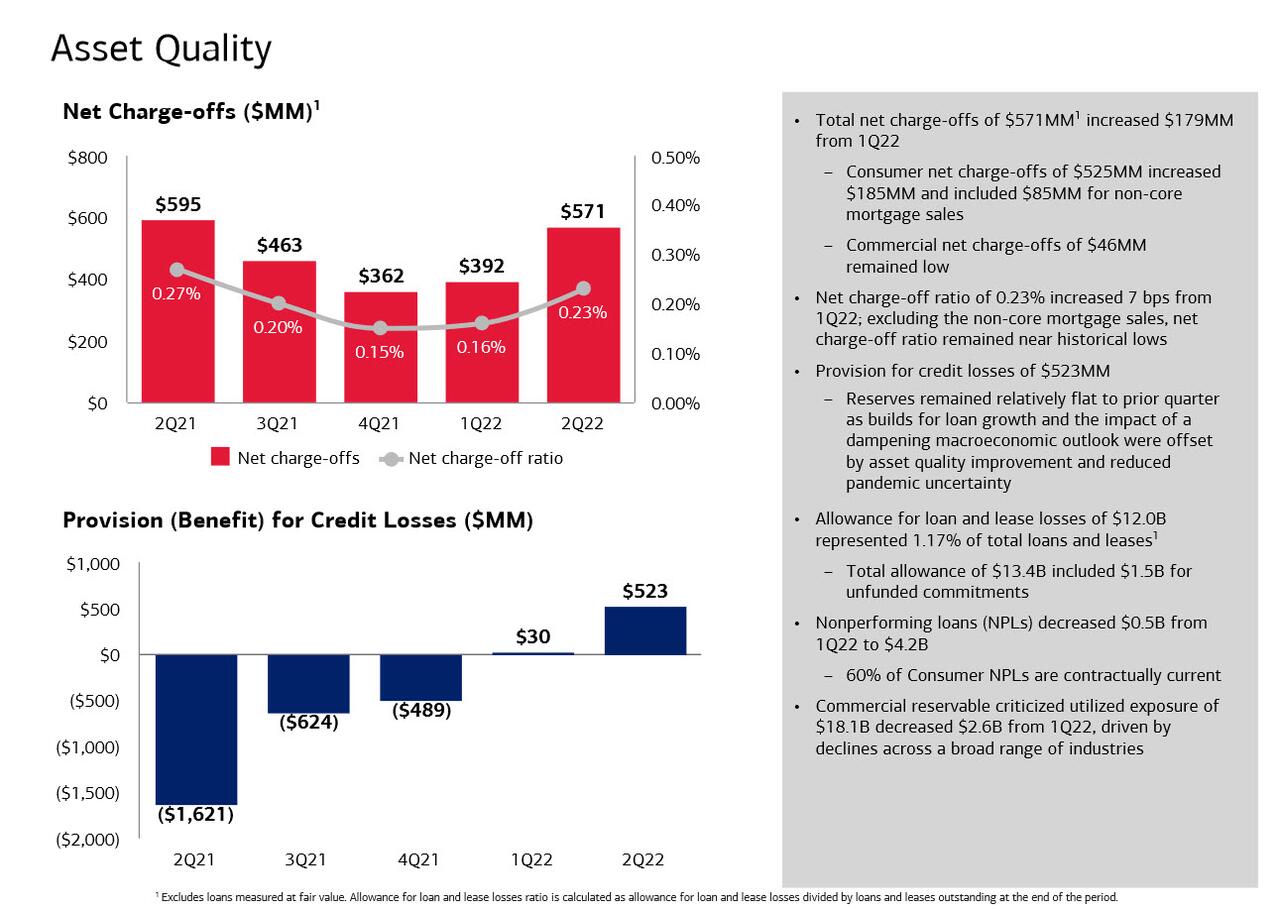

Provision for credit losses came at $0.5B, better than expected, including a small reserve release of $48 million and $571 million of net charge-offs vs. a benefit of $1.6B in 2Q21. BofA said that "reserves remained relatively flat to the prior quarter as builds for loan growth and the impact of a dampening macroeconomic outlook were offset by asset quality improvement and reduced pandemic uncertainty." On the other end, net charge-offs (NCOs) of $571MM declined 4%; a net charge-off ratio of 23 bps. NCO ratio did jump 7% from Q1, however, rising by almost $179 million.

