Bank Earnings In Focus As Q3 Earnings Season Takes Center Stage

Image Source: Unsplash

- For 2025 Q3, total S&P 500 index earnings are expected to be up +5.5% from the same period last year on +6.1% higher revenues.

- The positive revisions trend makes the overall setup for the Q3 earnings season favorable, but it raises the odds of actual results coming up short of expectations. In other words, it is reasonable to worry whether expectations for the period are too high, particularly for the Tech and Finance sectors.

- For the Magnificent 7 group, Q3 earnings are expected to be up +12.1% from the same period last year on +14.7% higher revenues, which would follow the group’s +26.4% earnings growth on +15.5% revenue growth in the preceding period.

- For the 19 S&P 500 members that have recently reported quarterly results for their fiscal quarters ending in August (part of the Q3 tally), total earnings are up +11.9% from the same period last year on +7.2% higher revenue, with 73.7% beating EPS estimates and 78.9% beating revenue estimates.

Bank Earnings Set to Give a Good Read on the Economy

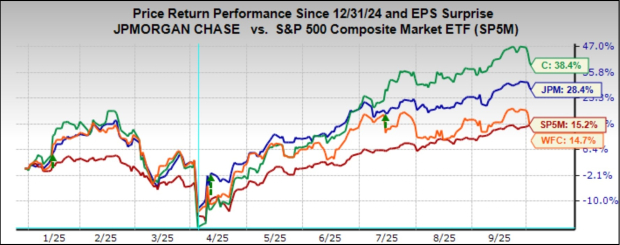

JPMorgan (JPM - Free Report), Wells Fargo (WFC - Free Report), and Citigroup (C - Free Report) will kick off the September-quarter reporting cycle for the Finance sector before the market opens on Tuesday, October 14th. These stocks have been impressive performers lately, even after taking into account their weakness in recent days, as the chart below shows.

Image Source: Zacks Investment Research

There is justifiable optimism in the market about these banks’ business prospects. Loan demand is expected to accelerate, and the peak in delinquencies is now behind us. On the capital market’s front, deal pipelines are seen as steadily getting stronger, and trading activities remain robust. A favorable monetary policy and regulatory backdrop contribute to the positive narrative surrounding JPMorgan, Citigroup, Wells Fargo, and others in the space.

On the other hand, there is uncertainty about the magnitude of moderation in economic growth resulting from the new tariff regime. Recent public commentary from management teams has broadly been positive, which has helped drive estimates higher for the group. But it will be hard for these stocks to sustain their recent positive momentum unless management teams are able to validate the market’s optimistic expectations.

JPMorgan is expected to report $4.79 per share in earnings on $44.66 billion in revenues, representing year-over-year growth rates of +9.6% and +4.7%, respectively. Estimates for the period have steadily moved up, with the current $4.79 estimate up +2.1% over the past month and +6.7% over the past three months. Estimates for Citigroup and Wells Fargo have not increased by the same magnitude, but the revisions trend has nevertheless been positive for them as well.

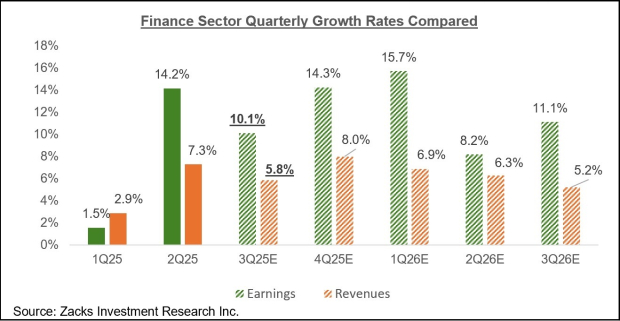

For the Zacks Finance sector as a whole, Q3 earnings are expected to increase by +10.1% from the same period last year on +5.8% higher revenues, as the chart below shows.

Image Source: Zacks Investment Research

The Earnings Big Picture

Positive Q3 results and reassuring management commentary from these banks will help sustain the favorable revisions trend that has been in place lately.

For 2025 Q3, the expectation is for earnings growth of +5.5% on +6.1% revenue gains. We have consistently shown in this space how Q3 estimates have steadily increased since the quarter began.

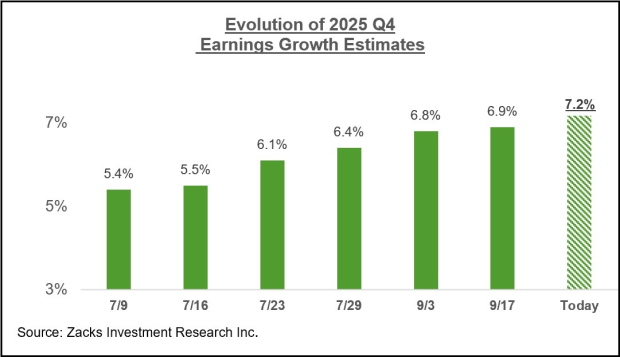

A comparable trend has been at play with respect to estimates for the last quarter of the year, when S&P 500 earnings are expected to increase by +7.2% on +6.7% higher revenues. The chart below shows how Q4 estimates have evolved over the last couple of months.

Image Source: Zacks Investment Research

Some of the same sectors that have been enjoying a favorable revisions trend for Q3 are in play for Q4 as well, particularly the Tech, Finance, and Energy sectors.

The chart below shows expectations for 2025 Q3 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

Image Source: Zacks Investment Research

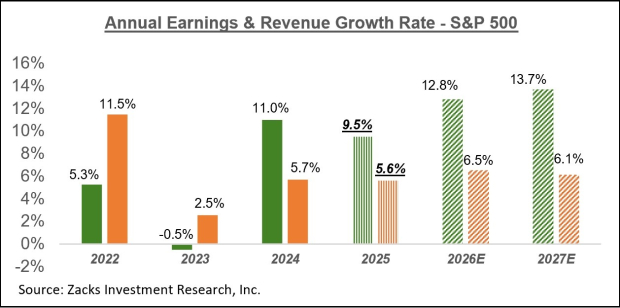

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment Research

The aforementioned favorable revisions trend validates the market’s rebound from the April lows. However, the trend can only be sustained if Q3 earnings results and management guidance for Q4 and beyond confirm it.

More By This Author:

Making Sense Of Current Earnings Expectations

Handicapping The Q3 Earnings Season

Q3 Earnings Outlook Remains Positive: A Closer Look