Bank Of America, A Good Play?

Image Source: Pixabay

Is Bank of America (BAC) a good play for investors? Thanks to its size and strength in customer service, BAC has a dominant position in the banking landscape in the US. Banks are not doing great at the moment and there is much uncertainty about what comes next. How will BAC fare through this?

About BAC

Bank of America operates four segments:

- Consumer Banking: offers a range of credit, banking products and services, and investment products and services to consumers and small businesses.

- Global Wealth & Investment Management (GWIM), which includes two businesses. The first is Merrill Wealth Management. It offers tailored solutions to meet clients’ needs through a range of investment management, brokerage, banking, and retirement products. The second business is Bank of America Private Bank, which provides comprehensive wealth management solutions.

- Global Banking: provides a range of lending-related products and services, integrated working capital management and treasury solutions, and underwriting and advisory services.

- Global Markets: offers sales and trading services and research services to institutional clients across fixed-income, credit, currency, commodity, and equity businesses.

Bank of America’s strengths

We’ve already stated that Bank of America’s size and strength in customer service have propelled it to a dominant position in the U.S.

BAC enjoys one of the highest ratios of net interest income to revenue. It has benefited greatly from the Fed’s rate hikes over the last few years which have expanded its margins. The question is how will loan activity evolve next; will it grow, stagnate, or decline?

BAC can also rely on its wealth management division and investment management divisions to support its growth. We think that BAC should keep its focus on traditional banking activities and wealth management.

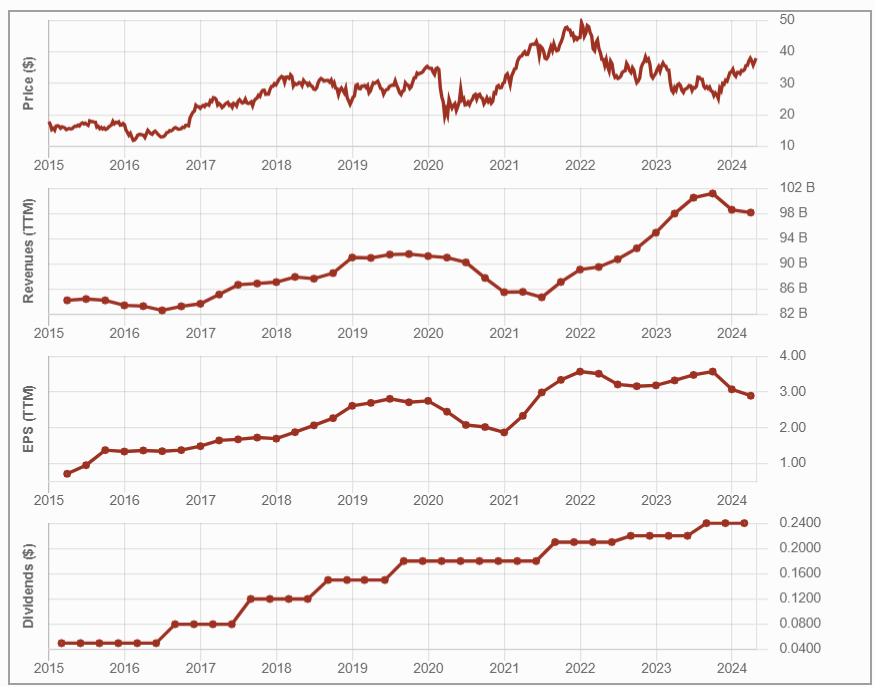

In March 2023, several regional banks such as Silicon Valley Bank were severely impacted on the stock market because they held long-term bonds whose value fell sharply. As clients concerned about small banks switched to larger ones, BAC received a net inflow of deposits. At the time though, BAC’s stock price declined, as did all U.S. banking stocks due to wobbling consumer trust. It has steadily risen since fall 2023 but is still below its high of early 2022.

Below, we see the ten-year evolution of BAC’s stock price, revenue, earnings, and dividend payments. Notice the stock price rebound in late 2023, and slowdown in revenue and earning for 2024.

Be aware of potential risks

When a bank becomes too large, management can quickly lose its grip on the business. We saw this with Wells Fargo in 2016 when a series of scandals began involving Wells Fargo creating fake deposits and credit card accounts, charging borrowers for unnecessary insurance, concealing information, and lying to the public and Congress. Now, the consequences faced by Wells Fargo for these failures motivate banks to keep a solid grip on operations, and we are not saying that any such shady activity is happening at BAC, only that it is a risk in such large organizations.

Another risk is the emergence of Financial Technology companies (FinTechs). These competitors aim to disrupt traditional financial industries by providing services more efficiently, conveniently, and often at lower costs. They do so by leveraging technology to offer innovative financial services and solutions. Although BAC places significant importance on its digital services, FinTechs are growing rapidly and attempting to grab big banks’ market share.

BAC was able to weather the pandemic, and it will have to navigate an economic downturn, however severe it ends up being. The overheated housing market has facilitated BAC’s profitability, but the opposite can occur in a downturn.

Recent performance

Banks are currently performing poorly, and BAC is not immune. In its most recent results, Bank of America disappointed the market with revenue down 11% and EPS down 18%. Consumer Banking revenue declined on lower deposits (-8%), partially offset by higher credit card spending (+3%). Global Wealth and Investment Management revenue also fell slightly compared to last year. Global Banking revenue fell on weaker client demand for loans. Also affecting earnings were a $2.1B pre-tax expense related to the FDIC’s special assessment for bank failures and a $1.6B negative pre-tax impact from the cessation of the Bloomberg Short-Term Bank Yield Index (BSBY).

In closing

Bank of America has a lot going for it; impressive reach through its strong distribution network, a top-four position for credit card issuers in the U.S., and it’s a strong player in the commercial space. Through the banking saga of 2023, BAC proved that it is well capitalized, earning trust and likely more customers.

However, as interest rates have seemingly peaked (and will probably go down), it will become harder for BAC to generate revenue growth. Also, in the event of a major rate cut, BAC’s long-duration bond portfolio will take a while before maturing and recovering its value.

The regional bank debacle with Silicon Valley Bank showed how fast the U.S. banking system can veer off the rails. While such events usually occur with smaller regional banks, they unnerve consumer confidence in the entire banking system and cause ripple effects on the bigger players also. They also generate additional expenses for all banks as regulators require a new assessment of their balance sheet.

Uncertainty is on the horizon and bank results have not been great recently. We rate BAC highly at Dividend Stocks Rock due to its strengths and resilience, but we advise investors to proceed with caution. Before you click Buy, do your research, and ensure Bank of America fits well with your strategy and within your portfolio.

More By This Author:

Interest Rate Cuts Are Coming, Right?

Add Economic Moats To Your Stock Analysis

Buy List Stock For April 2024: Automatic Data Processing