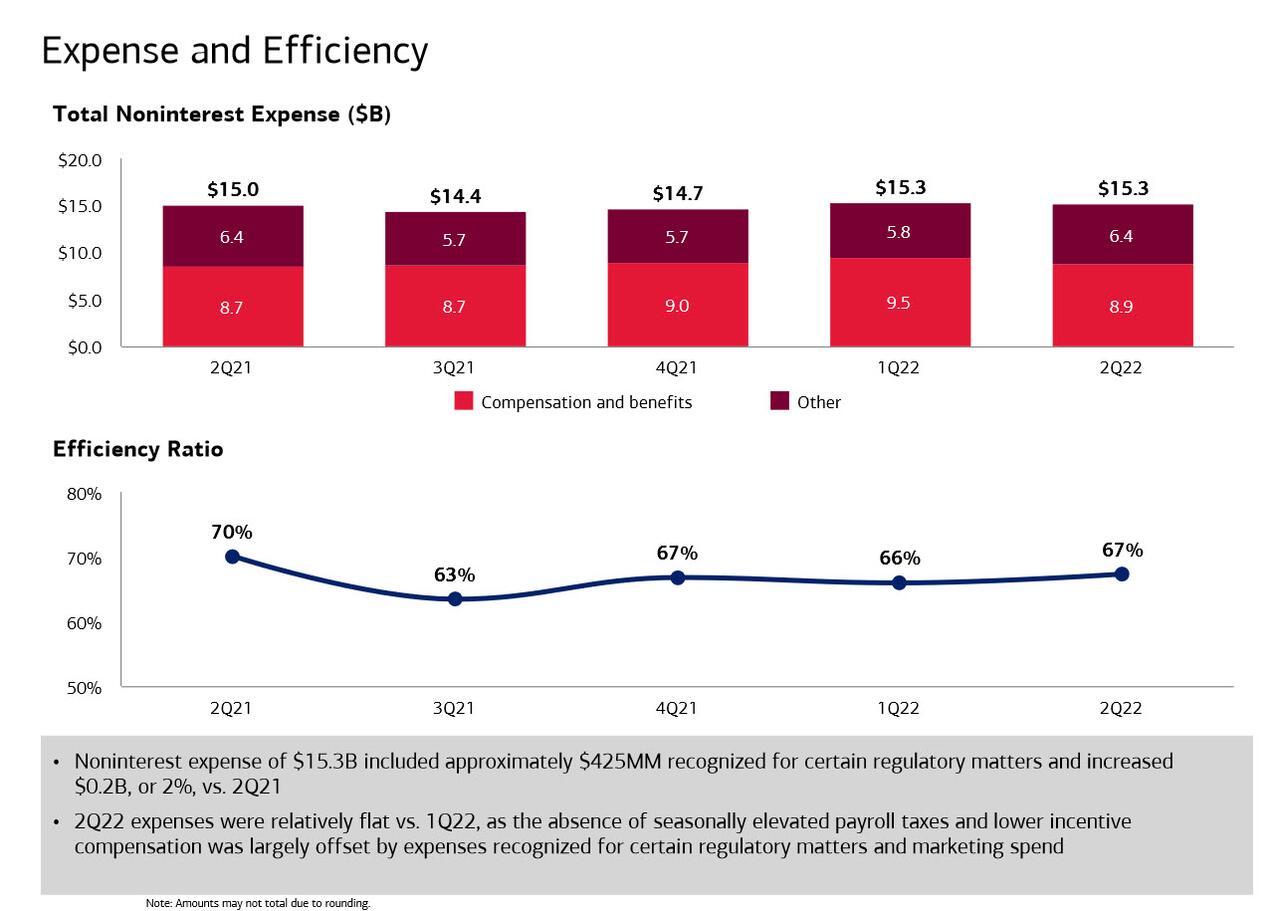

Noninterest expense of $15.3B increased $0.2B, or 2%, vs. 2Q21, and remained flat QoQ, despite approximately $425MM

recognized for certain regulatory matters. The increase also included regulatory matters.

