Baidu: A Rare Value And Growth Stock

(Featured image: Simone Brunozzi)

Baidu (BIDU) keeps showing up in my value screeners. Interestingly, it also appears in some of my growth screeners. The only possible explanation for that is the fact that Chinese stocks got hammered during the last few months, while the growth forecasts have remained positive. Additionally, last month’s rebound in Chinese stocks hasn’t helped Baidu much.

Table 1 – Screener for over 15% ROE, under 30 P/E, 0 to 10% above the 52-Week low

(Click on image to enlarge)

(Source: Finviz)

I’ve previously analyzed Baidu, and I believe the investment story remains the same. However, it is worth recapitulating the main pros and cons of this stock:

List of Baidu’s main headwinds

- Regulation of internet search has slowed growth. China has increased its grip on the information and practices of internet companies. Baidu has complied, but it has slowed innovation and growth.

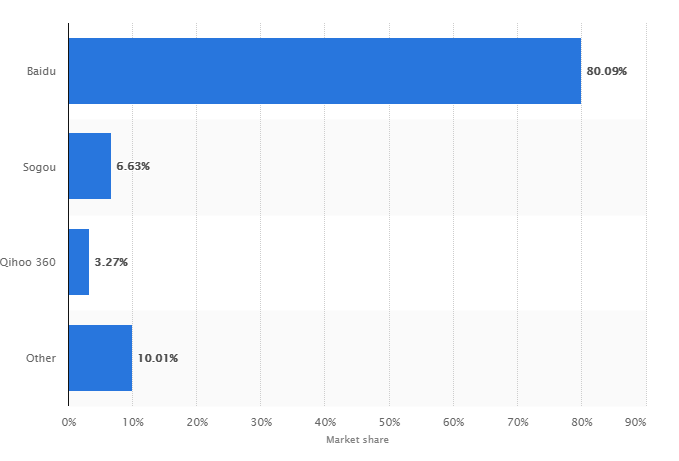

- Competition by Google and other Chinese tech companies. Google has been a dark cloud on Baidu’s horizon since it left the Chinese market. Rumors about a possible comeback appear sporadically and, usually, it has a negative impact on the stock. On another note, WeChat (TCEHY) is making interesting progress into the search business, capitalizing on its strong chat application.

- The slowdown in the Chinese economy has been a powerful story since 2018, and it has been amplified, by the trade war. The obvious negative economic developments stemming from lower growth and trade war will have an impact on the Baidu’s ecosystem.

- Quality of its search engine. Several reports have surfaced, pointing to the fact that Baidu is focusing too much on funneling searches to its own content and app pages. The consequence being users not finding what they search.

List of factors capable of countering Baidu’s headwinds

- Brand image. Accuracy is one of the main attributes that users value on search engines. If a search engine is reliable and accurate, people will stick with it. That creates a reinforcing cycle. Brand recognition attracts additional users, which tend to improve the search engine accuracy by providing extra queries and a bigger audience for advertisers. New advertisers will provide extra funding for the search engine to improve its quality and attract new users.

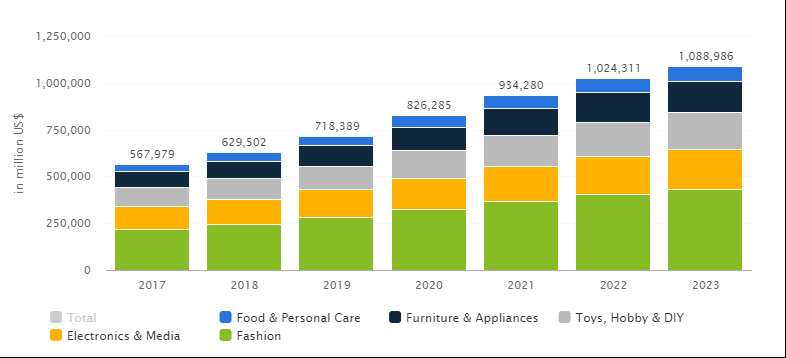

- Secular trends favor Baidu’s underlying business. Although the growth in internet penetration has been spectacular in China (it is now slightly above 50%), it is still far from many developed nations like the US (more than 75%). There is a lot of room to grow. Additionally, China has leapfrogged the fixed line revolution, and it went straight to mobile. Most users have gone from no internet connection to having internet on their phones. That has increased the speed of internet adoption, and, at the same time, it has created an edge in the mobile payments revolution. Therefore, the ability, to match consumers with advertisers, has never been so valuable.

- A strong balance sheet allows the company to heavily invest in its apps and websites.

Investment story for Baidu

Baidu’s main virtue lies in its ability to connect Chinese language speakers, through its AI-powered engine search. In a still rising Chinese consumption economy, Baidu has a huge role to play in connecting advertisers with consumers in a Chinese speaking ecosystem.

Graph 1 – Search engine market share China 1Q18

(Click on image to enlarge)

(Source: statista.com)

The huge growth prospects for e-commerce, and for the Chinese consumption economy, seem enough to offset most of the headwinds the company might face. The growth is still underway, and it seems promising.

Graph 2 – E-commerce revenue forecast in China (in million USD)

(Click on image to enlarge)

(Source: statista.com)

Presently, the most dangerous aspect seems to be the temptation to build a garden wall around the company’s services and apps. That could end up diluting Baidu’s brand, which could be irreparable, especially, with so many competitors trying to steal Baidu’s lunch. At the present stage, I am inclined to believe that the company might pursue some degree of apps and services cross-selling, but it will be wise enough not to push it beyond reasonable levels. If that hypothesis is confirmed, all indicate that Baidu might be a rare value and growth stock.