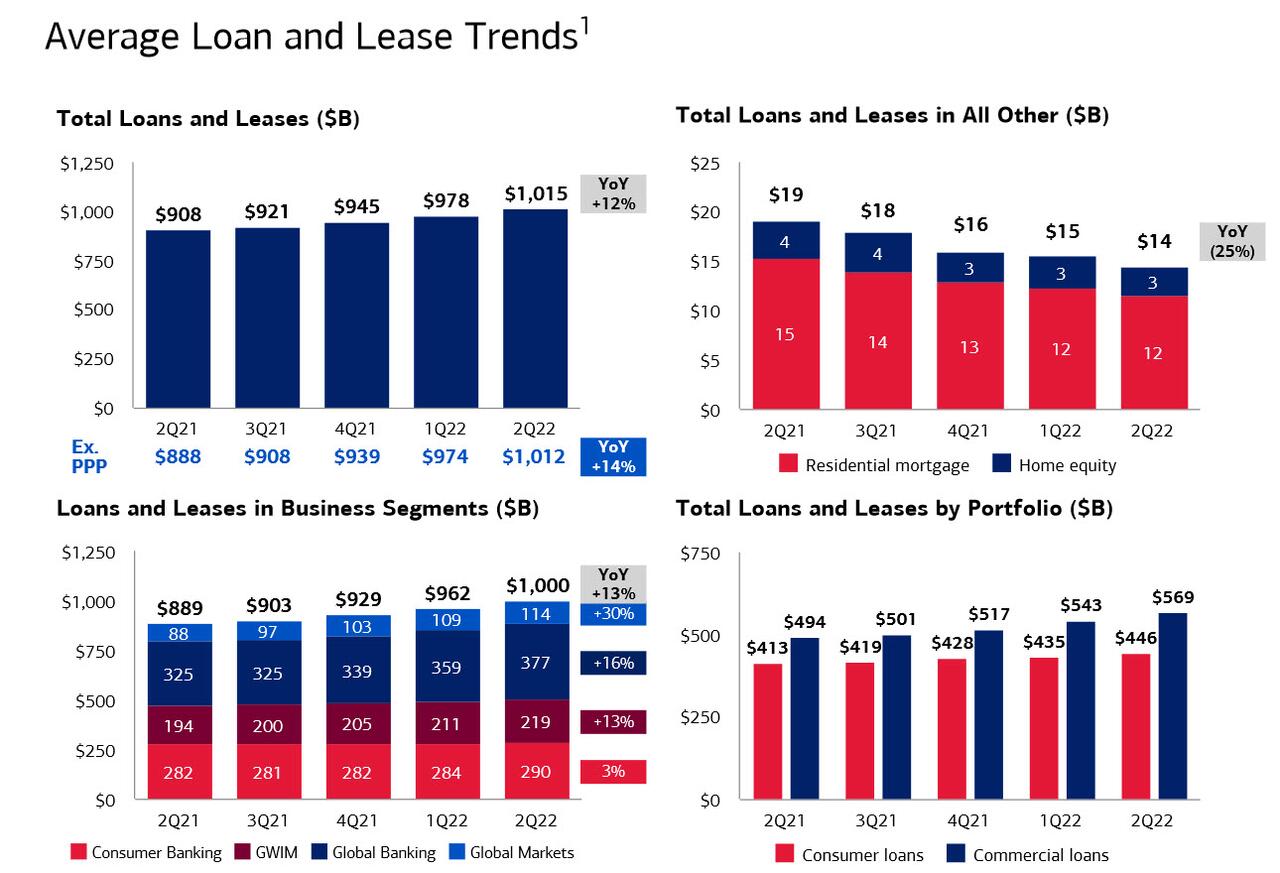

A quick look at the balance sheet shows some growth there too, with total loans rising 12% Y/Y to $1.015 trillion, above the estimate $1.01 trillion...

... while total deposits of $2.012 trillion, rose 7% Y/Y (they did drop modestly from Q1) and were in line with the estimate of $2.02 trillion:

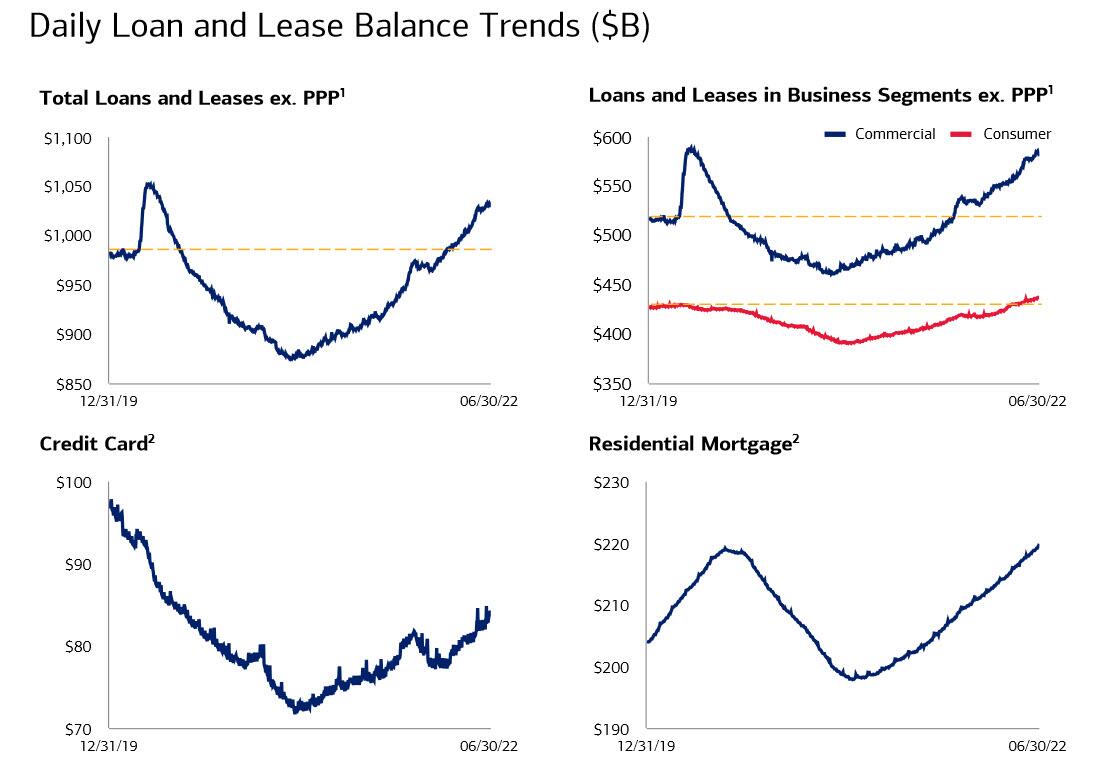

The bank was also kind enough to share its daily loan and lease balances: the bounce here is clearly visible across all products.

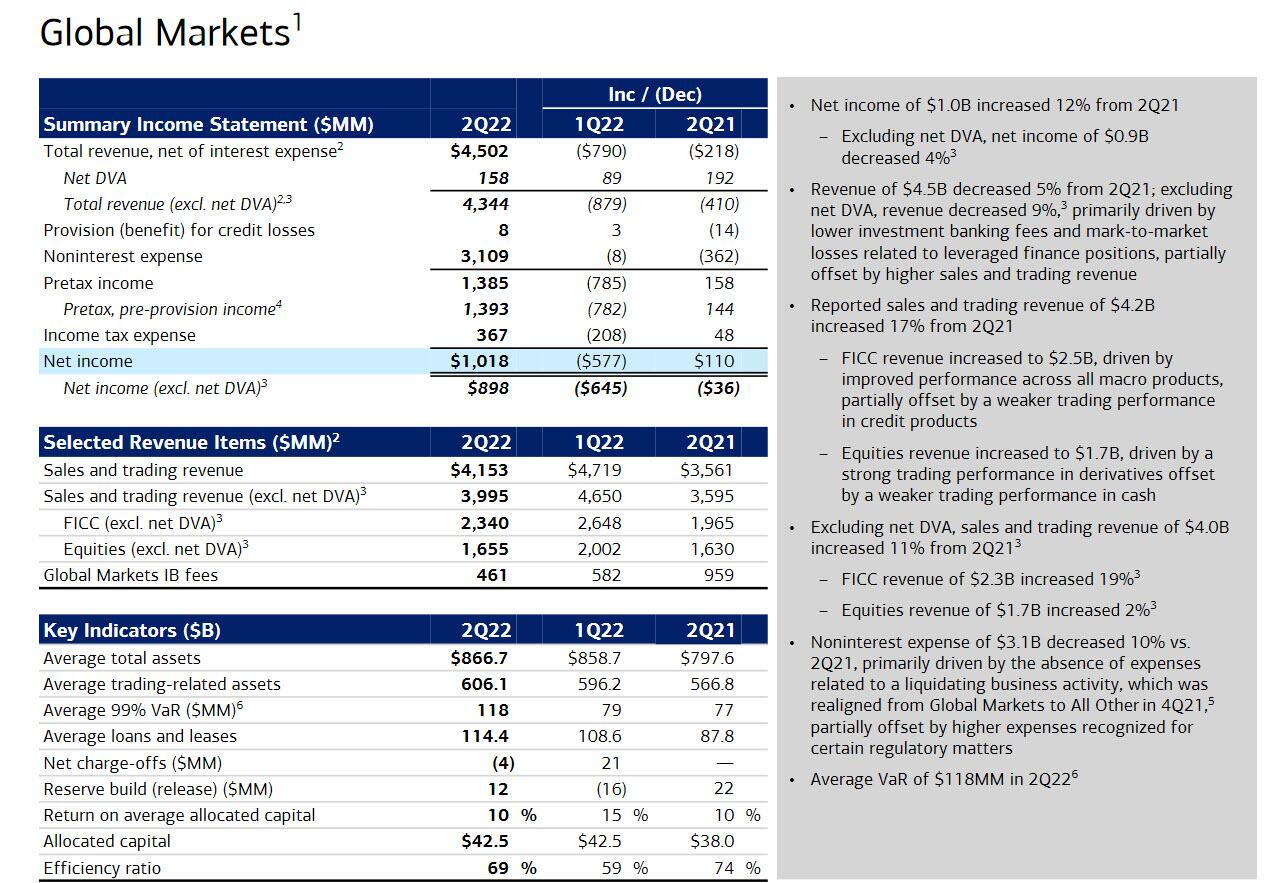

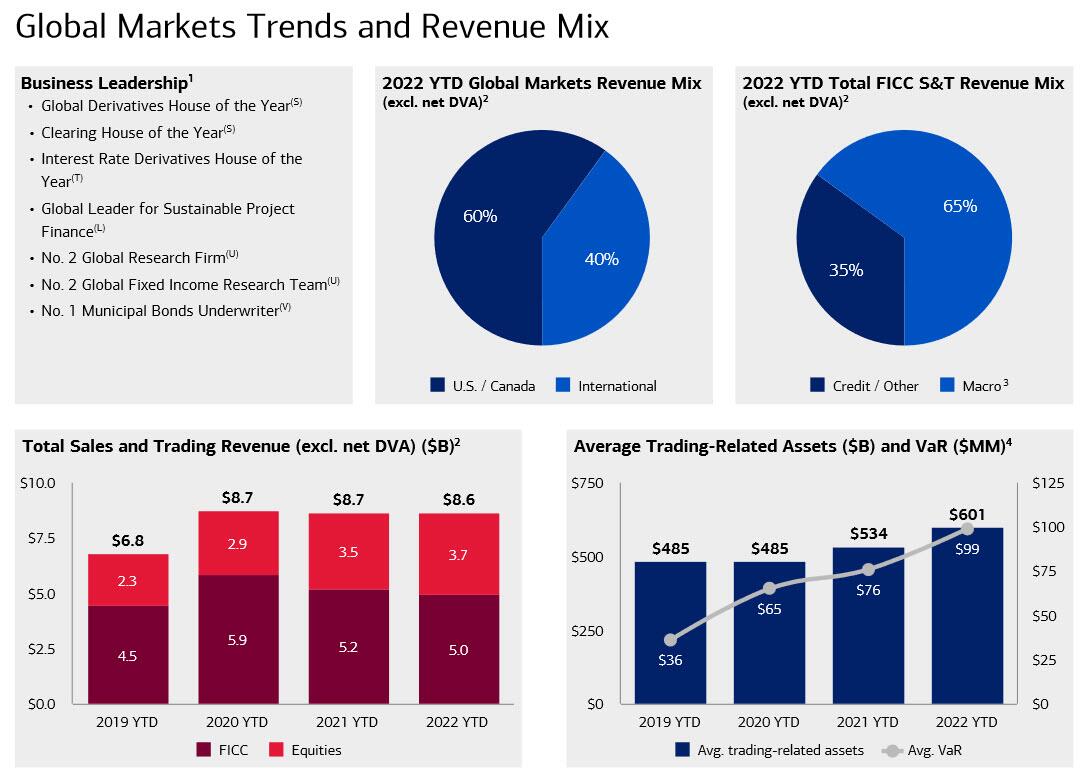

Turning to the bank's trading division, we find that Trading revenue excluding DVA rose 11% Y/Y to $4.00 billion, just barely missing the $4.01 billion Bloomberg estimate, and driven by an equities trading miss offset by a modest FICC beat:

- FICC trading revenue excluding DVA $2.34 billion, +19% y/y, beating the estimate $2.29 billion; according to the bank, "FICC revenue increased to $2.5B, driven by improved performance across all macro products, partially offset by a weaker trading performance in credit products"

- Equities trading revenue excluding DVA $1.66 billion, +1.5% y/y, missing the estimate $1.72 billion; per BofA, "equities revenue increased to $1.7B, driven by a strong trading performance in derivatives offset by a weaker trading performance in cash"

On the expense side, noninterest expense of $3.1B decreased 10% vs. 2Q21, primarily driven by the absence of expenses related to a liquidating business activity, which however was "partially offset by higher expenses recognized for certain regulatory matters."

Also of note, the average Q2 VaR of $118MM rose significantly from $77MM in Q2 2021 and $79MM in Q1 2022.

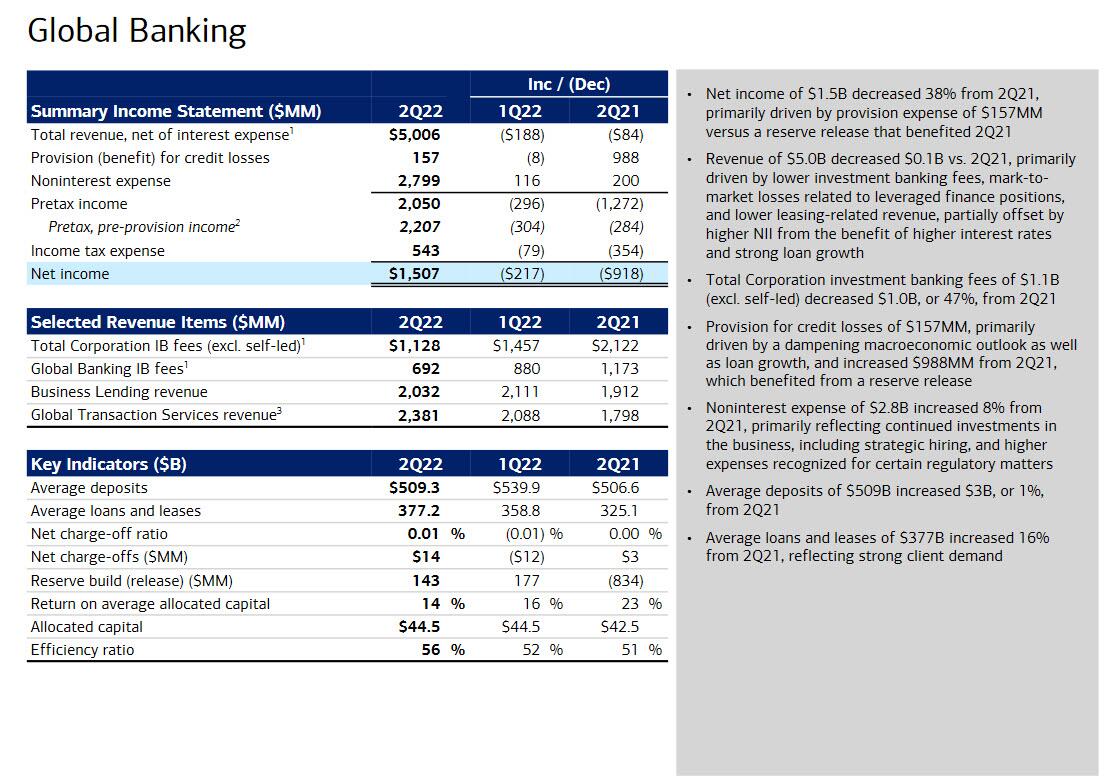

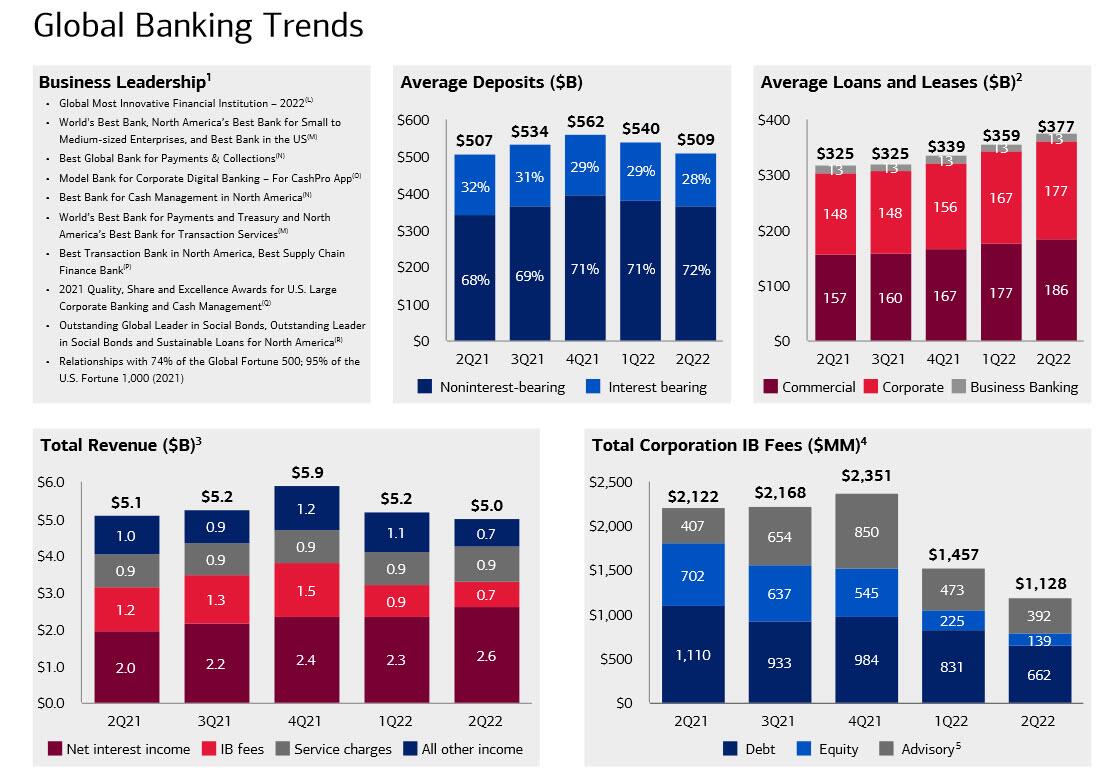

Meanwhile, Investment banking revenue $1.13 billion, missing the estimate $1.31 billion and down sharply from $2.11 billion a year ago. Despite the drop in Ibanking revenue, the non-interest expense of $2.8B increased 8% from 2Q21, "reflecting continued investments in the business, including strategic hiring, and higher expenses recognized for certain regulatory matters." Advisory revenues came in at $392 million -- that’s actually better than the $362 million analysts in a Bloomberg survey were expecting.

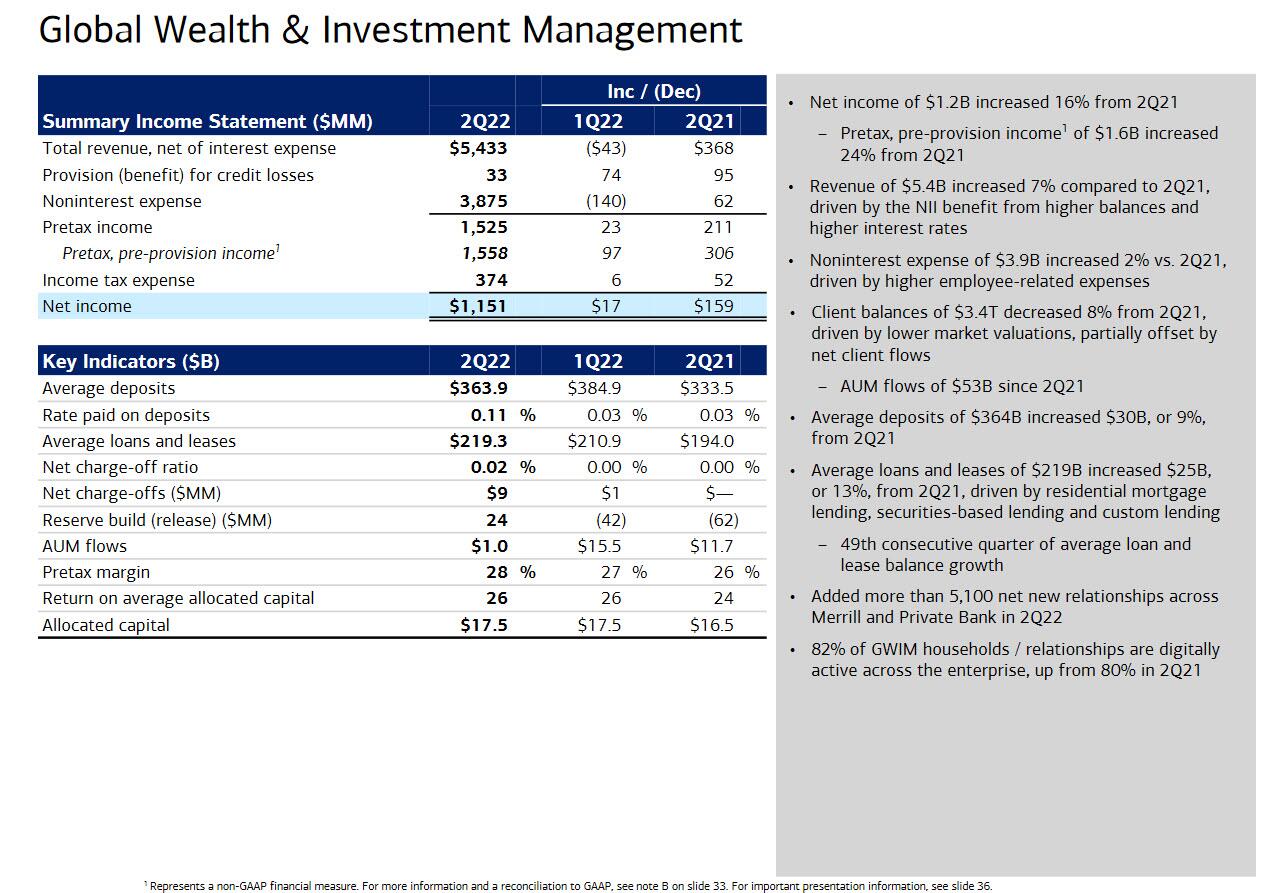

Elsewhere, the bank's Wealth & investment management revenue dropped 1% from a year ago but rose by $368 million from a year ago to $5.43 billion, matching estimates of $5.43 billion. Here, Bank of America does something interesting and breaks out how much of their assets under management in the wealth unit have dropped due to market valuations. It looks like the craziness in markets in the second quarter shaved off $161.2 billion in AUM in the second quarter, that’s more than double the amount that AUM declined in the first quarter.

Commenting on the quarter, CEO BrianMoynihan said that "solid client activity across our businesses, coupled with higher interest rates, drove strong net interest income growth and allowed us to perform well in a weakened capital markets environment,” said CEO Brian Moynihan. “As we enter the second half of the year, we believe we are well-positioned to deliver for our shareholders while continuing to invest in our people, businesses, and communities,” he added noting that “Our US consumer clients remained resilient with continued strong deposit balances and spending levels.”

CFO Alastair Borthwick also chimed in saying that "our earnings generation over the next 18 months will provide ample capital to support growth, pay dividends, buy back shares and continue to invest in our people, platforms, and communities as we grow into new regulatory capital level requirements.” Borthwick also noted that Bank of America gave $2.7 billion back to shareholders this quarter.

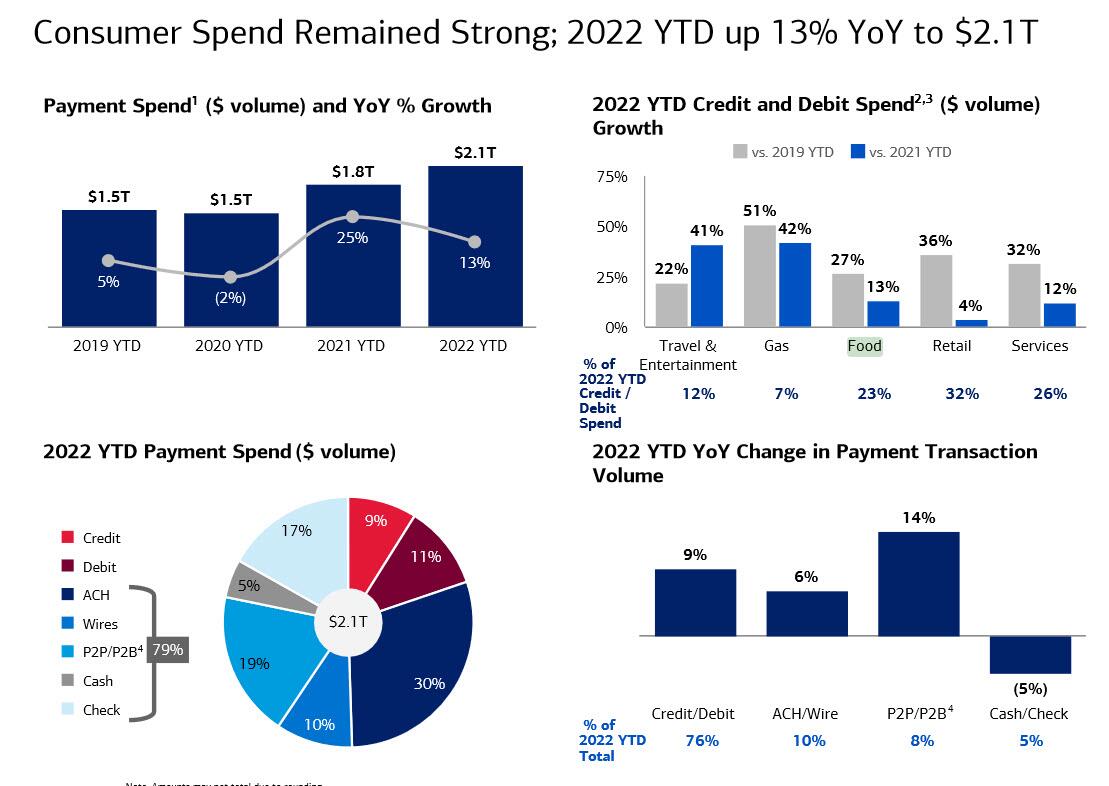

Bank of America also shared interesting stats that show the health of the US consumer right now and how they’re handling once-in-a-generation levels of inflation. To start: They show that overall spending on their products is up 13% so far this year, coming in at $2.1 trillion. As Bloomberg further details, it looks like folks are finally getting back out and traveling and enjoying entertainment: Spending on those items is up 41% compared to last year. But you can also see the evidence of inflation pretty starkly: Spending on gas is up a whopping 42% compared to last year, while spending on food is up 13%. Just gas and food costs are now taking up 30% of consumers’ wallets.

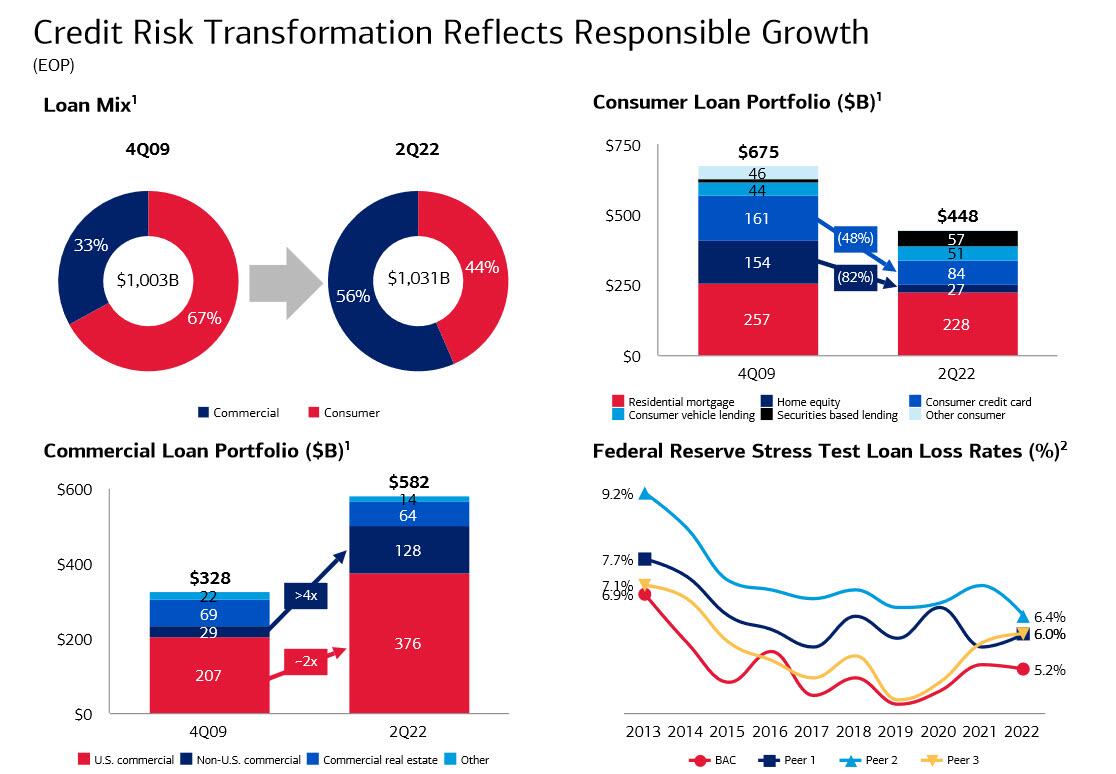

There’s also an interesting slide in the presentation, where Bank of America shows just how different it’s become since 2009 and 2019 -- the last time the US was heading into recessionary periods. Bank of America says it’s got a lower concentration in consumers, less exposure to unsecured consumer credit and home equity loans, and its commercial real estate portfolio is more balanced with less concentration in construction loans.

In kneejerk response, BAC stock has been volatile after initially sliding as much as 2%.

(Click on image to enlarge)

More By This Author:

German Energy Giant Warns Of Insolvency "Within Days", Starts Draining Gas From StorageWells Fargo Misses Across The Board As Rate Hikes Grind Mortgage Banking To A Halt

Alibaba Lays Off More Than 35% Of Its Investment Team Amidst Continued Regulatory Crackdowns

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more